Arbitrum, the largest Ethereum layer-2 scaling solution in terms of total value locked (TVL), is making strides toward decentralisation by deploying its permissionless fraud proof system, known as Bounded Liquidity Delay (BOLD), to its testnet on April 16. This development by Offchain Labs, the team behind Arbitrum, aims to enhance the security and integrity of transactions processed off-chain.

You might also like

Polkadot Makes a Splash at Indianapolis 500 with Crypto-Branded Car

dYdX Community Approves 20M Token Stake as Network Activity Surges

Ethereum Layer-2 Solutions and Their Challenges

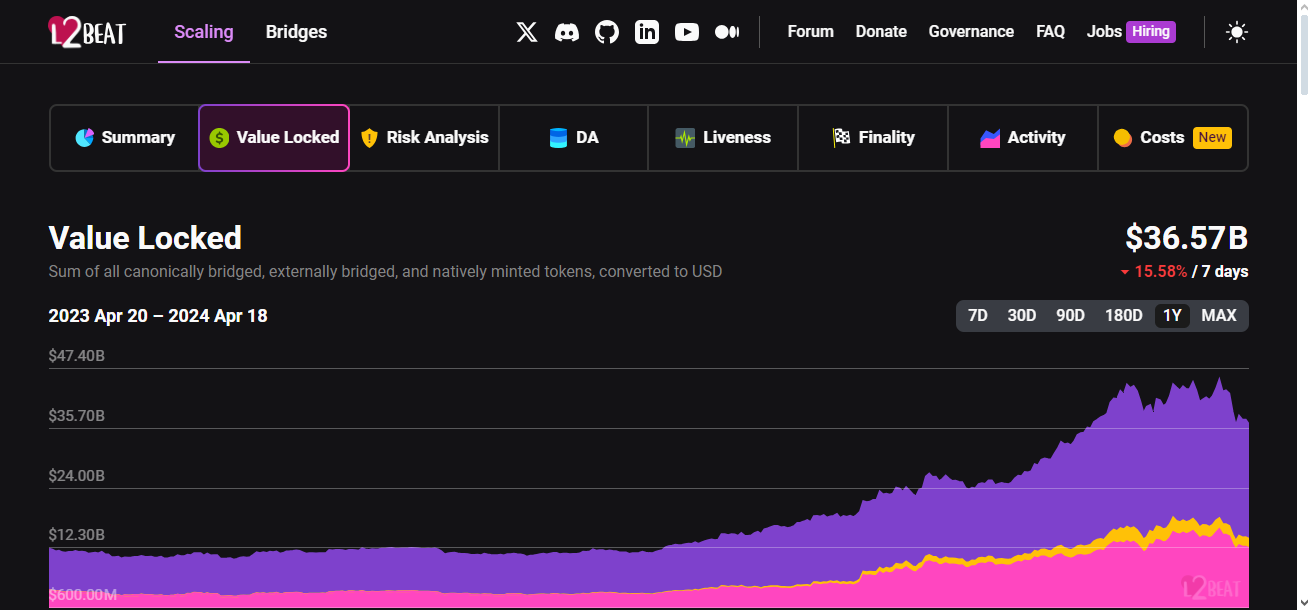

Ethereum layer-2 solutions, such as Arbitrum, Optimism, and Base, have gained traction over the years due to their ability to enable inexpensive transactions. Currently, these layer-2 platforms handle $36.57 billion in assets according to L2Beat data. However, these solutions face the challenge of processing transactions off-chain without immediate proof of their validity before batching and confirming them on-chain.

Fraud proofs, like the ones Arbitrum and other optimistic rollup solutions implement, are designed to address this challenge by ensuring the validity of off-chain transactions. Once fully integrated into Arbitrum, BOLD will serve as a safety net to maintain transaction integrity while allowing for efficient off-chain processing.

Decentralization and Community Participation

In line with blockchain principles, BOLD will be decentralised, allowing the community to operate nodes and validate withdrawals back to Ethereum. This marks a shift from the current centralised setup, in which only a few validators handle transaction validation in Arbitrum.

ARB Prices and Market Pressure

Despite the introduction of BOLD in the testnet, ARB token prices remain stable but under pressure. ARB is down 50% from its March 2024 peak at current rates and is still experiencing significant selling pressure. If buyers can reverse the sell-off seen on April 12 and 13, the token could recover strongly, potentially reaching $1.5.

Overall, the deployment of BOLD in the testnet marks a significant milestone for Arbitrum, positioning it as the first Ethereum layer-2 to implement its fraud proofs on the testnet. This step is vital for creating a more decentralised ecosystem and reinforcing the platform’s robustness.

coinculture.com

coinculture.com