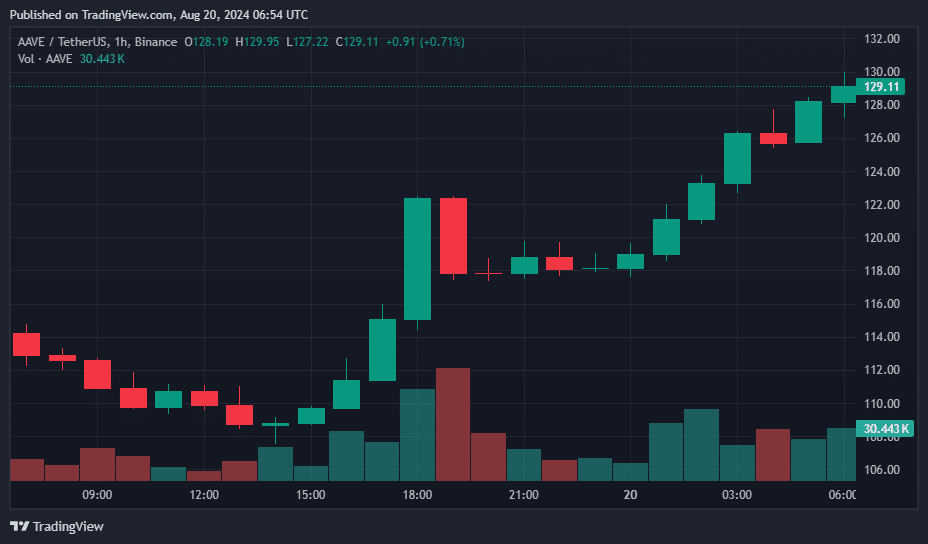

Aave’s price saw a surge of over 12% amid heightened whale activity and a broader jump in the global crypto market.

At the time of writing, Aave ($AAVE) has become the 47th largest cryptocurrency, with its market cap exceeding $1.89 trillion as its price soared 12.4% on Aug. 20, trading at $126.9, according to data from crypto.news.

Despite this rise, the cryptocurrency remains down 80.8% from its all-time high of $661.6, while its daily trading volume is staying at $392 million.

2 whales bought 31,407 $AAVE($3.92M) in the past 4 hours!

— Lookonchain (@lookonchain) August 20, 2024

Whale"0x3737" holds 3.56T $PEPE($28.4M) with a profit of over $28M on $PEPE.

He spent 813 $ETH($2.18M) to buy 17,690 $AAVE at $123 in the past 4 hours.https://t.co/zoKrgBuOYu

Whale"0x1D15" withdrew 13,717 $AAVE($1.73M)… pic.twitter.com/UOnnH9RU88

Meanwhile, blockchain analytics firm Lookonchain revealed that whales had significantly increased their holdings of Aave within just a three-hour window. According to their data, these large-scale investors acquired a total of 31,407 $AAVE, valued at approximately $3.92 million.

In one instance, the whale address 0x3737 spent 813 $ETH, equivalent to $2.18 million, to purchase 17,690 $AAVE at a price of $123 per token. Another whale, identified by the address 0x1D15, withdrew 13,717 $AAVE worth about $1.73 million from Binance. As of press time, that whale holds a total of 19,373 $AAVE, valued at $2.45 million.

Whale activity around Aave surges as DeFi shows signs of maturation

The latest surge in whale activity coincides with a broader recovery in the DeFi sector, as indicated by Edward Wilson, Head of Marketing at Nansen Analytics.

In a statement to crypto.news, Wilson outlined a pivotal shift in the crypto market from the frenzy of speculative meme coins towards more fundamentally strong DeFi projects. This trend, Wilson suggests, signifies a maturation within the market that favors sustainable growth over fleeting excitement.

Moreover, Nansen Analytics has tracked a substantial increase in Aave holdings by seasoned investors, amounting to around $5 million since early August, with this growing confidence seemingly supported by technical patterns on Aave’s price chart.

“The developing Adam & Eve bottom pattern suggests a strong potential for further upward momentum, which aligns with the market’s renewed focus on strong fundamentals.”

Edward Wilson

Earlier in July, Aave’s price had already seen an 8% boost following a proposal by founder Marc Zeller to implement a token buyback program, further fueling optimism about the token’s future.