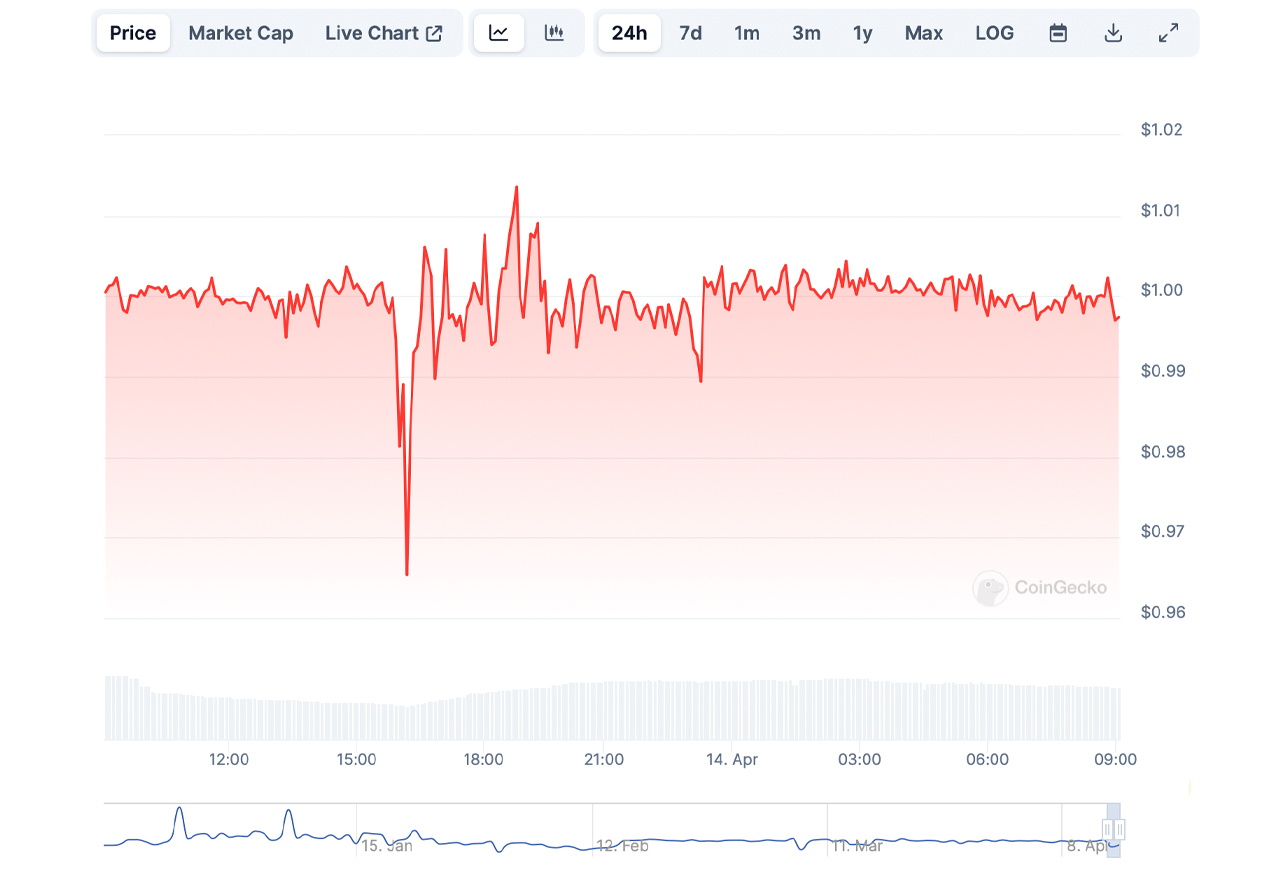

The fifth-largest stablecoin in the crypto economy by market capitalization, Ethena’s USDE, temporarily detached from its peg on Saturday amid market declines. Data reveals that the token, designed to mirror the U.S. dollar’s value, declined to $0.965 each. Similarly, the market witnessed the fourth largest stablecoin, $FDUSD, fall to a low of $0.9557 per coin.

Stablecoin Sector Once Again Faces Scrutiny After USDE and $FDUSD Temporarily Slip Below Intended Peg

During significant fluctuations in the crypto markets over the last day, both Ethena’s USDE and First Digital’s $FDUSD fell below their target pegs to the U.S. dollar. USDE recorded its lowest value to date, touching $0.965 on Saturday afternoon, while $FDUSD had previously dropped to $0.9421 per token in Aug. 2023. The downturn for USDE occurs as it faces scrutiny from certain decentralized finance (defi) community members over its risk elements.

The instability for both stablecoins was brief, with each experiencing depegs of approximately 30-45 minutes. By Sunday, April 14, 2024, they had recovered to $0.99 each, following a significant shock to the crypto market triggered by a sharp decline in BTC’s price. The incident drew considerable commentary from both supporters and critics of Ethena, with one individual noting on X the following day, “So far so good: USDE passed its first stress test.”

While $FDUSD also declined, much of the discussion focused on USDE. “Ethena getting its first stress test with negative funding, should be short-lived but it was enough to briefly depeg USDE,” another person wrote on the social media platform. “Ethena’s % of OI should self-regulate, but considering that a large % of USDE supply is locked in the Sats campaign there were no significant outflows.”

Others were decidedly more pessimistic about the stablecoin project. “Ethena will ultimately collapse because they are basing yearly funding within the previous 4 year cycles,” another X user said. “After this glorious bull, we will have a longer 2-3 year bear market with negative funding APY. Reserve capital will not be enough to sustain the protocol and USDE will depeg.”

Depegs have troubled crypto enthusiasts since Terra’s UST deviated from its intended U.S. dollar value and failed to recover. In addition, numerous other stablecoins stumbled following UST’s downfall, and several have undergone so many redemptions that they are now barely noticeable blips in the stablecoin market’s radar.

This episode underlines the inherent risk factors in the stablecoin sector, pointing to the challenges of maintaining pegs amidst market turmoil and massive price fluctuations. The resilience of USDE and $FDUSD, though momentarily questioned, showcases the complex dynamics within the world of U.S. dollar-pegged tokens.

What do you think about USDE and $FDUSD dealing with peg troubles during Saturday’s market fluctuations? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com