Prominent global strategy consulting organization EY-Parthenon recently surveyed institutional investor decision-makers globally and found that over 20% of them acknowledged investing in XRP.

XRP community pundit WrathofKahneman (WOK) highlighted this development in a post on X today. The survey covered 277 institutional investors, including COOs, CEOs, and portfolio managers.

The respondents represented wealth managers, family offices, traditional asset managers, hedge funds, and asset owners. The majority of them—at least 147—were from the U.S. Europe made up the next majority, with 90 respondents. Other surveyed institutional investors were from Asia-Pacific (APAC), Canada, and Latin America.

Notably, EY-Parthenon conducted the survey in early March after the SEC approved Bitcoin ETFs. The survey aimed to understand respondents’ views on crypto assets, including sentiment, allocations, future expectations, and tokenization perspectives. A third party ensured a fair and balanced response pool.

Institutional Investors Admit Holding XRP

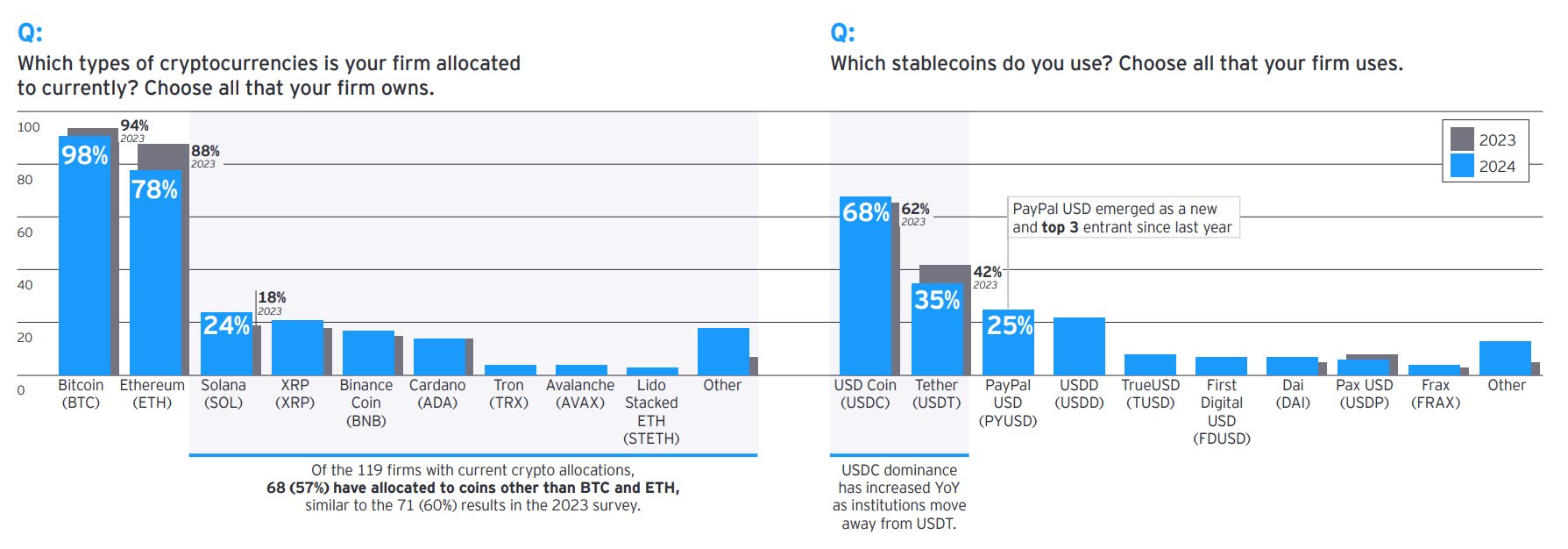

The survey revealed that a significant proportion of respondents who invest in cryptocurrency have diversified their portfolios beyond the two largest players. Specifically, 57% of respondents have allocated to coins other than Bitcoin (BTC) or Ethereum (ETH), a figure similar to last year’s record of 60%.

This trend is even more pronounced among family offices, with 68% expressing a preference for investing in alternative cryptocurrencies like XRP.

Yet, it is worth noting that BTC and ETH account for the largest share of their crypto allocation. In particular, 98% of respondents agreed that their firms allocated to Bitcoin, while 78% disclosed that they allocated to Ethereum.

Solana (SOL) and XRP followed, with 24% admitting to investing in SOL and just 20% agreeing to invest in XRP.

Meanwhile, the survey also noted a shift in the stablecoin market, with USDC increasing its dominance year-over-year as institutions moved away from Tether (USDT).

While preference for USDC increased, USDT market share from these investors decreased from 42% in 2023 to 35% in 2024. Notably, PayPal USD emerged as one of the top three players in the stablecoin market over the past year.

Future Allocation Plans

The survey also provided insight into the future of digital asset allocation. It revealed that investor segments plan to maintain their current allocation levels from 2023 to 2024. However, a significant increase in allocation is expected over the next three years.

In 2023, 42% of investors increased their digital asset holdings, 42% kept their allocations steady, and 16% decreased their holdings.

thecryptobasic.com

thecryptobasic.com