Over the past 19 days, the stablecoin economy has stabilized with negligible growth after reaching the $160 billion threshold at April’s end. Out of the top five, $FDUSD is currently the frontrunner in terms of 30-day growth, showing a 15.3% increase in supply.

Stablecoin Valuation Holds Steady With Little Growth

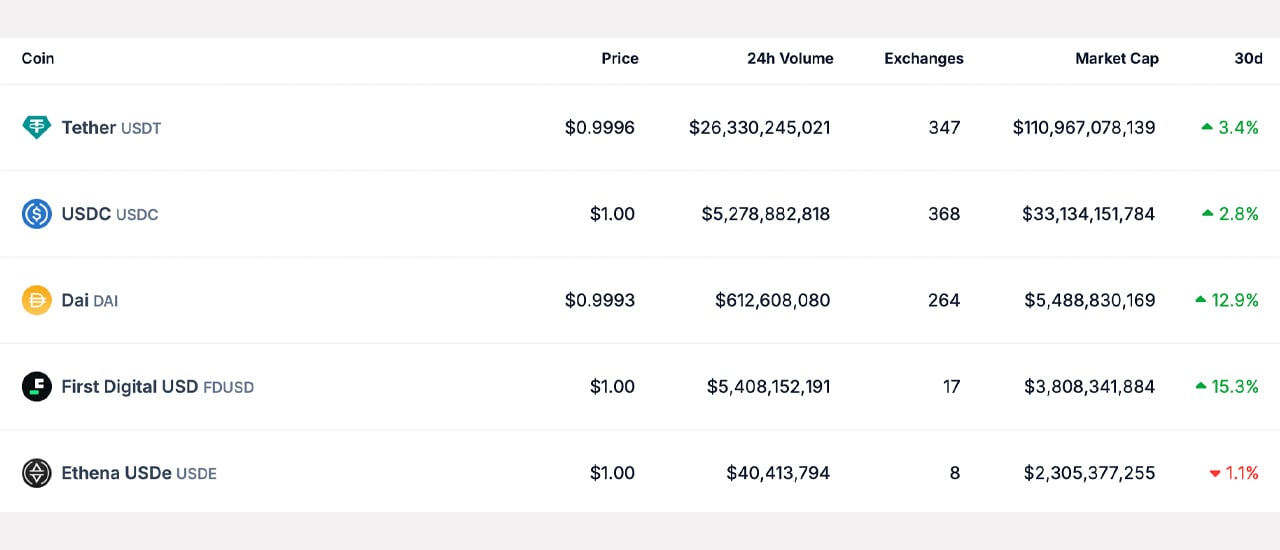

Following a period of rapid expansion, the growth in supplies of the major fiat-backed cryptocurrencies has decelerated in the last 19 days. At present, the stablecoin market is estimated at $160.86 billion, with a 24-hour trading volume of $37.88 billion. Consequently, the most widely used stablecoins now account for over 52% of the $72.25 billion total global trade volume over the previous day. Tether ($USDT) maintains its lead in supply and trading volume, with a 3.4% rise in supply over the past 30 days.

As of May 11, 2024, $USDT’s market capitalization stands at $110.96 billion, making up 68.97% of the total stablecoin market value. Circle’s $USDC, the second-largest stablecoin, has experienced a 2.8% increase this month, bringing its market cap to $33.13 billion. This weekend, $USDC’s market valuation commands 20.59% of the fiat-pegged cryptocurrency economy. After experiencing some declines in recent months, Makerdao’s $DAI has seen an increase this month.

$DAI’s supply has escalated by 12.9% in 30 days, positioning its market valuation at $5.48 billion or 3.4% of the total $160.86 billion. First Digital’s $FDUSD, with a 15.3% increase, competes closely with $USDT in terms of top stablecoin volumes recently. Post-growth, $FDUSD’s market capitalization approximates $3.8 billion. Ethena’s USDE is the sole top-five stablecoin to witness a 30-day decline, with its market valuation now 1.1% lower than last month, standing at $2.3 billion.

Over these 30 days, most other stablecoins have seen modest increases in supply. Contrarily, Paypal’s $PYUSD has noted a 96.5% rise in supply over the month. Currently, as the ninth largest stablecoin by market value, $PYUSD boasts a market cap of approximately $377 million. In the ever-changing stablecoin landscape, the recent plateau may indicate a consolidation phase following a period of intense growth. As leading contenders like $USDT and $FDUSD compete for trade volume dominance, their patterns of global trade volumes may predict broader market trends.

How do you think the current stability in the stablecoin market will influence future trading and investment strategies? Share your insights below.

news.bitcoin.com

news.bitcoin.com