GameStop’s shares have seen a rally of more than 70%, reminiscent of a few years ago. This time, it was due to the return of trader and investor Keith Gill, better known as “Roaring Kitty.”

The stock market was set ablaze on Monday as Keith Gill, famously known as “Roaring Kitty,” suddenly returned to social media, reigniting the meme stock frenzy that captivated the world in 2021.

Speculation Mounts Around Meme Stocks

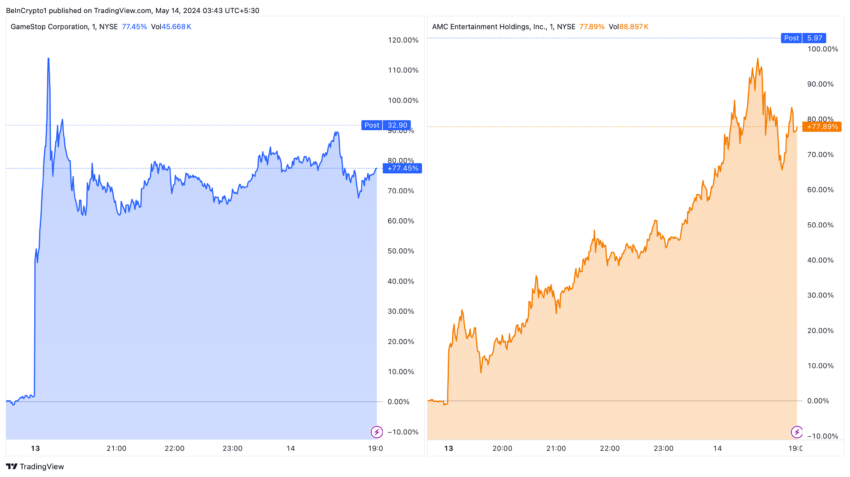

Gill’s post on X, depicting a video gamer intently leaning forward — a stance known to signal serious gameplay — was enough to send GameStop and AMC Entertainment’s stocks through the roof, with increases of 77.5% and 77.9%, respectively.

This dramatic market reaction marks the first time Gill has been publicly active since his last appearance roughly three years ago. The mysterious post quickly attracted over 12 million views, with Gill adding a cryptic video clip hours later, further fueling speculation and excitement among traders.

GameStop saw its shares momentarily peak at a staggering 110% increase before stabilizing. The trading frenzy was so intense that it triggered multiple daily trading halts. Similarly, AMC shares also saw a significant uptick, with prices doubling at one point during the trading session.

The resurgence of these stocks can be traced back to Gill’s influence in the early days of the pandemic. His advocacy for GameStop, a struggling video game retailer at the time, drew in a horde of retail investors who opposed hedge funds shorting the stock.

This collective action forced massive buy-ins from short sellers, skyrocketing the stock’s price and causing significant disruptions in the market.

Read more: GameStop NFT Marketplace: The Basics Explained

Gill’s recent activity has spurred buying in GameStop and AMC and spilled over to other meme stocks like BlackBerry and Trump Media & Technology Group Corp., which experienced their own respective rallies. Still, some industry analysts remain skeptical.

“I don’t think they have the numbers to keep this up, nor do I think the shorts have the resolve shown by Gabe Plotkin three years ago, so likely this fizzles as the fundamentals continue to deteriorate,” Wedbush’s Michael Pachter said.

beincrypto.com

beincrypto.com