The cryptocurrency market is abuzz with anticipation over the potential approval of a spot Ethereum ETF by the US Securities and Exchange Commission (SEC).

Daniel Yan, co-founder of Matrixport, believes Solana (SOL) could be next in line.

Solana May be the Next ETF Approval

As the SEC’s decision on a spot Ethereum ETF looms, speculation is rife about which cryptocurrency might be next. Daniel Yan believes Solana is a prime candidate, potentially benefiting from Ethereum’s anticipated success: he draws parallels to the Bitcoin ETF approval, which boosted Ethereum’s value and market interest.

Indeed, the launch of the spot BTC ETF in the US led to a 12% increase in the ETH/BTC pair within a week. Matrixport co-founder suggests Solana could experience similar momentum.

Сrypto community members are also actively speculating that the approval of a spot Ethereum ETF will inevitably lead to applications for ETFs on other altcoins. Popular crypto analyst Ted also hinted at the possibility of spot the ETF filings shortly.

“The market is certainly not priced for this… if it’s approved, get ready for all kinds of spot altcoin filings. cough, cough SOL,” he remarked.

On the other hand, some experts believe that filing for a spot ETF for Solana might be challenging because SOL futures ETF is not yet listed. Unlike Bitcoin and Ethereum, which had actively trading futures ETFs at the time of their spot ETF approvals, Solana lacks this critical step, potentially hindering its immediate consideration for a spot ETF.

“It is natural for the crypto sphere to be excited about the potential of Solana ETF to be listed, but this would be a major stretch. There are no futures listed on Solana. If anything, the ones surprisingly ahead of Solana, by virtue of these being listed on CFTC-regulated Coinbase Derivatives, are BCH, LTC, and yes Doge ( not a surprise, fair launch POW chains),” Dimitrios Kavvathas, Founder of Ithaca told BeInCrypto.

TradFi-Related SOL Trading Products

While no Solana ETFs are currently approved in the US, alternatives like the Grayscale Solana Trust (GSOL) and products such as VanEck’s Solana ETN and 21Shares’ Solana ETP offer exposure to SOL prices, albeit through derivatives. These products provide investors with indirect ways to trade SOL, reflecting its price movements.

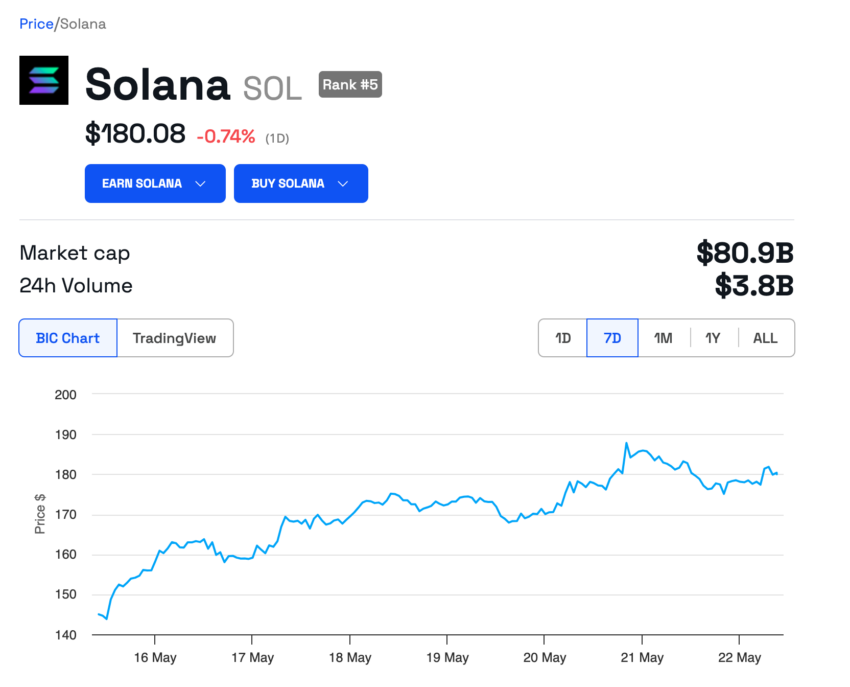

Over the past week, SOL has surged by more than 23%, indicating heightened interest and speculation. This impressive rise reflects growing investor confidence and anticipation surrounding Solana’s potential.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

With the right regulatory environment, it could soon join Bitcoin and Ethereum in achieving ETF approval, marking a turning point in its development. While challenges remain, the optimism from industry leaders like Daniel Yan confirms that bold predictions can become reality.

beincrypto.com

beincrypto.com