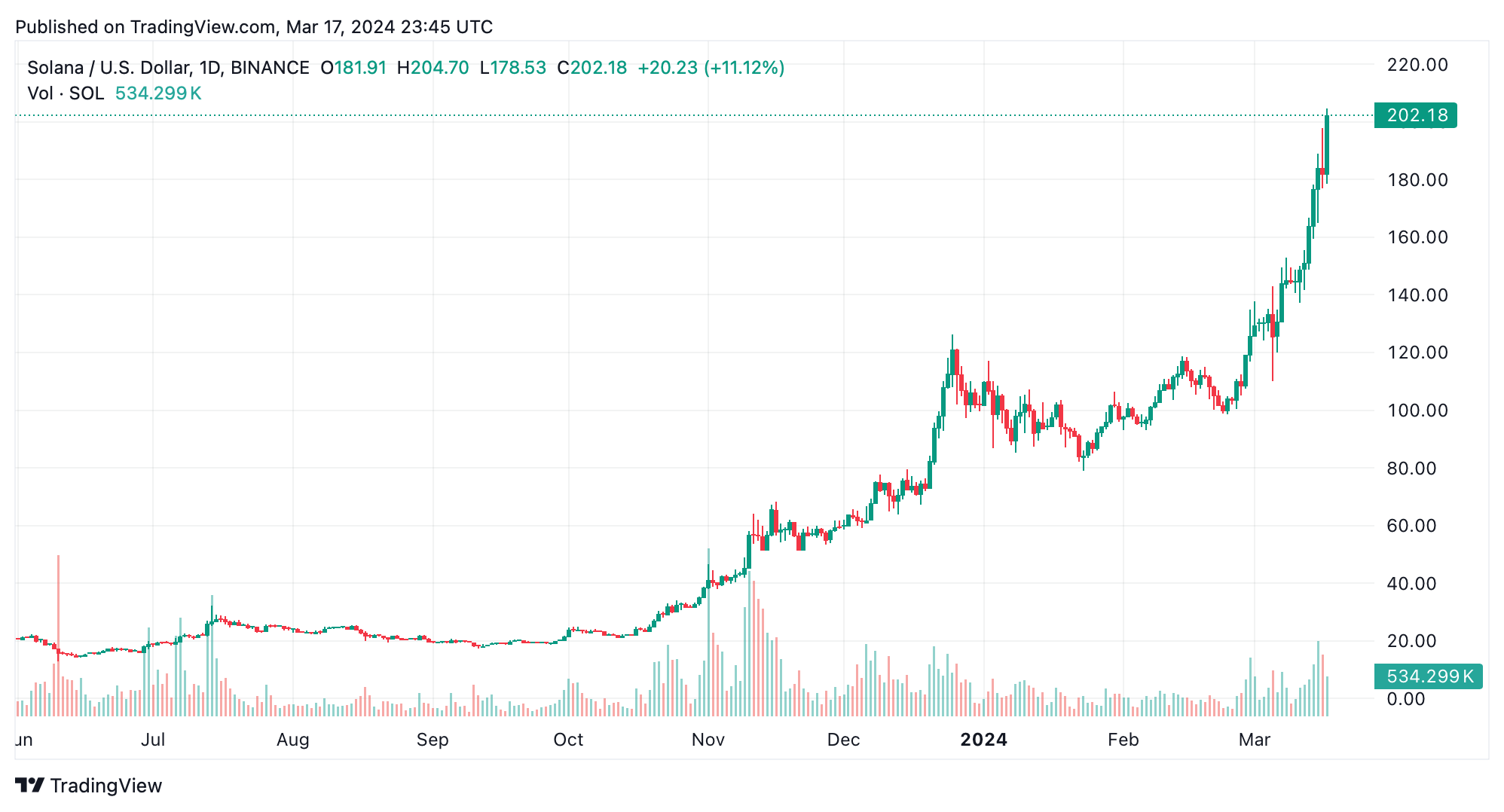

Based on the latest metrics, the cryptocurrency landscape has experienced a widespread but modest downturn. Yet, the digital asset solana has risen by 12.2% in the last 24 hours and 43% against the U.S. dollar over the past week. Currently, solana surpassed the $200 mark per coin as it closed in on BNB’s market capitalization.

Solana Defies Market Trend With Impressive Gains

The native cryptocurrency of the Solana layer one (L1) blockchain network, solana (SOL), has witnessed significant growth in its value recently. In the last month alone, SOL has risen by 85%, and looking at the past year, it has soared by over 850%.

Currently priced at $202 per coin, SOL boasts a market capitalization of $90 billion, positioning it as the fourth largest in the market at 7:45 p.m. Eastern Time on Sunday evening. Additionally, SOL has officially overtaken BNB’s market capitalization of $86 billion, securing its former spot among the top ten cryptocurrency leaders. While SOL climbed by 12%, BNB, currently priced at $569 per coin, declined by 1.97% against the greenback.

On March 17, 2024, SOL also commands the fifth-highest trading volume among all cryptocurrencies, with trade volume totaling $11.9 billion over the past day. Excluding stablecoins, SOL would occupy the third-highest volume spot. Tether (USDT) emerges as the strongest trading pair with SOL, followed by the U.S. dollar, FDUSD, the Korean won, and bitcoin (BTC).

Notably, the Korean won (KRW) accounted for 6.62% of solana’s trading volume in the last 24 hours. While SOL’s global trading price stands at $202 on a weighted average, it’s noteworthy that in South Korea, SOL is being exchanged at a premium of $223 per unit. Solana trades contribute to 9% of Upbit’s volume, while on Bithumb, SOL makes up 5.12%.

SOL has yet to approach its all-time high (ATH) in U.S. dollar value of $259 per coin, necessitating at least a 21% increase to revisit its peak price. This historic ATH was achieved more than two years ago, on Nov. 6, 2021, coinciding with the period SOL was trading at its current value.

What do you think about solana’s market performance over the last day and over the past week as well? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com