After a period of waning popularity in April, the memecoin sector appears to be experiencing a resurgence. This potential revival is fueled by a recent surge in activity on Pump.fun, a platform that streamlines the creation and deployment of memecoins.

Pump.fun removes the technical barriers often associated with launching a cryptocurrency. Users can design their memecoin with a name, ticker symbol, and image for a minimal fee, all without needing advanced technical knowledge or pre-existing liquidity.

The platform even incorporates safeguards against rug pulls, a notorious issue in the memecoin space. Every token launched on Pump.fun automatically implements a bonding curve for trading, where users directly influence the price through buying and selling.

Once a token reaches a specific market cap, a portion of the liquidity is deposited into a decentralized exchange and permanently locked, preventing developers from manipulating the token’s value.

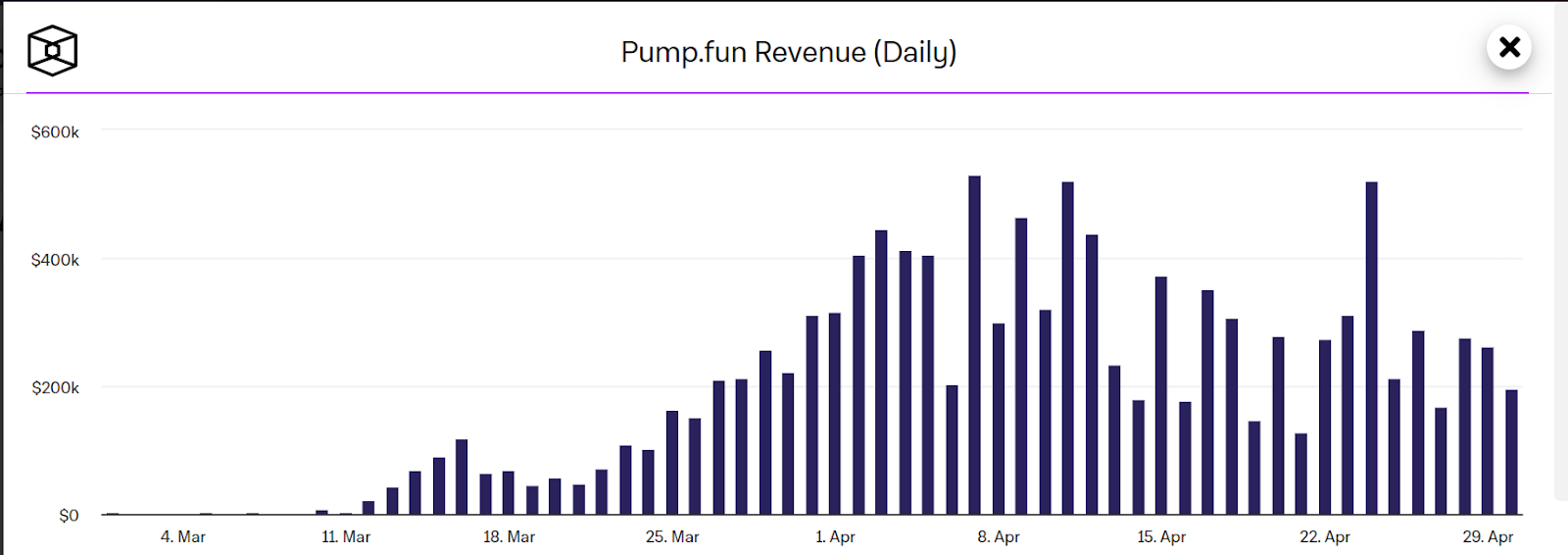

Source: TheBlock

This user-friendly approach has been a recipe for success for Pump.fun. The platform surpassed a staggering $5 million in revenue within just two months of launch. Their daily earnings peaked in early April, coinciding with the apex of memecoin popularity. While revenue softened later in the month as memecoin interest cooled, Pump.fun maintained a steady daily income exceeding $120,000.

However, recent developments hint at a potential second wind for memecoins. The renewed activity on Pump.fun suggests a rise in memecoin deployments, indicating continued interest in the sector.

Source: TradingView

Additionally, the GMCI MEME index which is a benchmark that tracks the performance of memecoins, displayed a positive shift. After dipping in mid-April, the index climbed back above 300 last week, signaling a potential rebound in memecoin valuations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com