TRON is establishing itself as the go-to blockchain for stablecoin payments in Eastern Europe, South America, Africa, and Argentina. This development coincides with shifts in the broader crypto market, with TRON’s recent performance reflecting its growing strength.

. @BanklessHQ: "Eastern Europe, South America, Africa and in Argentina #TRON is the dominant blockchain for stablecoin payments." 🌐

— TRON DAO (@trondao) August 23, 2024

Learn more at 9:26: 👇https://t.co/6Dv0kZTOor pic.twitter.com/icTaHo0BNP

In a podcast, an analyst discussed key market trends, pointing out the contrasting paths of Ethereum and TRON. Ethereum ETFs, it is to be noted, have seen significant outflows of $458 million since August 15th. Despite these outflows, However, major institutions like BlackRock, Fidelity, Bitwise, and VanEck are still pouring money into their crypto funds, indicating continued institutional interest in the sector.

In contrast, TRON has surged by 20% in the past week, leading the pack in terms of performance. It also leads in revenue generation, capturing 93% of the total revenue among the top five blockchains. TRON’s strong use case and revenue model, along with the influence of Justin Sun’s meme coin ventures, have driven its recent success.

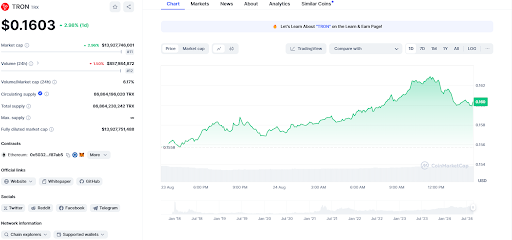

As of this writing, TRON is trading at $0.1601, with a 24-hour trading volume of $857 million. It currently holds the #10 position on CoinMarketCap, boasting a market cap of $14 billion and a circulating supply of 86 billion TRX coins.

In addition, TRON’s price chart over the past 24 hours shows a steady upward trend, starting from nearly $0.1545 and ending at around $0.161. Despite minor fluctuations, this persistent growth indicates strong buying pressure and increased investor confidence in the asset.

TRON’s dominance in stablecoin payments and impressive market performance make it a key player in the current crypto cycle. Market developments and trends in the coming months will likely shape its future trajectory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com