Three cryptocurrencies will unlock over $170 million in tokens this week, which cryptocurrency traders should avoid having substantial exposure to. These unlocks have the potential to flood the market, leading to increased selling pressure and significant price fluctuations.

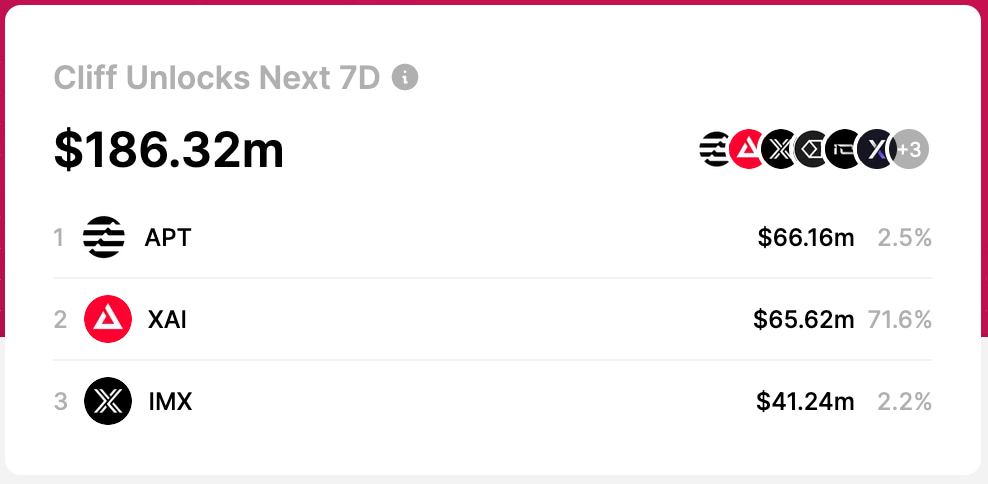

On July 7, Finbold retrieved data from the TokenUnlocks.app, which shows $186.32 million in the seven-day cliff unlocks. Notably, this week’s three leading protocols will release $173.02 million in tokens, accounting for 93% of the total.

Nine projects in total make up the “next seven days cliff unlocks:” Aptos (APT), Xai (XAI), ImmutableX (IMX), Ethena (ENA), io.net (IO), dYdX (DYDX), Moonbeam (GLMR), 1inch (1INCH), and Forta (FORT).

Aptos’s (APT) $66M token unlock

First, investors should avoid trading and having exposure to APT amid a potential sell-off incoming. Aptos is a layer-one blockchain for Web3 and decentralized finance (DeFi) solution developed by former Meta Platforms (NASDAQ: META) engineers.

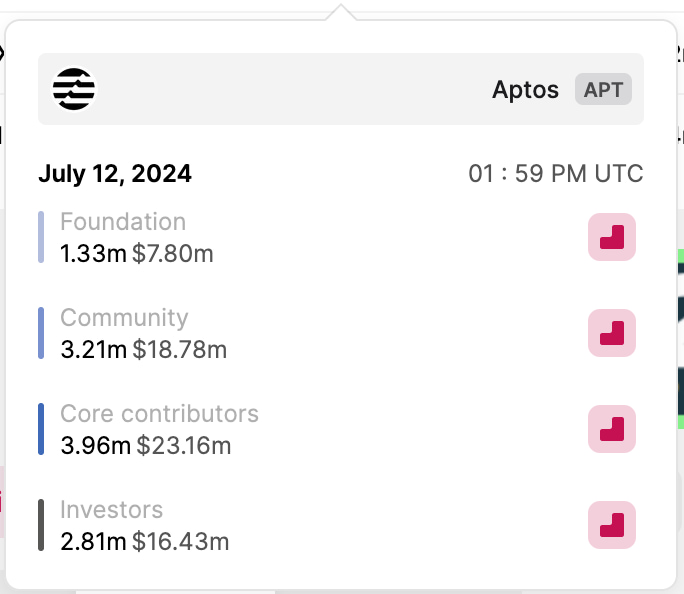

On July 12, the protocol will unlock 11.31 million APT tokens currently worth $66.16 million. Interestingly, the network unlocked the same amount of tokens on June 12, worth $103.48 million, as Finbold reported.

Aptos’s unlock represents a nearly 2.5% supply inflation that repeats every month with slight variations. The month-over-month loss of purchasing power demonstrates the possible economic impact of this inflation.

Core protocol contributors and the Foundation will receive 5.29 million APT worth $30.96 million, while private investors will get $16.43 million to realize their monthly profits over retail buyers.

Xai’s (XAI) $65M token unlock

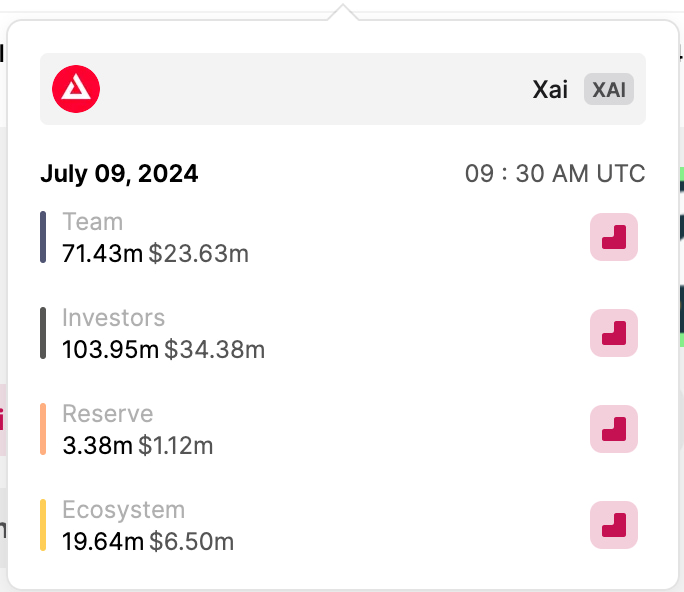

Second, XAI has a more relevant unlock despite having the same nominal value as Aptos because of its lower capitalization. On that note, this upcoming event will represent a worrying 71.6% supply inflation for the project.

On July 9, the protocol will nearly double its market cap, unlocking 198.4 million XAI for private investors, the development team, the ecosystem, and “reserves”. Notably, private investors will receive 103.95 million XAI for over 52% of the total $65 million worth of unlocks.

The team will receive the second-largest share of 71.43 million tokens, worth $23.64 million. A sell-off of this whole amount could liquidate XAI’s buy orders in all markets, driving the price to zero.

ImmutableX’s (IMX) $41M token unlock

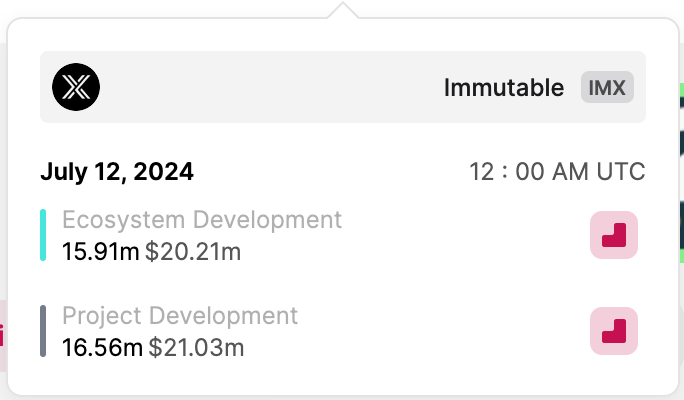

In closing, the last significant unlock is from ImmutableX, with a 32.47 million IMX unlock worth $41.24 million. The project will have an even distribution aiming at ecosystem and project development, triggering the event on July 12.

Cryptocurrency traders will try to speculate on the economic effects of these unlocks and sell-offs on price, which could increase volatility and worsen the potential risk-reward ratio. The market is uncertain and influenced by multiple factors, requiring proper risk management and learning when to avoid trading specific cryptocurrencies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com