The launch of the $EIGEN token is set to commence with an airdrop, a process where tokens are distributed to users based on certain criteria, including a points system that rewards early service adopters.

Kunal Goel, an analyst at Messari, noted that anticipating this airdrop was a “primary incentive” for users to place funds in EigenLayer’s service.

However, the excitement has been tempered by the fact that many participants who accumulated points are now barred from claiming their tokens due to using virtual private networks or residing in excluded countries.

Robert Drost, executive director at the Eigen Foundation, explained that the exclusions were a necessary step to adhere to regulatory guidelines, which are often unclear and challenging to navigate, noting:

It’s not possible to operate in the space without following regulatory guidelines and being responsible, and the challenging part is that there is not a lot of clarity.

This sentiment was echoed by Nick Cote, co-founder of Secondlane, who noted:

Issuers not being upfront with jurisdictional restrictions leaves a sour taste in people’s mouth when it comes time to receiving your rewards, and then you find out you’re disqualified for X, Y, Z reason.

Impact On The Broader DeFi Ecosystem

EigenLayer’s restaking service is not just a new feature in the Ethereum ecosystem; it represents a shift in how applications can leverage the deep pool of transaction validators that underpin Ethereum.

This service increases the yield from staking $ETH – from a baseline of around 3% to higher rates, albeit with additional risks.

As a result, EigenLayer has risen to become the “second most popular DeFi application,” as reported by Bloomberg, partly at the expense of liquid staking protocols like Lido and Rocket Pool, which have seen significant outflows in recent months.

Meanwhile, according to a recent report from IntoTheblock, nearly 4% of all $ETH is now restaked using EigenLayer, showcasing the project’s growing popularity.

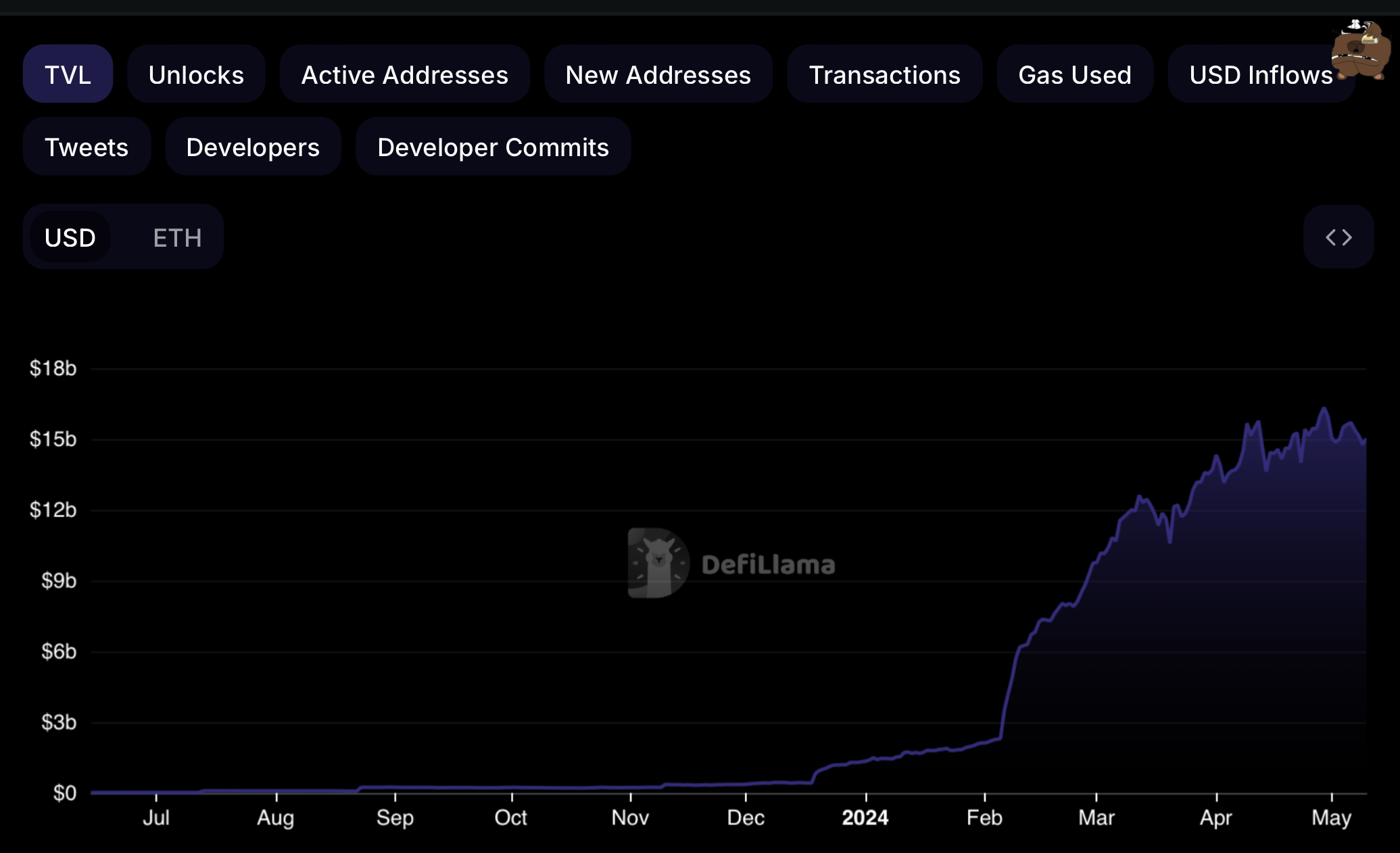

EigenLayer recently surpassed $15B in TVL.

Nearly 4% of all $ETH, and 40% of liquid staking tokens (LSTs) supply is currently being restaked into EigenLayer pic.twitter.com/LZ0vbp3L3z

— IntoTheBlock (@intotheblock) April 26, 2024

newsbtc.com

newsbtc.com