Ethena gained bullish momentum after Securitize, the distributor of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), proposed a significant investment.

Late on July 23, Ethena Labs, the company behind the USDe stablecoin, posted on X that Securitize requested a $34 million allocation in BUIDL from the company’s $45 million reserve fund. This could allow Ethena Labs to gain exposure to the U.S. Treasury funds and make “low-risk” investments and generate yield.

The second of which was from Securitize, distributors of @BlackRock BUIDL: pic.twitter.com/tAy7HtMj9y

— Ethena Labs (@ethena_labs) July 23, 2024

Following the announcement, Ethena ($ENA) surged by 11.2% and is trading at $0.5 at the time of writing. The asset’s market cap is hovering close to the $850 million mark. Notably, the $ENA daily trading volume rallied by 81%, reaching $150 million.

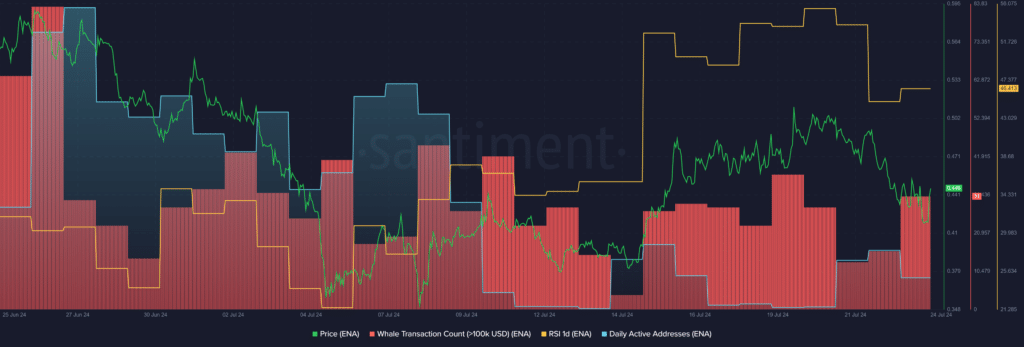

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of $ENA almost doubled over the past 24 hours — rising from 16 to 31 unique transactions per day.

On the other hand, data from the market intelligence platform shows that the number of Ethena daily active addresses plunged by 19% over the past day — falling from 1,042 to 844 active unique wallets.

At this point, the decline in the number of active addresses while the whale activity around the asset rises shows the possibility of high price volatility due to potential short-term whale profit-taking.

Per Santiment, the $ENA Relative Strength Index (RSI) is currently hovering at 46. The indicator shows that Ethena is sitting in a good spot for a price hike. However, a short price correction would be expected due to the high amount of whale transactions.