Tether wants to launch a new stablecoin pegged to the United Arab Emirates (UAE) dirham (AED). The company announced the move today, noting that it will launch the new stablecoin in partnership with Green Arcon Investments Ltd and Phoenix Group PLC.

The new stablecoin will be fully backed by liquid reserves based in the UAE. It marks another step for Tether as it expands its stablecoin offerings across currencies and blockchain networks.

AED Stablecoin will be regulatory compliant

According to the USDT issuer, the new stablecoin will be regulatory compliant. This is because Tether is seeking approval from the UAE central bank under the new Payment Token Services Regulations, which came into force in 2024 and regulates the issuance, conversion, transfer, and custody of all payment tokens, including stablecoins.

The company explained that the stablecoin will give users a cheap and seamless way to use AED for transactions via blockchain. It added that it will be crucial for cross-border transfers and remittances within the UAE financial ecosystem.

Tether CEO Paolo Ardoino described it as a huge one for UAE, noting that it would become a valuable and versatile tool for users. He said:

“We’re pleased to announce this initiative to develop Tether’s Dirham-pegged stablecoin, adding to our range of stablecoin options.”

By partnering with UAE-based companies and aiming for regulatory compliance, Tether is positioning itself to become a major player in the UAE financial sector. The country has emerged as one of the major hubs for cryptocurrencies in Asia and the Middle East and has seen a lot of crypto adoption due to its regulatory regime under the Virtual Assets Regulatory Authority.

Meanwhile, introducing AED stablecoin adds to Tether’s growing list of fiat-backed stablecoins. In addition to its flagship USDT, the company has Euro EURT, Mexican Peso MXNT, Gold XAUT, and Australian dollar aUSDT.

Tether’s USDT circulating supply is growing

Tether’s USDT is the largest dollar-pegged stablecoin in the market and one of the most popular digital assets. Data from CoinMarketCap shows that it is one of the most traded crypto, with a trading volume nearing $50 billion during the past day —far ahead of the cumulative volume of Bitcoin and Ethereum during the same period.

USDT has recorded substantial growth over the past year, with around $33 billion worth of stablecoin minted on the Tron and Ethereum blockchains, according to blockchain analytical platform Lookonchain.

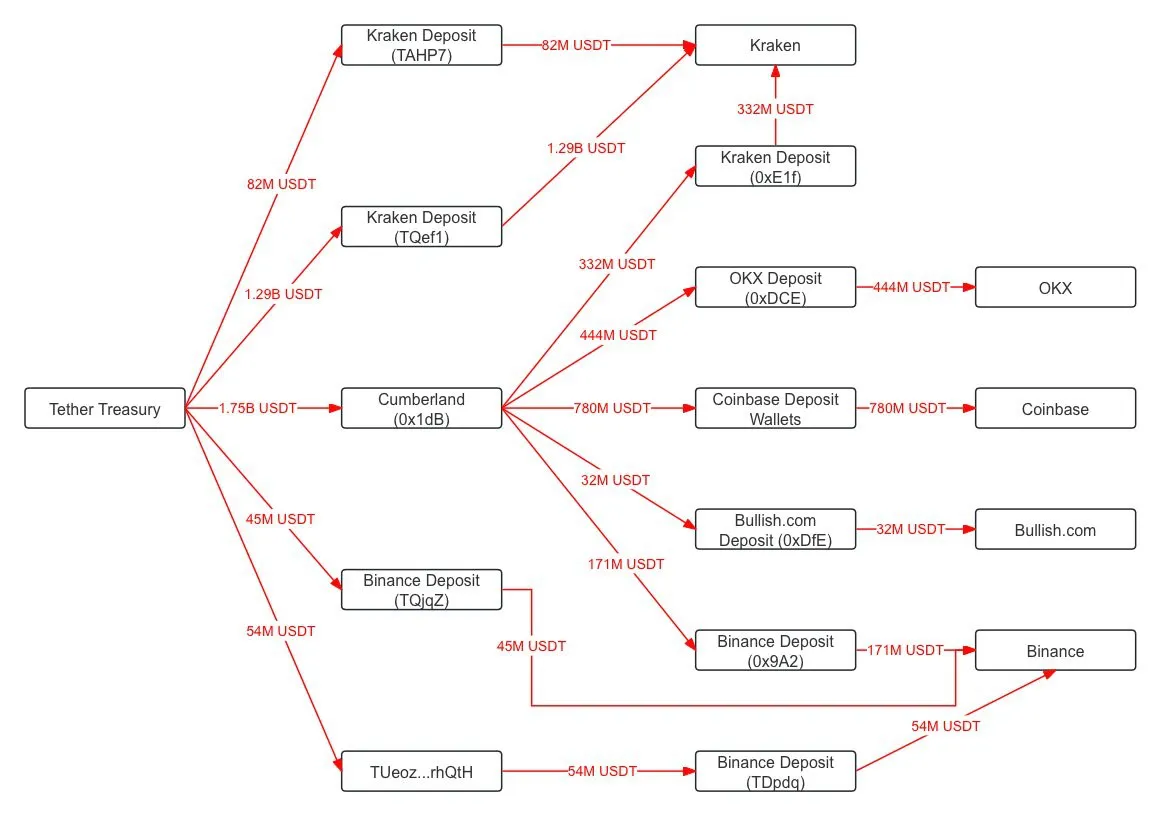

On-chain data indicates that since August 5, approximately $3.22 billion USDT has moved from Tether Treasury to various exchanges. Notably, $1.75 billion of this total was directed to Kraken, OKX, Coinbase, Binance, and Bullish via Cumberland, while $1.29 billion flowed into Kraken through the deposit address “TQef1.”

Additionally, USDT has expanded to blockchain networks like Aptos, cementing its status as the leading stablecoin in the crypto market. Further, its issuer recently reported a record net profit of $5.2 billion for the first half of 2024, making it one of the most profitable companies in the world.

cryptopolitan.com

cryptopolitan.com