In 2024, validators on Solana have experienced a notable shift in revenue distribution, due to the rise in decentralized finance (DeFi) activities.

Data shared by Tom Wan from a Dune Analytics dashboard highlights the changes in revenue sources for Solana validators.

Revenue Breakdown Over Time

In January 2024, Solana validators saw a revenue structure dominated by issuance, which constituted 95% of their income. In contrast, Minor Extractable Value (MEV) and fees accounted for only 1.9% and 3.1%, respectively.

Solana Validators' Revenue Breakdown has changed drastically in 2024 thanks to the increase in DeFi activities

1. In early Jan:

– 95% from issuance

– 1.9% from MEV

– 3.1% from Fee2. On 29th July:

– 78.2% from issuance

– 15.3% from MEV

– 6.5% from Fee pic.twitter.com/DLUks6b1nd— Tom Wan (@tomwanhh) August 29, 2024

However, by July 29, the landscape changed drastically. Issuance had reduced to 78.2%, while MEV revenue surged to 15.3%, and fees increased to 6.5%. Notably, according to Wan, these shifts were due to the rise in decentralized finance activities.

Correlation with Major Cryptos

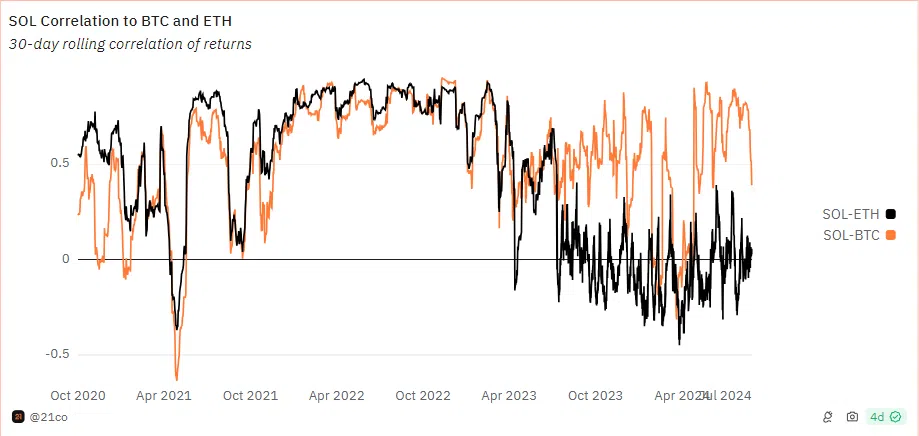

Meanwhile, further data analysis reveals interesting trends in the correlation between Solana (SOL) and two major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH).

The 30-day rolling correlation of returns shows significant volatility in the relationship between SOL and BTC, with notable dips into negative correlation around April 2021 and late 2023 to early 2024.

SOL|BTC|ETH Correlation

This suggests that Solana’s price movements do not consistently align with Bitcoin, reflecting the market’s fluctuating sentiment.

Meanwhile, the correlation between SOL and ETH has been more stable, indicating that Solana’s price often mirrors Ethereum’s, despite occasional independent movements in 2023 and 2024.

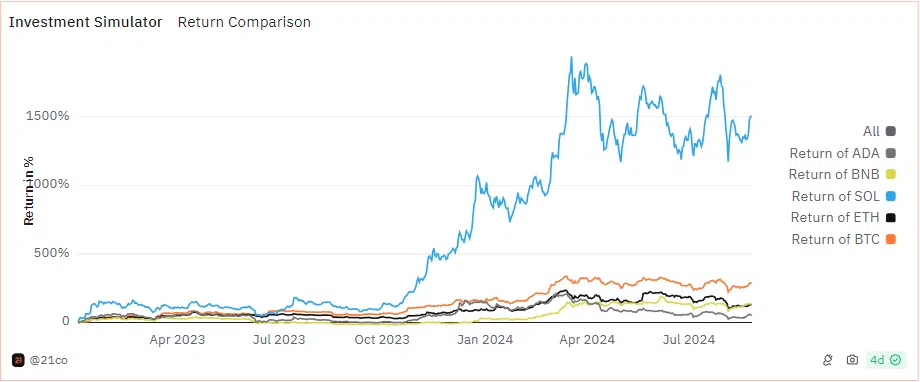

Investment Performance Comparison

Also, an investment simulator comparison from April 2023 to July 2024 shows Solana has notably outperformed other major cryptocurrencies. Solana’s returns peaked at over 1,500% in early 2024, outpacing Bitcoin and Ethereum, which both saw more moderate growth, peaking around 200%.

Despite some volatility, Solana maintained its lead, with BNB and ADA showing more restrained returns around 100%.

However, amid Solana’s positive feat, renowned TradingView analyst Alan Santana has issued a cautionary forecast, predicting a steeper decline for Solana to $55.

Santana warns that the lack of significant support at this level could exacerbate the downturn, drawing parallels with Ethereum’s recent performance.

thecryptobasic.com

thecryptobasic.com