The Reserve Rights (RSR) token has surged by 30% in the last 24 hours, setting it apart as one of the standout performers in the cryptocurrency market.

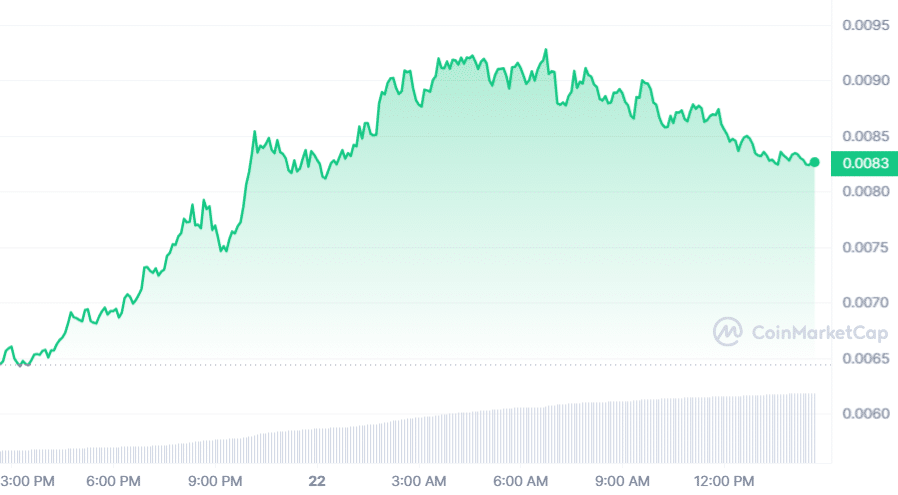

As per data by CoinMarketcap, on March 22, the token’s value reached $0.0096, marking its highest level since 2022.

The surge occurs at a time marked by a general downturn in the market, with major cryptocurrencies such as Bitcoin, Ethereum, and Ripple experiencing declines.

Reserve Rights is a blockchain initiative aimed at creating a stable, inflation-resistant currency. The Reserve Protocol allows users to produce RTokens, which are assets that are launched into the ecosystem.

Anyone can create an RToken by simply depositing collateral utilizing blockchain technology. Typically, these tokens can be redeemed 1:1 for the underlying assets. Most significantly, they are intended to be overcollateralized, which means that if any of the collateral tokens fail, there is a pool of value to protect the value of the RToken holders.

The reasons behind the sudden increase in Reserve Rights Token’s price remain speculative. According to sources, the sudden surge of this token appears to have been caused by tweets from several well-known people in the cryptocurrency business.

They speculated on Twitter about Reserve’s potential involvement in the emerging blockchain asset tokenization trend. RSR investor @MopHandle envisioned a scenario in which Reserve Protocol would launch on Coinbase’s newly launched Ethereum Layer-2 network Base in August 2023.

Time get @reserveprotocol $RSR, @CoinBase and @Blackrock in the same room. Follow along me with me, the path has been paved. @coinbase Launches @base in Feb 2023, a Layer 2 developed on $ETH@reserveprotocol (Native to ETH) Launches on Base in August 2023… pic.twitter.com/8lDtrqKEEb

— MopHandle (@MopHandel) March 21, 2024

You might also like: Ronin’s RON jumps 11% on the heels of Coinbase listing

Another factor attributed to the rise is the enthusiasm surrounding Blackrock’s announcement of a tokenization fund on Ethereum.

The Blackrock USD Institutional Digital Liquidity Fund’s ticker is BUIDL, and it is backed by cash and Treasuries. According to a statement from the company’s head of digital assets,

“We are focused on developing solutions in the digital assets space that help solve real problems for our clients, and we are excited to work with Securitize.”

Robert Mitchnick, BlackRock’s head of digital assets

Blackrock’s venture into tokenization underscores a growing interest in tokenized assets, joining other prominent entities such as Franklin Templeton, JPMorgan, London Stock Exchange, and Citi, which have introduced similar products in recent months.

With over $10 trillion in assets under management, Blackrock’s entry into the tokenization space is seen as a significant endorsement of the demand for such assets and a validation of the Reserve Rights blockchain company.

Discussions on social media further suggest that the Reserve Protocol’s capacity to maintain stable assets, demonstrated during the USDC depeg event amidst the Silicon Valley Bank crisis, positions it as a vital player in the tokenization efforts of major firms.

Tweets by @cjdemelker highlighted the alignment of Blackrock’s involvement and rumors of a Coinbase collaboration with Reserve’s potential, signaling a promising outlook for RSR holders, especially if the token surpasses the $0.01 mark.

Gonna surpass that one cent line soon with a quick pool above! Than come down below and reload. Couple of days underneath around 0.0085 and than another seconde push above 0.01 cent which we will than turn into support, from there blue skies. 🙌🏻

— CJ de Melker (@cjdemelker) March 21, 2024

Read more: Coinbase chief lawyer urges SEC to approve Ethereum ETFs