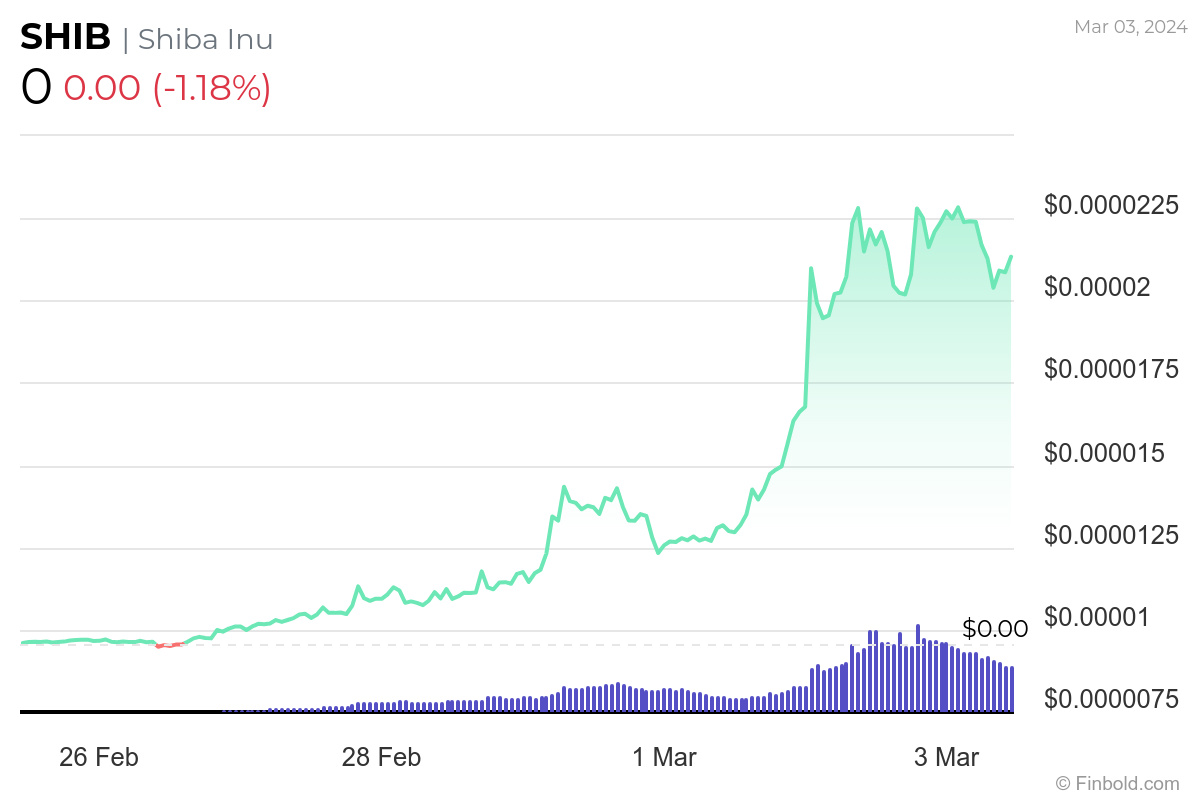

Backed by generally positive market sentiments, meme cryptocurrency Shiba Inu ($SHIB) is demonstrating strength in the short term, propelling the token to shed a zero as it continues to rank among the best-performing digital assets at the moment.

Before the current movement, $SHIB had exhibited a sideways trading pattern in recent weeks as investors awaited a possible breakout amid notable onchain developments aimed at giving the coin more utility.

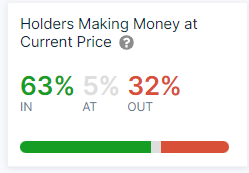

With the recent uptick in $SHIB’s valuations, investors are also reaping profits. Notably, data obtained by Finbold on March 3 from the crypto on-chain analysis platform IntoTheBlock revealed that 63% of current $SHIB holders are making money, with 32% recording losses, while only 5% have broken even.

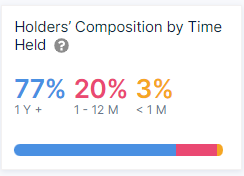

A breakdown of the holders indicates that 77% have held their $SHIB for over a year, 20% have held $SHIB between one and 12 months, and the remaining 3% have held $SHIB for less than a year.

$SHIB’s key metrics on the rise

The surge in $SHIB’s price aligns with a notable rise in key metrics associated with the coin’s ecosystem. For instance, by press time, besides stablecoins, $SHIB was the third highest cryptocurrency in trading volume, with the 24-hour figure at $4.2 billion.

The gains have also coincided with a period when $SHIB is witnessing increased social interactions with data by LunarCrush revealing that in February, Shiba Inu’s social interactions reached an all-time high, rising by +1,520.6%, helping launch a new frenzy around meme cryptocurrencies.

It’s worth noting that although $SHIB is currently significantly influenced by overall market sentiment, other elements, such as ongoing network development, are also touted to impact its valuations.

In this line, excess token burning remains a crucial element seeking to give $SHIB more utility. The activity has continued to accelerate, with data from Shiba Inu burn tracker Shibburn indicating that 643,656,418 $SHIB tokens were burned from 134 transactions in February.

In the meantime, the main focus for $SHIB will be to sustain the current gains, although it faces threats of correction if most investors turn to profit-taking.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com