A new whale wallet accumulates over 583.7 billion Shiba Inu tokens from crypto exchange Binance amid SHIB’s recent collapse to the $0.000015 region.

The procurement, which was part of a broader accumulation frenzy by this whale address, comes at a time when the crypto market is witnessing turbulence. Prices continue to drop to lower levels, with investors showing mixed reactions to the trend.

Shiba Inu has collapsed 45.87% from its May 29 high of $0.00002945, having breached the $0.000016 support. It now changes hands at a 19-week low. Interestingly, some market participants regard this downturn as a buy-the-dip opportunity, as evidenced by the recent movement.

Whale Procures 583.7B SHIB from Binance

The 583.7 billion SHIB transaction, spotlighted by Lookonchain, occurred yesterday at 12:46 UTC. Shiba Inu traded for $0.00001666 at the time, with the assets worth $9.725 million upon purchase. Procuring the same tokens at the May 29 high would have demanded $17.192 million, essentially $7.4 million more.

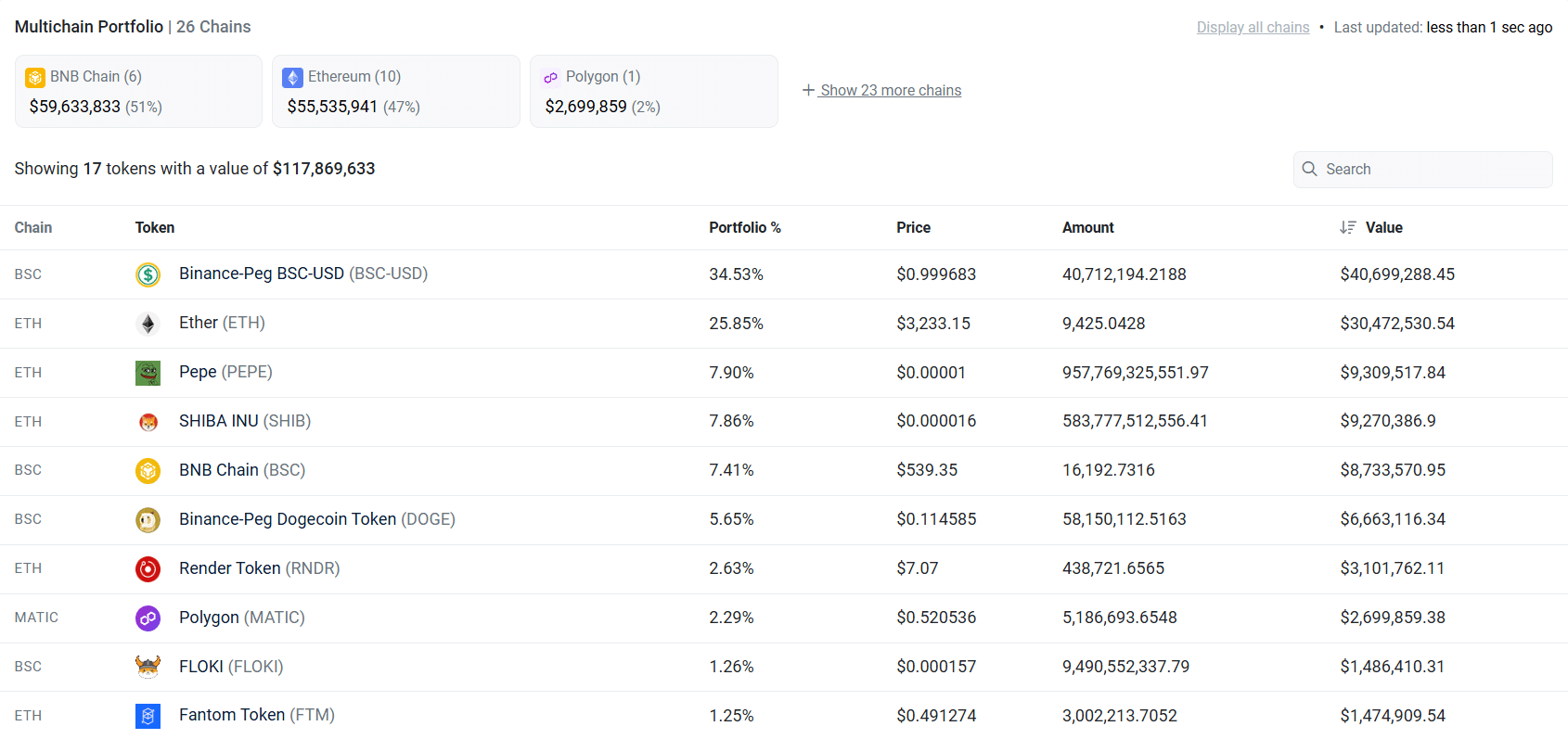

A fresh wallet withdrew more than $120M worth of assets from #Binance 2 hours ago.

Including:

40.7M $USDT

9,425 $ETH($30.15M)

957.77B $PEPE($9.84M)

583.78B $SHIB($9.68M)

16,192 $BNB($9M)

58.15M $DOGE($6.95M)

438,721 $RNDR($3.17M)

5.18M $MATIC($2.81M)

3M $FTM($1.59M)

9.49B… pic.twitter.com/lOrROZzVYl— Lookonchain (@lookonchain) July 3, 2024

Interestingly, on-chain data shows this whale was not only interested in Shiba Inu, but also a host of other assets. Some of the most notable tokens include 9,425 Ethereum worth $30.15 million, 957.7 billion PEPE valued at $9.84 million, and 16,192 BNB worth $9 million.

The individual also procured FLOKI ($1.56 million) DOGE ($6.95 million), USDT ($40.7 million) and MATIC ($2.81 million). In all, he scooped up $130 million worth of crypto within six hours. However, due to the latest market drop, his multi-chain portfolio has now declined to $117.8 million. The whale has held onto the tokens, triggering speculation on the next possible move.

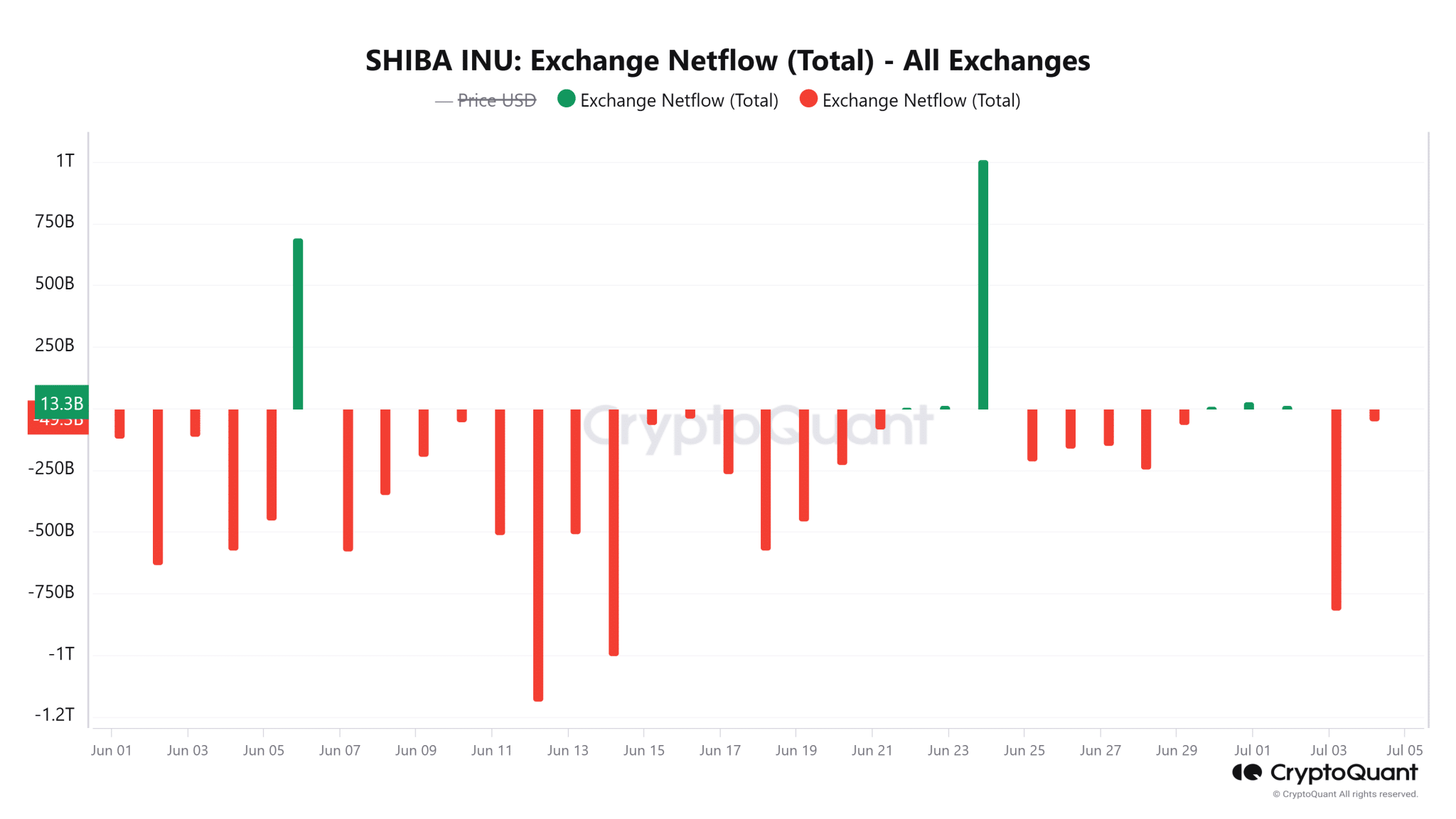

Shiba Inu Witnesses Exchange Withdrawals

Meanwhile, the recent Shiba Inu transaction is the latest involving multiple withdrawals from exchanges in the past month. Interestingly, investors have continued to procure and withdraw their SHIB tokens from exchanges in recent times, suggesting bullish sentiments.

Since June 1, the CryptoQuant SHIB Exchange Netflow metric has only recorded seven days of positive netflows. In contrast, there have been 26 days of negative netflows. Remarkably, exchanges have witnessed 7.823 trillion SHIB in net outflows within this period. This represents the largest cluster of exchange net outflows since January.

The Crypto Basic called attention to some of these exchange outflows transactions on multiple occasions. On June 20, whales withdrew 2.55 trillion SHIB from Robinhood and Binance. Another report last week confirmed the reduction in exchange reserve as these net outflows persisted.

The last time this trend of reduced reserve occurred in January, Shiba Inu witnessed a remarkable upsurge the next month. However, amid the recent ongoing withdrawals, market pressure has kept Shiba Inu down, now trading for $0.00001584. Despite this, analysts continue to project an imminent recovery.

thecryptobasic.com

thecryptobasic.com