Amid a wider cryptocurrency market downturn that has seen cryptocurrency prices plunge after Bitcoin ($BTC) hit a new all-time high, the smart contract platform Cardano ($ADA) has been seeing its smart contract development skyrocket.

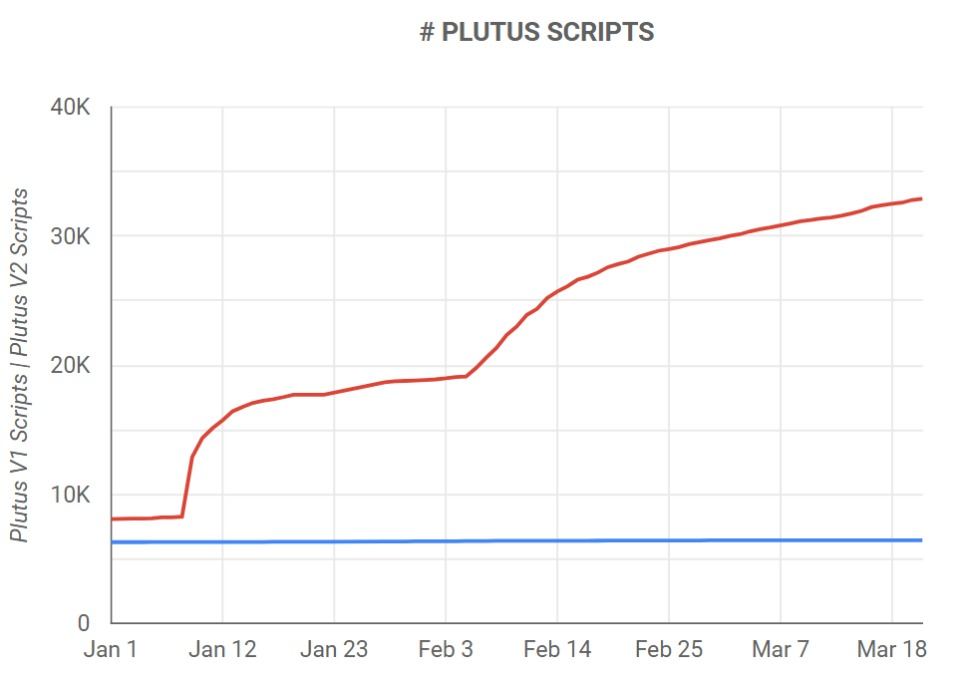

Data from Cardano Blockchain Insights shows a remarkable increase of over 170% in Plutus scripts, the network’s language for building smart contracts, since the beginning of the year.

This translates to nearly 500 new smart contracts being added to the Cardano network per day, as CryptoPotato first reported. The total number now sits at an impressive 39,000, with a particular emphasis on the newer Plutus V2 iteration.

Plutus is designed with a focus on security and reliability, drawing on principles from functional programming. Plutus V2, however, offers additional features and benefits for developers that include reduced transaction sizes and costs, along with a more flexible and scalable framework for building applications.

Cardano’s growth extends beyond smart contracts, as the network has seen a significant rise in user activity over the last 30 days, with the number of active wallet addresses reaching a one-year peak of over 600,000 after surging nearly 40% over that same period.

According to data from Cardano-based decentralized exchange Danogo, the number of active wallet addresses on the network hit a lot of 297,000 back in September 2023, when the price of $ADA was trading at $0.24 before a wider cryptocurrency market rally kicked off earlier this year with the approval of spot Bitcoin exchange-traded fund (ETFs) in the United States.

cryptoglobe.com

cryptoglobe.com