Ethena Labs presented its new roadmap, promising a convergence between DeFi, CeFi, and TradFi.

Its synthetic stablecoin, $USDe, aims to replicate what Tether’s USDT did in 2014 and MarkerDAO did in 2017.

Ethena’s Vision: DeFi, CeFi, TradFi Convergence

According to the DeFi protocol, $USDe succeeds because its reserves represent more than double the open interest in each combined perpetual DEX.

Ethena explained in its roadmap that it can provide valuable ‘non-toxic’ flows to exchanges DEX and CEX by using $USDe as collateral and triggering open interest. It emphasized that they act as a neutral infrastructure, which has resulted in up to $1.25 billion in protocol allocation towards $USDe.

“As other stable coin issuers grow and proliferate through DeFi, Ethena will expand along with them. The foundation in the futures markets is higher real yields. $USDe will be the core element on which these interest rate markets will be built,” Ethena said.

Read more: What Is Ethena Protocol and its $USDe Synthetic Dollar?

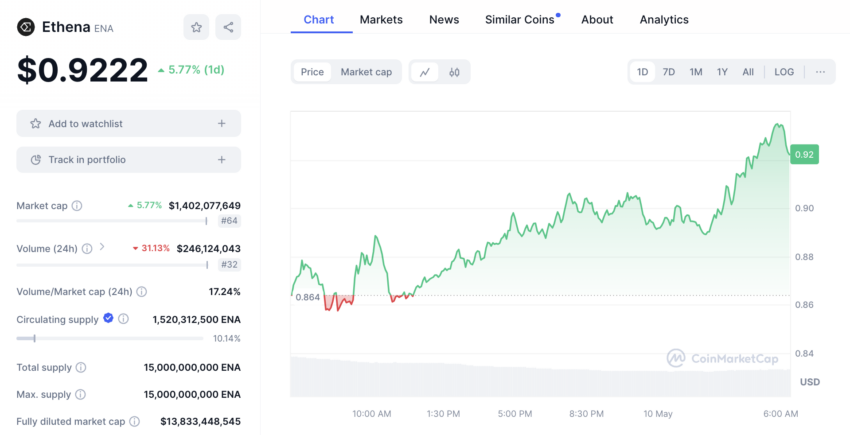

After launching its roadmap, Ethena’s native token, $ENA, soared more than 8%, rising from $0.85 to $0.93. $ENA is in a bullish rally, having risen 18.22% last week and 47.24% since its launch, with a market capitalization of $1.41 billion.

beincrypto.com

beincrypto.com