Ethereum Name Service (ENS), Lido DAO (LDO), and Pyth Network tokens staged a strong recovery this week as the fear and greed index turned green. LDO jumped to a high of $2.31 on Tuesday, its highest swing since April 12th. It has soared by over 53% from its lowest point this year as its total value locked (TVL) soared to over $34.40 billion.

Ethereum Name Service token soared to $21.87, its highest level since April 9th while Pyth Network jumped to $0.540, up from this month’s low of $0.5330. Other tokens like Renzo, Metis, and Tectum also jumped by double-digits.

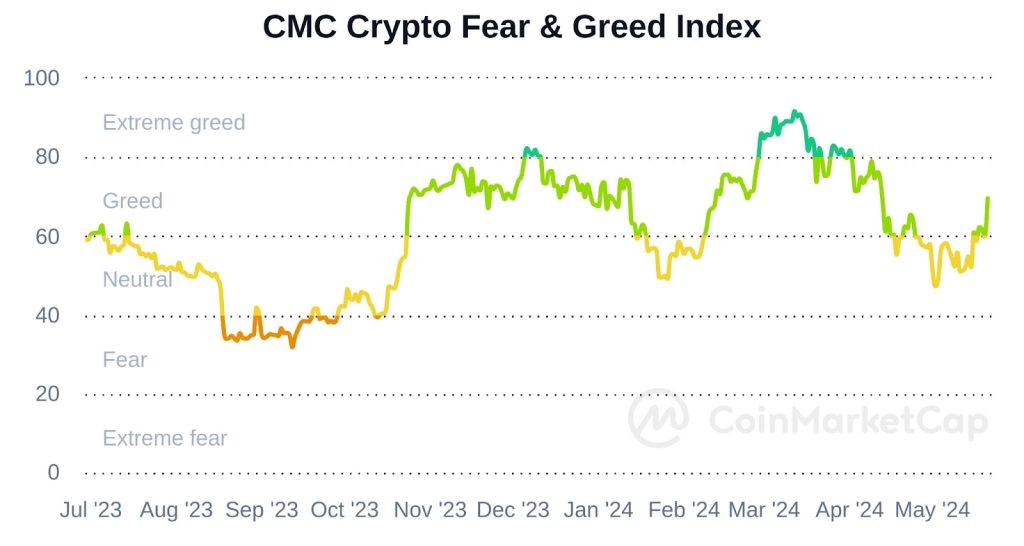

Crypto fear and greed index jumped

This performance happened as the crypto fear and greed index moved to the greed zone of 70, its highest point since April 18th. In most cases, cryptocurrencies do well when there is a sense of greed in the market.

Cryptocurrency prices surged as investors remained optimistic about the likelihood of spot Ethereum ETFapprovals. Several companies like Blackrock, VanEck, Franklin Templeton, and Ark Invest have applied for these funds.

Such approval is expected to lead to more inflows from institutional investors as we saw in the Bitcoin market. All spot Bitcoin ETFs have added over $50 billion in assets in the past few months and this trend may continue. Indeed, almost 1000 companies have reported spot Bitcoin ETF holdings.

JUST IN: 937 financial firms disclosed spot #Bitcoin ETF holdings in Q1 2024.

— Watcher.Guru (@WatcherGuru) May 16, 2024

Gold ETFs had just 95 firms invested in its first quarter. pic.twitter.com/a6g4Js9uYA

Lido, Ethereum Name Service, and Pyth are soaring

Lido is set to benefit from an Ethereum ETF approvals because it is the biggest player in the liquid staking and DeFi industry. It has over $34.40 billion in assets, a 15% increase in the past 30 days. It is also one of the most profitable networks in the blockchain industry as it generated over $413 million in revenue this year.

Ethereum Name Service is also the biggest ETH domain registrar with over 2.14 million names and integrations with over 420 networks. It will likely continue doing well as the Web3 industry evolves. As such, instead of using long addresses, one can use his preferred name with the ETH extension.

Meanwhile, Pyth Network has rebounded because of the growth of Solana’s ecosystem. Pyth is a Chainlink alternative that lets users connect off-chain data to the on-chain. It focuses mostly on Solana’s ecosystem, which is seeing robust growth.

Data shows that the Total Value Secured in its ecosystem has jumped to over $5 billion, with most of the assets being in Kamino Lend, Marginfi Lending, Drift, Jupiter, Solend, and Avalon Finance.

The post Here’s why the ENS, Lido, Pyth Network prices are soaring appeared first on Invezz

invezz.com

invezz.com