Ethena’s $USDe, a synthetic dollar stablecoin, encounters critical assessments. TardFiWhale, a blockchain sleuth known has spotlighted “critical flaws” in Ethena’s system.

Despite issuing over $1.5 billion in $USDe, Ethena is now grappling with potential vulnerabilities that could endanger user investments.

TradFiWhale Raises Concern Despite Ethena’s Token Listing

TardFiWhale, with a track record of exposing financial missteps such as the collapse of the TerraLuna ecosystem, has raised alarms about Ethena’s structural weaknesses.

“They’re paying me off to stop shitposting Ethena; how they’re launching a bug bounty program after launching their token allowing insiders to cash out from their shard campaign participation and hedge out with perps while not publicly disclosing material risks omitted from docs,” TradFiWhale revealed.

Given his history of foresight, these concerns carry significant weight, urging caution among Ethena’s stakeholders.

Read more: How To Use Ethena Finance To Stake $USDe

Moreover, TardFiWhale’s request for donations to unveil these flaws adds to the intrigue. He initially sought $500,000, allocating the funds to reputable entities like Protocol Guild and legal defenses. Later, he increased the amount to $1 million, highlighting the severity of the issues.

TradFiWhale says his intention is to prevent another financial catastrophe, reflecting on past crises in the crypto domain.

Conversely, Ethena is expanding its presence. The launch of its $ENA token airdrop marks a growth phase, allocating 750 million tokens to eligible users.

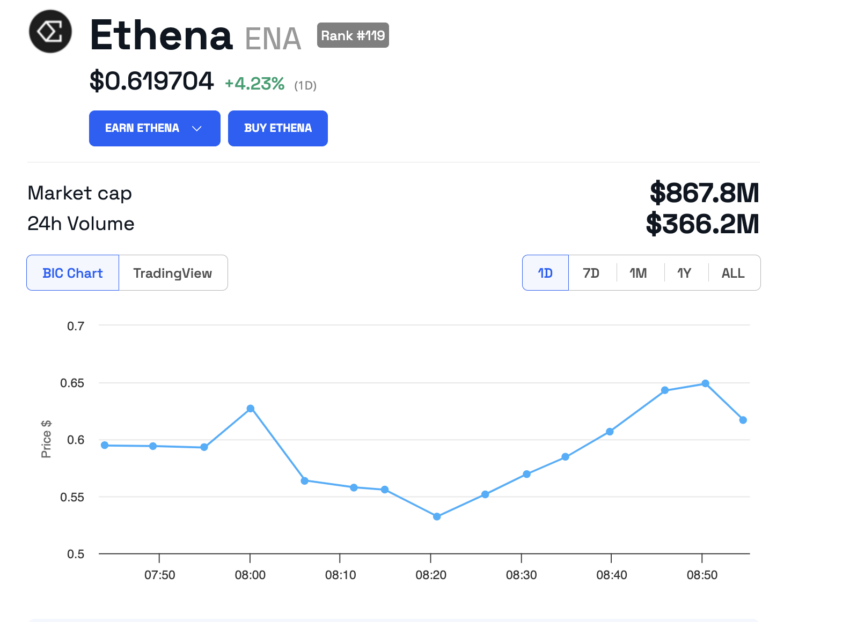

The $ENA token has been listed on major centralized exchanges since 8:00 AM UTC on April 2. As of writing, the token is trading at $0.6197.

This follows a successful $14 million funding round, valuing Ethena at $300 million. Prominent investors, including Dragonfly and Arthur Hayes’ Maelstrom, have shown confidence in its potential.

Ethena’s $USDe is innovating within the stablecoin market. Unlike traditional stablecoins, it doesn’t rely on fiat or asset backing. Instead, it employs a unique approach, using derivative hedging and arbitrage to maintain currency stability.

Read more: What Is Ethena Protocol and its $USDe Synthetic Dollar?

This strategy, involving Ethereum futures and Ethereum staking, generates shared profits for $USDe holders.

beincrypto.com

beincrypto.com