$DYDX, the native token of the dYdX Chain, has evolved from a governance-only coin to a dynamic, multifaceted asset within six months of its launch.

According to a blog post by the dYdX Foundation, $DYDX has become the powerhouse of the layer-1 blockchain, enabling decentralized governance and allowing users to stake their tokens for rewards.

A Timeline of $DYDX’s Launch

$DYDX was launched in October 2023 alongside the dYdX Chain. Before that, the dYdX Foundation had launched $DYDX (now ethDYDX) in August 2021. ethDYDX serves as a governance token for the Ethereum-based layer-2 protocol dYdX v3.

In September 2023, the dYdX community voted to adopt $DYDX as the native token of the dYdX Chain. To this effect, a wethDYDX smart contract was deployed to serve as a bridge for token holders to convert their ethDYDX to $DYDX.

At the time of writing, more than 75% of all ethDYDX have been converted to $DYDX and migrated to the dYdX Chain. With 25% left, the circulating supply of ethDYDX now sits at roughly 247 million.

Staking $DYDX

dYdX Chain was designed with a staking reward mechanism that distributes 100% of the protocol’s fees, paid predominantly in Circle ($USDC), to stakers.

“This mechanism not only incentivizes the provision of security but also opens up various practical use cases for Stakers. Specifically, they can reinvest their $USDC staking rewards into crypto or other assets or use the $USDC as collateral for trading on the dYdX Chain with just a few clicks,” said the dYdX Foundation.

More than 18,900 $DYDX stakers are receiving rewards, with $20 million disbursed so far. Around 149 million $DYDX, representing 14.9% of the total supply, are staked to active set validators on the dYdX Chain with an annual percentage yield of 18%.

The Journey So Far

Earlier this month, the dYdX community approved a proposal to liquid-stake 20 million $DYDX to reduce the chance of malicious attacks, improve network security, and decentralize validator operations. Rewards from the liquid staking would auto-compound $USDC, be automatically converted into $DYDX, and then re-staked to generate additional yield.

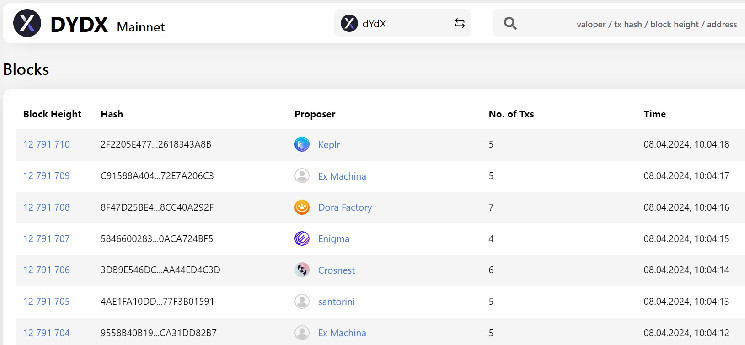

The dYdX Chain now has over $120 billion in cumulative trading volume with increasing staked assets. Community members have also initiated 55 governance proposals, indicating active participation in the network’s decision-making process.

Meanwhile, $DYDX has a total supply of 1 billion tokens, a circulating supply of 501 million $DYDX, and a five-year token distribution schedule.

cryptopotato.com

cryptopotato.com