Recently some really great news has been published by Tether, the company that issues and manages the world’s leading stablecoin (USDT).

Yesterday, in fact, the company published the economic and financial results of the first quarter of 2024.

Tether Releases Q1 2024 Attestation: Reports Record-Breaking $4.52 Billion Profit, Highest Treasury Bill Ownership Percentage Ever, Total Group Equity of $11.37 Billion

— Tether (@Tether_to) May 1, 2024

Summary

Tether news: The record profits for the company issuing the USDT stablecoin

The economic and financial report of Tether Holdings Limited, and it was prepared by BDO, one of the leading independent accounting firms globally.

In the first quarter of 2024, from January 1st to March 31st, Tether reported a record profit of 4.52 billion dollars.

The total net worth of the group (Tether Group) has risen to 11.37 billion dollars.

Approximately 1 billion dollars of that profit comes from net operating profits, generated mainly from holdings in US state bonds (Treasury bonds), while the rest comes from mark-to-market gains on positions in Bitcoin and gold.

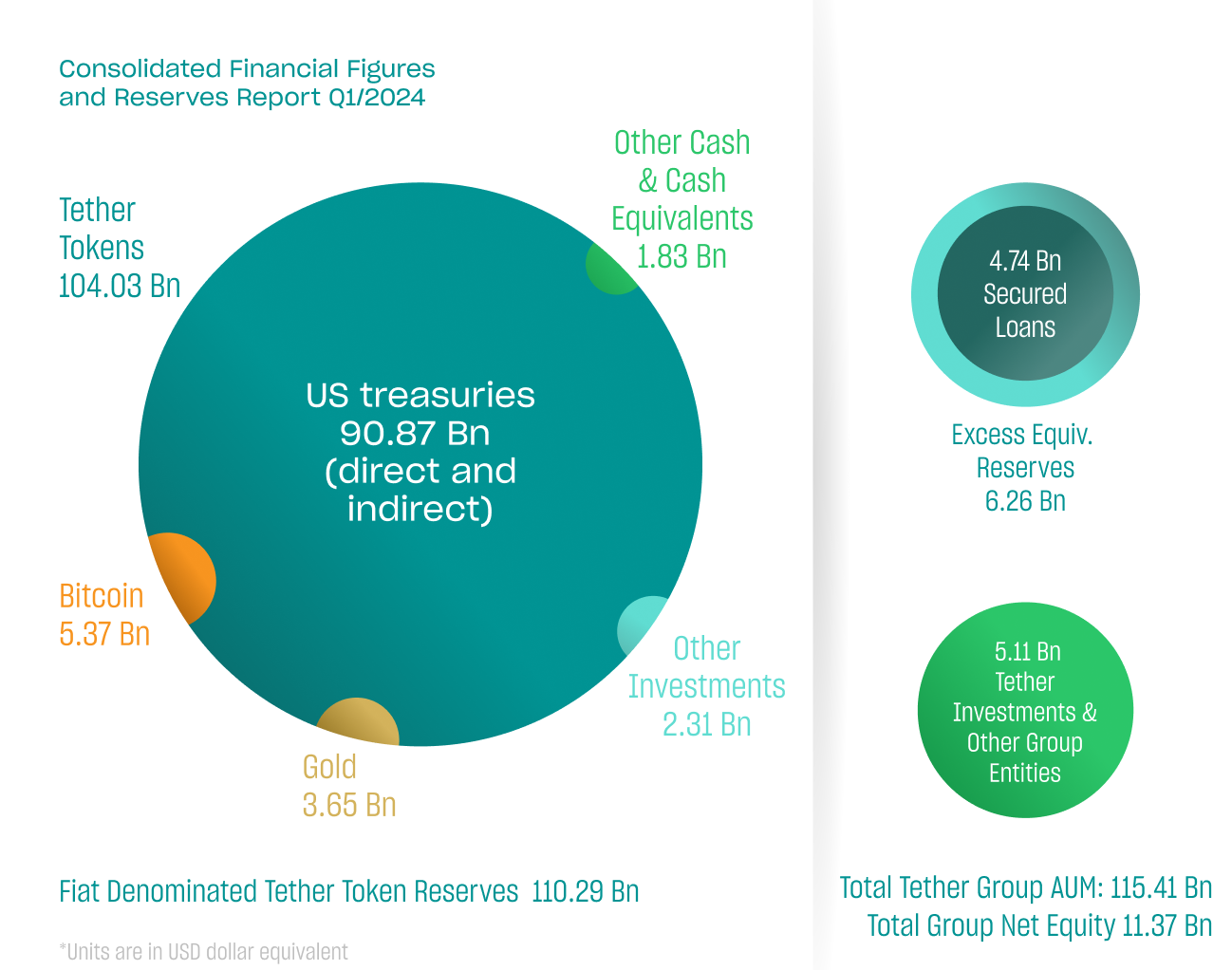

The first quarter of 2024 has highlighted unprecedented results achieved by Tether in the direct or indirect possession of US Treasury securities, now exceeding 90 billion dollars.

This means that more than 80% of the reserves of the USDT stablecoin are made up of US bonds, making it one of the safest stablecoins in the world.

Crypto news: The reserves of the stablecoin Tether (USDT)

USDT is the world’s leading stablecoin anchored to the US dollar, and is convertible on a 1:1 basis to USD at any time net of a relatively small fee.

Furthermore, it is exchangeable in USD on various exchanges, including Bitfinex, the crypto exchange that belongs to the same group as Tether and serves as the primary market.

Tether has in its treasury funds in cash or cash equivalents equal to or greater than the total value of all USDT in circulation worldwide. Of these funds, more than 80% is made up of Treasury bonds issued by the US Treasury, which have had a relatively high yield for some time due to high interest rates.

Today the company is one of the largest private holders of US government securities, although it is obviously surpassed by several foreign states.

BDO has confirmed that the USDT issued by Tether are backed by cash or equivalents (such as Treasuries) for approximately 90% of their total value. The remaining reserves are made up of illiquid assets.

The report certifies that as of March 31st, Tether held reserves for circulating tokens exceeding 110 billion dollars, compared to the overall market value of the same tokens of 104 billion dollars. Therefore, as of March 31st, 2024, Tether’s reserves exceeded the value of the tokens by over 6 billion dollars.

Overall, the company’s net worth, excluding reserves to support tokens, is 11.37 billion dollars.

Investments

Since the reserves of the USDT stablecoin now far exceed the market value of the tokens in circulation, Tether has also recently started reinvesting its proceeds in other activities.

As of March 31, it had more than 5 billion dollars in strategic investments, in various sectors such as AI and data, renewable energies, P2P communication, and Bitcoin mining.

Nowadays the Tether Group is not just a company that issues and manages a stablecoin, but a group composed of different companies active in various sectors that also deal with reinvesting the profits generated by managing USDT.

It should not be forgotten that the profits generated from investing in Treasury dollars from primary USDT buyers all remain within the company, and are never distributed to USDT holders. This means that, thanks to relatively high interest rates, the company is simply earning a lot by buying and holding US bonds with the USD that users exchange for USDT.

Since interest rates will remain high for a long time, perhaps until 2026, Tether will continue to easily churn out profits as long as USDT remains widely used in the crypto markets.

However, the most interesting thing is that Tether does not spend these profits, except for a minimal part, but generally invests them in other activities including some that are profitable in turn, such as Bitcoin mining. This is why the Tether Group managed to record $4.52 billion in profit in three months compared to $1 billion in profits generated from the investment in Treasury.

The comment

The CEO of Tether, Paolo Ardoino, stated:

“With the first attestation of 2024, Tether has demonstrated its ongoing commitment to transparency, stability, liquidity, and responsible risk management. As shown in this latest report, Tether continues to break records with a new profit benchmark of $4.52 billion, reflecting the strength and financial stability of the company. By reporting not only the composition of our reserves, but also the Group’s net worth of $11.37 billion, Tether is once again raising the bar in the cryptocurrency industry in terms of transparency and trust.”

en.cryptonomist.ch

en.cryptonomist.ch