Decentralised exchange Uniswap is gearing up for a critical juncture as the community prepares to vote on a proposal to activate protocol fees for the first time since Uniswap V3 was launched.

On Friday, May 31st, Uniswap token holders will begin on-chain voting to decide whether to enable the fee switch in Uniswap V3 pools. This move would allow the protocol to collect a portion of trading fees generated on the platform to reward $UNI token holders who have staked or delegated their governance tokens.

Uniswap Foundation Prepares for Key Governance Vote

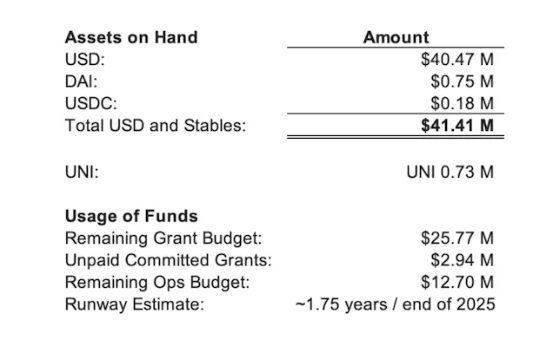

Ahead of the vote, the Uniswap Foundation disclosed that it is now holding $41.41 million in fiat and stablecoins, along with 730,000 $UNI tokens. According to Unchained, the foundation plans to allocate $25.77 million of these funds for grants and operational expenses over the next two years.

The decentralised finance (DeFi) community has been waiting for the activation of the fee mechanism in Uniswap V3, as it would significantly transform the platform’s economics.

Currently, all trading fees go to liquidity providers who stake their assets in Uniswap’s pools. Once the fee switch is enabled, it would redirect some of these revenues to $UNI token holders as an extra incentive for participation in the protocol’s governance.

However, previous attempts to activate the fee system have faced opposition. Some community members concerned it might negatively affect liquidity on the exchange.

Fee Mechanism Implementation Plan

If the May 31st vote is successful, the fee mechanism will not be implemented immediately. The Uniswap team proposes an additional upgrade to simplify setting fee parameters, granting the community more control and flexibility.

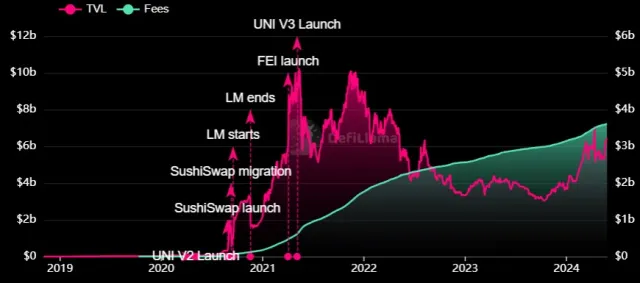

With $3.6 billion in historical trading fees generated on Uniswap, activating the protocol’s fee switch could significantly reshape the economics and governance of one of DeFi’s most influential decentralised exchanges.

Uniswap Labs has recently received a Wells Notice from the SEC. This notice indicates that the SEC staff has completed its investigation and is considering recommending enforcement action against the entity.

As of the latest update, $UNI, the platform’s native token, has seen a slight price drop of 1.4%, bringing its current value to $11.16. However, $UNI has surged over 58% in the past two weeks, following a low of $6.8 on May 15th.

coinculture.com

coinculture.com