A volatile week looms over the cryptocurrency market, with the Federal Reserve interest rate decision shaking the macroeconomic landscape. Moreover, the industry will unlock nearly $190 million in vested tokens this week, sounding an alarm to these affected cryptocurrencies.

These crypto unlocks release previously illiquid tokens, usually in vesting contracts, inflating the circulating supply and creating sudden selling pressure. Usually, the involved entities receive the unlocking promise within the project’s initial distribution and have to wait for the schedule to sell and realize the promised value.

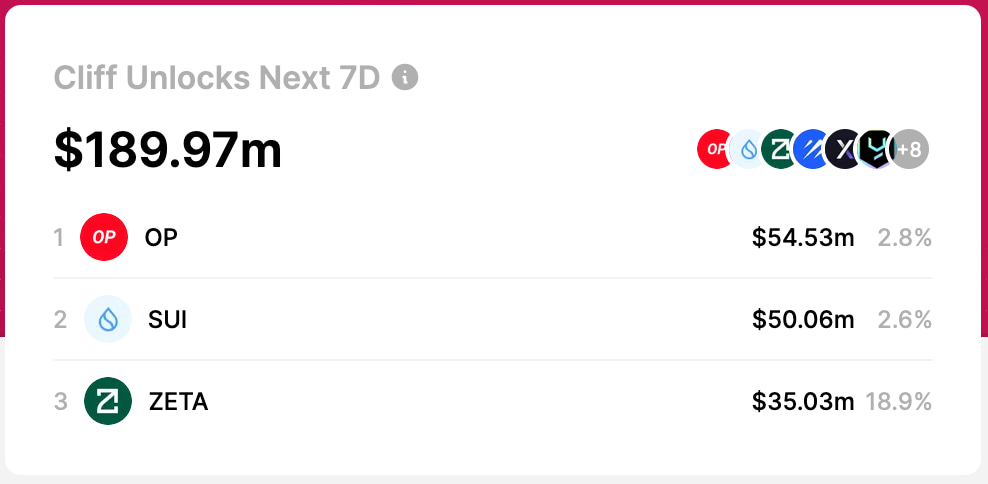

According to TokenUnlocksApp data, 14 projects will unlock $189.97 million in tokens in the seven days following July 27. In particular, three cryptocurrencies stand out with $139.62 million in unlocks, representing 73.5% of this week’s events.

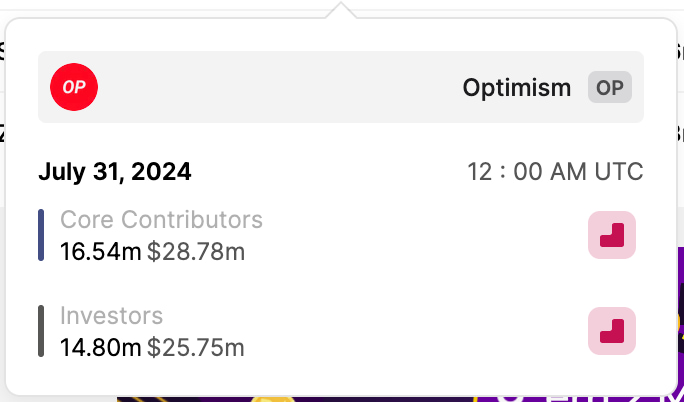

Optimism (OP) monthly token unlock

On July 31, Optimism (OP) will unlock 31.34 million OP to core contributors and investors, worth $54.53 million. This amount represents a 2.8% supply increase, part of Optimism’s monthly unlocks that result in nearly 35% annual inflation.

Notably, the same amount was worth $55 million, $80 million, and $144 million in previous unlocks from June to April. The decrease in value from the same amount of unlocked tokens evidences the economic effects of such high inflation.

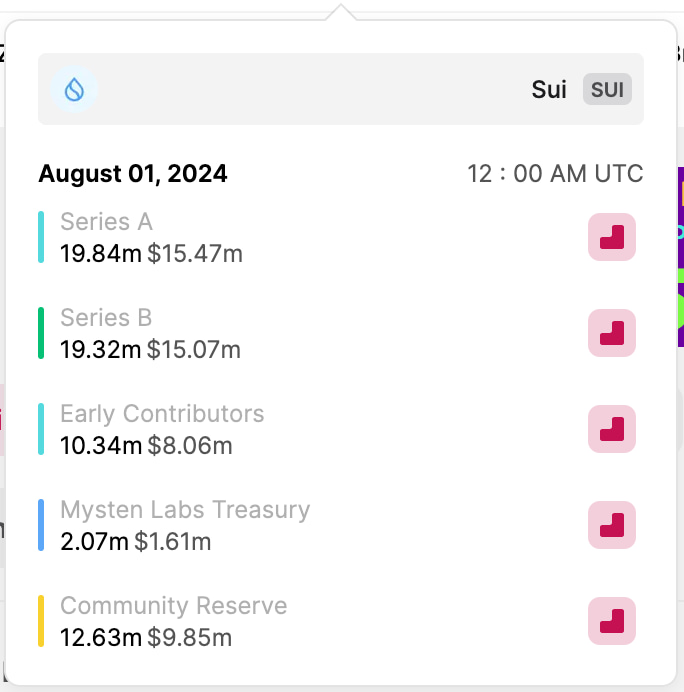

Sui Network ($SUI) supply inflation

On August 1, Sui Network ($SUI) will unlock $50.06 million worth of 64.2 million tokens for a 2.6% monthly inflation. This represents a nearly 10% loss from the same unlocked amount in July, worth $54.63 million, as Finbold reported. In June, a similar amount was worth almost $70 million.

Notably, Series A and Series B private investors will receive most of this release. Early contributors, Misten Labs treasury, and the Community Reserve will receive the remaining tokens to sell and profit over retail.

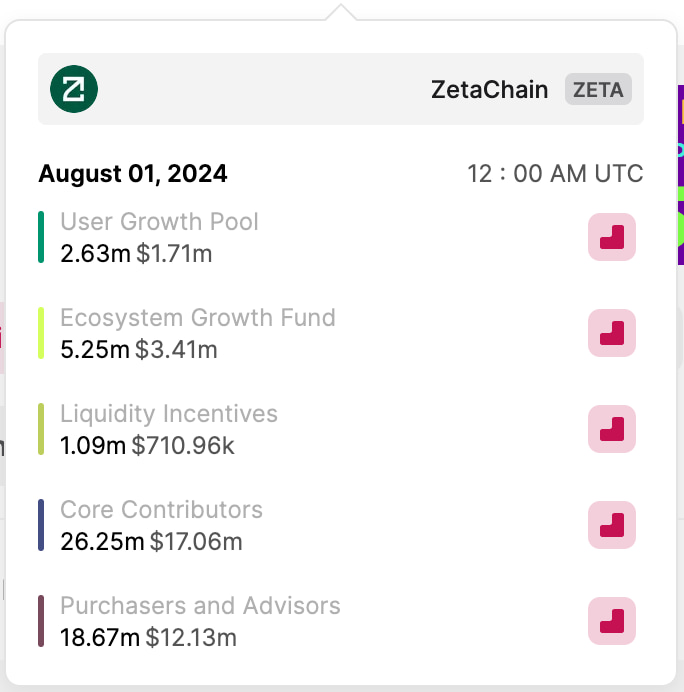

Avoid trading ZetaChain ($ZETA)

However, it is ZetaChain ($ZETA) that will be mostly affected by this week’s cliff unlocks. The low-cap cryptocurrency will release 53.89 million $ZETA worth over $35 million on August 1.

Despite having a lower nominal value than the previous two, ZetaChain’s unlock represents 18.9% of its current capitalization. Thus, a sudden supply inflation of nearly 20% will flood the market and will likely crash $ZETA’s price.

As things develop, traders will speculate and try to price these token unlocks on each of these inflated cryptocurrencies. This may intensify the already expected volatility for this week, ahead of the Federal Reserve’s interest rate decision.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com