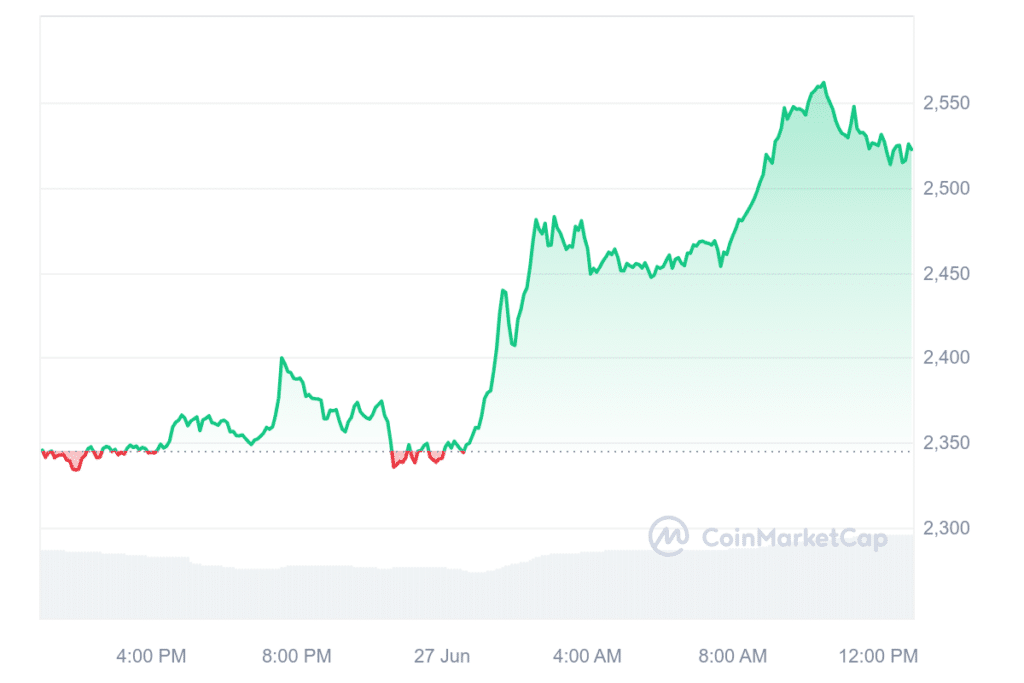

MKR, the native token of the Maker protocol, has surged by 9%, making it one of the top gainers among the top 100 cryptocurrencies.

At the time of writing, MKR was trading at $2,522, with its daily trading volume up 23% to $107 million. The token’s market cap also climbed 8% to reach $2.34 billion, ranking it as the 39th largest crypto asset per data from CoinMarketCap.

The latest surge in the MKR token follows a June 25 X post from MakerDAO, a DeFi lending protocol and developer of the stablecoin DAI, in which it revealed a $1.35 million audit contest, marking the largest of its kind.

Announcing the official Endgame audit contest, hosted on @sherlockdefi.

— Maker (@MakerDAO) June 25, 2024

DeFi builders are invited to participate in the largest bug-finding contest in the space, with a total of 1,350,000 DAI in rewards, scheduled to run from July 8th through August 5th, 2024.

This is a unique… pic.twitter.com/XWoc5KNbYb

The audit contest will be hosted on the Sherlock Platform, a leading provider of audit contests in Web3.

The $1.35 million Sherlock audit contest is a pivotal part of MakerDAO’s Launch Season, which is the first phase of the Endgame, scheduled for later this summer.

Endgame represents the final development stage in MakerDAO’s long-term strategy. It aims to revamp governance to establish a self-sustaining equilibrium known as the Endgame State.

Rune Christensen, co-founder of MakerDAO, outlined the significance of the Endgame launch, noting that “rock-solid security has always been a priority for MakerDAO.”

He added that it has become one of the project’s defining features. Partnering with Sherlock to “create a program to pressure test the system” was a logical step as MakerDAO progresses towards the Endgame.

The open-invite bug-finding competition aims to attract top security experts and emerging researchers to identify vulnerabilities quickly.

Scheduled from July 8 to Aug. 5, 2024, the contest seeks to leverage the global security community’s expertise to rigorously test the codebase before the launch.

Participants will have four weeks to scrutinize every line of the codebase.

Jack Sanford, co-founder of Sherlock, remarked that “nothing demonstrates MakerDAO’s unwavering commitment to security,” like initiating the largest audit contest in history.

He noted that Sherlock has engaged some of the world’s top security experts for this contest while also anticipating strong performances from up-and-coming participants.

In 2024, Sherlock has conducted over 70 audit contests with major Layer-1 and Layer-2 networks.

Leading up to the contest, the week of July 1 will feature educational content, including tips and insights from top MakerDAO bug bounty hunters and a code walkthrough from the MakerDAO team and prominent figures in the crypto space.

Another potential cause for the surge in the Maker protocol may be significant whale buying activity, as reported by the on-chain analytics platform iCrypto.

$MKR – Smart Whales Have Acted, Will You Too? 👨💻

— iCrypto | Sentiment & On-chain Analysis (@iCryptoAI) June 27, 2024

Watch details here: https://t.co/9EaswLV79l$MKR topped the list of accumulation by Smart Money in the past 24 hours.

Some Smart Whales have started to take action:

📌 Wallet 0x3737 (https://t.co/kEj1mRJOR5), also known as… pic.twitter.com/35nzDvtW55

Within a period of three hours, a whale with a wallet named “Thiswillmakeyouloveagain” bought 37.35 MKR ($94,562) in the price range of $2,521 – $2,526. Currently, the wallet holds 452.76 MKR, which is worth about $1.15 million.

Similarly, another whale with a wallet named “twofoldcap.eth” bought 66.55 MKR ($165,000) at a price of $2,447. Currently, it is holding 100.81 MKR ($256,860).

Meanwhile, according to multiple analysts, MKR is forming a falling wedge pattern in the last 12-hour timeframe, indicating a potential breakout.