Blockchain and cryptocurrencies have revolutionized the banking system, with stablecoins becoming the most prominent subcategory of crypto.

Blockchain technology has evolved significantly in the past few months. Its growth has led to the advancement of the traditional finance system. Stablecoin has become one of the most prominent sectors of the cryptocurrency sector.

Tether($USDT) is one of the leading stablecoins in the market, with a market capitalization of $99.5 Billion. The market cap of this fiat-pegged stablecoin grew above 19%.

It is crucial to note that the market cap of $USDT has reached nearly $100 Billion for the first time in its history. According to CoinMarketCap, there are approximately 200 stablecoins globally.

Tether ($USDT), $USDC ($USDC), Dai (DAI), First Digital USD (FDUSD), TrueUSD(TUSD), $USDD($USDD), Athena $USDe ($USDe), Frax (FRAX), TerraClassicUSD(USTC) and PayPal USD (PYUSD) are most prominent stablecoins available.

The spot trading volume of the stablecoin market is $176.11 Billion, and the market cap of the sector contributes majorly to the crypto market cap. In the past few months, the usage of stablecoins grew specifically for the staking purpose.

Other Related News

Earlier on February 02, 2024, news came to the market that Tether has developed an educational branch. It aims to offer courses, workshops, and other resources for skill development in the digital asset industry and blockchain technology.

Paolo Ardoino, the recently joined Chief Technology Officer of Tether ($USDT), highlights, in his conversation, that the company made a profit of $4.5 Billion in 2023.

Arduino has worked with renowned companies, such as Frame Asset Management, Fincluster, Holepunch and Bitfinex.

Investments of Tether ($USDT)

The Tether($USDT) foundation has made significant investments in the past few years; it recently funded Oobit on February 5, 2024. The foundation majorly funds the Academy of Digital Industries.

Celsius Network, once the most popular cryptocurrency lender, also secured Tether’s funding in its corporate round on June 22, 2022.

Crypto Market Price Update

The crypto market capitalization grew over 2.30% in the past 24 hours and was $2.5 Trillion as of writing. The market leader, Bitcoin, has reflected a profitable intraday movement, growing 2.35%.

As per the market observers, the boost in the trading price of Bitcoin is solely backed by the 4th coming halving event. However, other analysts state the growth is nourished by the inflow of massive funds in the ecosystem post-BTC spot ETF approval.

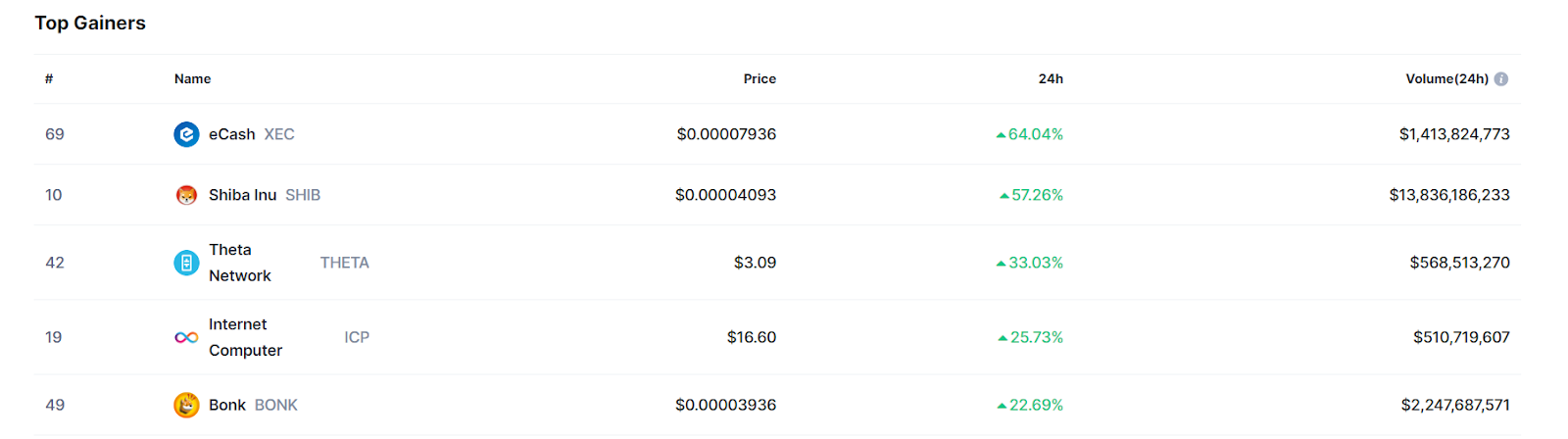

eCash price grew 58.79% in the past 24 hours, which makes it the leader of the intraday gainer’s list; Shiba Inu flourished by 43.37%, and Theta Network by 34.23%.

Dogwifhat ($WIF) has showcased impressive growth in the past few months; a severe decline of 20.68% has been seen in the past 24 hours. As of writing, it is trading at $1.46; a week earlier, it was below $1.00.

Following constant $WIF’s trading price growth, it became the fastest-growing meme coin in the past six months.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

thecoinrepublic.com

thecoinrepublic.com