Current stablecoin metrics show that USDE, the popular yield-bearing stablecoin, has slipped to fifth place among the top U.S. dollar-pegged tokens by market capitalization. Over the past three days, Ethena’s USDE supply has decreased by 130 million, pushing First Digital’s $FDUSD into the fourth largest spot.

Stablecoin Shakeup: USDE Slips to 5th, $FDUSD Rises to 4th

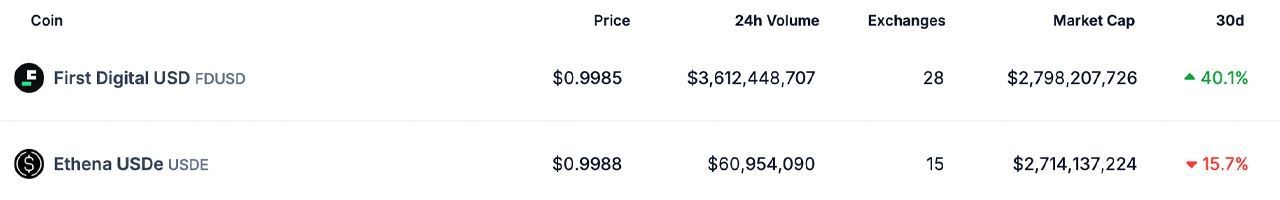

Just three days ago, Bitcoin.com News highlighted Ethena’s USDE shedding $770 million in less than two months, and since then, another $130 million has been redeemed. On Aug. 31, 2024, USDE’s market valuation stood at $2.84 billion, but today it’s down to $2.71 billion. According to coingecko.com, Ethena’s stablecoin supply has shrunk by 15.7% over the past 30 days.

As of Sept. 2, 2024, First Digital’s $FDUSD boasts a market cap of around $2.79 billion—roughly $80 million more than USDE. This isn’t $FDUSD’s first time in the fourth position; it’s been here before. While USDE’s supply dwindled over the last month, $FDUSD’s grew by a solid 40.1%.

Although $FDUSD doesn’t offer yield, it ranks among the top coins by global trading volume. Over the past week, $FDUSD has consistently held the fifth spot in global trade volume, right below USDC. On Sept. 2, $FDUSD saw $3.61 billion in trading volume over the last 24 hours, whereas USDE, primarily held for yield, recorded a much smaller $60.95 million in trades during the same period.

The shifting landscape of stablecoin rankings highlights the impact of market dynamics on even the most established tokens. As $FDUSD gains momentum, it spotlights the importance of adaptability in the competitive stablecoin market. The decline of USDE reflects broader trends and potential challenges for yield-bearing assets in maintaining their market position amidst evolving market preferences and competition.

What do you think about $FDUSD flipping USDE this week? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com