The price of Gnosis native token, $GNO, surged 20% after Thanefield Capital announced a proposed $30 million buyback program.

Holding significant amounts of $GNO, this crypto fund plans a large-scale buyback to realign the token’s market value with its intrinsic book value.

$30 Million Buyback Proposal Details

Thanefield Capital proposed that Gnosis DAO deploy $30 million from its treasury over six months. This initiative aims to boost the $GNO token’s value, which the fund argues is currently undervalued. According to Thanefield, Gnosis holds $630 million in non-$GNO liquid assets and $100 million in venture capital investments. In contrast, $GNO’s market capitalization is approximately $424 million, based on its circulating supply of 1.53 million tokens.

Read more: A Beginner’s Guide to Decentralized Autonomous Organizations

The proposal has received preliminary support from the Gnosis community, with 12 out of 14 governance forum voters in favor. Gnosis co-founder Martin Köppelmann endorsed the proposal, emphasizing the need to link the buyback to a growth program.

“I favor this proposal if it connects to a growth program where the $GNO acquired in the buyback is consequently used to attract more users,” Köppelmann commented.

If approved, the buyback program will follow a two-pronged strategy. The first approach, the Time-Weighted Average Price (TWAP) strategy, will allocate $15 million to purchase $GNO tokens over six months, aiming to exert a daily buy pressure of approximately $83,333. The second approach is discretionary, allocating another $15 million to optimize purchases based on market conditions. Karpatkey, an on-chain asset management project, will manage the buyback.

Gnosis DAO’s Financial Landscape

Gnosis DAO manages various initiatives, including the Gnosis Chain and CoW Protocol. It also has a significant stake in Safe, an Ethereum multisig provider. Despite these assets and previous buyback rounds, $GNO’s market value has not reflected these successes. Thanefield Capital noted that long-term $GNO holders have not benefited financially from Gnosis DAO’s product developments, venture investments, and treasury management.

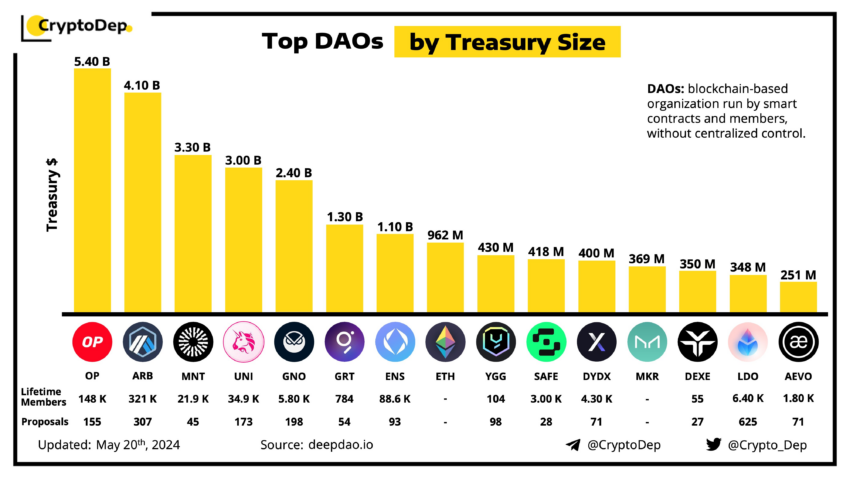

As of May 20, approximately 50,000 DAOs collectively hold $30 billion in assets. Gnosis ranks as the 5th largest DAO in terms of treasury size, holding over $630 million in assets, second only to Mantle in non-native marketable tokens.

Since the proposal’s announcement, Gnosis’ token price peaked at $320, a 20% increase, and is currently trading around $308. If implemented, the program could realign $GNO’s market value with its intrinsic worth, benefiting long-term holders and enhancing market perception.

beincrypto.com

beincrypto.com