Tokenization platform OpenEden has launched tokenized US treasury bills on the Ripple $XRP Ledger. Ripple Labs announced the development today in a press release, adding that it will allocate $10 million to the tokenized product.

Treasury bills are short-term government debt backed by the US Treasury. In recent years, the product has become the poster child for tokenizing real-world assets on-chain. With this launch, users of the $XRP Ledger will now have access to US Treasury bills.

OpenEden is the first issuer of tokenized government securities on XRPL

According to Ripple’s announcement, tokenizing the treasury bills on XRPL is part of making decentralized finance more accessible. Investors can mint the TBILL tokens using stablecoins, and the minting process is subject to regulatory compliance standards. These include stringent Know Your Customer and Anti-Money Laundering processes.

The partnership with OpenEden is remarkable for XRPL, given the protocol’s antecedents. According to DefiLlama data, the total value locked in TBILL tokens on the protocol is over $90 million across Ethereum and Arbitrum chains. Its tokenized product is also the first and only US treasury bills with an A rating from rating agency Moody.

This is an opportunity for Ripple to boost DeFi activity on its network. XRPL is a layer-1 smart contract network with several features that make it suitable for institutional-grade financial applications. Although it has several applications, its on-chain activity is not comparable to other networks like Ethereum and Solana.

However, the Ripple Labs team expects that to change with this new product. Markus Infanger, Senior Vice President, said:

“OpenEden’s tokenized US Treasury bills represent another exciting example of how all real-world assets are being tokenized (…) and the arrival of T-bills on the XRPL powered by OpenEden reinforces the decentralized Layer 1 blockchain as one of the leading blockchains for real-world asset tokenization.”

Meanwhile, the news did not affect Ripple $XRP as the token fell 6.2% today amidst a general decline in the crypto market. $XRP is trading at $0.6106 and is down 3% this year.

Ripple invests $10 million into the tokenized T-bills

Ripple is allocating $10 million to the OpenEden TBILL product to support the TBILL launch. The company mentioned that this is part of a larger fund that it plans to spend on tokenized treasury products from various issuers.

The move will likely encourage more tokenized US T-bills issuers to issue tokens on the $XRP Ledger. Most tokenized government securities products are issued on Ethereum and its Layer-2 networks. However, Stellar and Avalanche networks also have a sizable percentage of the activity.

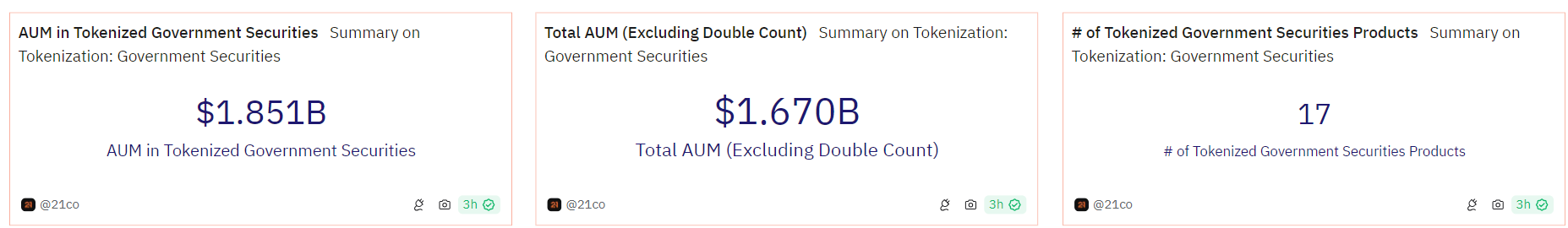

These products have emerged as one of the hottest asset classes over the past few years. According to Dune Analytics data, the assets under management (AUM) for treasury bills now stand at $1.85 billion. Major institutions, including BlackRock and Franklin Templeton, are currently major players. Others, such as Goldman Sachs, are planning to launch their tokenized products this year.

Unsurprisingly, experts have predicted that the AUM could reach as high as $3 billion before the end of the year. This is highly likely, especially as interest grows on multiple fronts, including DeFi protocols allocating part of their treasuries to the tokenized products.

cryptopolitan.com

cryptopolitan.com