PayPal’s stablecoin, $PYUSD, recently reached $1 billion in market cap, as reported by CoinMarketCap.

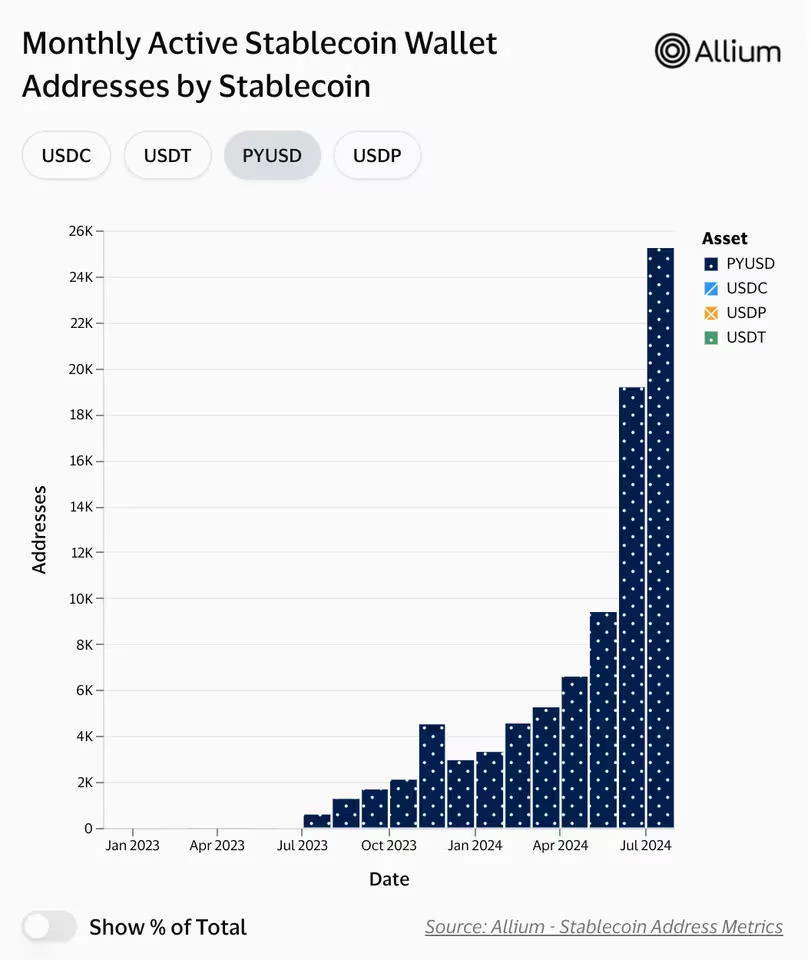

Issued with Paxos, $PYUSD saw its supply more than double since June, despite the crypto market’s slow summer period. According to Visa’s stablecoin dashboard in partnership with Alluvium, active wallet addresses also surged, reaching 25,000 in July compared to 9,400 in May.

PayPal’s entry into the stablecoin market was initially seen as a significant moment for the industry, with expectations it would compete with top stablecoins like USDC and $USDT. However, early excitement faded as $PYUSD struggled to gain traction on the Ethereum network. This changed when $PYUSD expanded to the Solana network in May, where its supply skyrocketed to $650 million in just three months, surpassing its supply on Ethereum.

Over the past month, $PYUSD supply on Solana grew by 171%, and it is quickly approaching Tether’s $USDT in scale on the network, according to DefiLlama.

Tom Wan, a business development associate at 21.co, credited $PYUSD’s growth to incentives and integration with decentralised finance (DeFi) protocols. Solana-based platforms like Kamino, Drift, and Marginfi offered high yields for $PYUSD deposits, and Anchorage Digital introduced similar incentives for institutional investors last week.

Still, concerns remain about the sustainability of $PYUSD’s growth once these incentives are removed. David Shuttleworth, a partner at Anagram, noted that while these incentives aren’t meant to last, they aim to increase $PYUSD circulation and drive new users to the Solana ecosystem.

coinculture.com

coinculture.com