Ethereum’s impending Dencun upgrade, scheduled for March 13, has sparked speculation about altcoins.

This upgrade, promising to significantly enhance Ethereum’s usability, security, and transaction capacity, could ignite a new altcoin season, setting the stage for a selected group of cryptocurrencies to skyrocket.

Why Ethereum’s Dencun Upgrade Matters

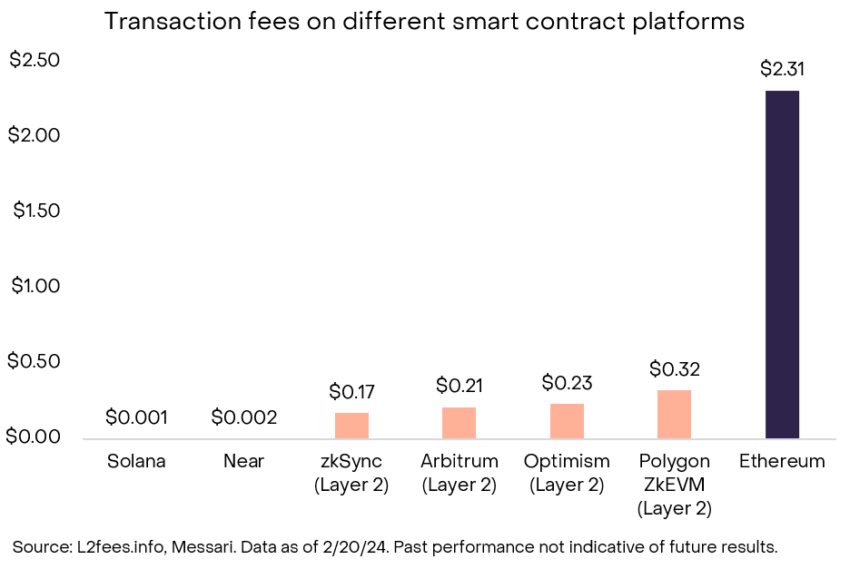

The Dencun upgrade bolsters Ethereum’s market competitiveness by introducing proto-danksharding and data blobs. These innovations mitigate the network’s longstanding transaction costs and throughput issues. According to Grayscale, these enhancements could catapult Ethereum to the forefront of the smart contract market, offering unprecedented scalability and efficiency.

This technological leap forward is anticipated to draw a wider array of applications and developers to Ethereum, challenging the dominance of faster chains like Solana.

“This software upgrade would provide Layer 2 scaling solutions a designated storage space on Ethereum, reducing their data cost and therefore improving their margins. While unclear exactly how much this will reduce transaction costs for end users of Layer 2s upon implementation, some have estimated it at over 20x,” analysts at Grayscale wrote.

The upgrade’s potential to drive up Ethereum’s price has only added to the optimism within the crypto community. Many investors eagerly eyeing the ripple effects on the broader blockchain ecosystem.

“[Ethereum] tailwinds include: (1) its upcoming upgrade, (2) net deflationary supply, (3) network revenue generation, $2 billion in 2023, (4) an SEC decision regarding spot Ethereum ETFs in May, and (5) increasing use cases to rent out Ethereum’s network security features,” analysts at Grayscale added.

Altcoins With Significant Bullish Potential

Amid this backdrop, a seasoned trader known as Cyclop has meticulously compiled a list of 22 altcoins, already listed on Binance, believed to have the potential for 100X gains. His selection criteria hinge on the tokens’ market caps and their alignment with the hottest narratives in the current bull run. These include AI, DeFi, RWA, SocialFi, GameFi, BRC-20, Modular, L1, and L2 sectors.

The list ranges from higher market cap tokens like Injective ($INJ) and Render (RNDR) to emerging players like SleeplessAI (AI) and Stella (ALPHA). Therefore, it offers a diverse portfolio for investors seeking to capitalize on the altcoin season.

Cyclop’s strategy emphasizes the importance of investing in tokens poised for mass adoption, highlighting the potential for significant returns.

Read more: 11 Best Altcoin Exchanges for Trading in February 2024

Here is the full list of altcoins with the potential for 100X gains:

- Injective ($INJ), market cap: $3 billion

- Reder (RNDR), market cap: $2,8 billion

- Arbitrum (ARB), market cap: $2,37 billion

- Sei Network (SEI), market cap: $2,11 billion

- Sui Network (SUI), market cap: $1,89 billion

- MakerDAO (MKR), market cap: $1,88 billion

- Starknet (STRK), market cap: $1,39 billion

- Ordi (ORDI), market cap: $1,33 billion

- Theta Network (THETA), market cap: $1,3 billion

- Synthetix (SNX), market cap: $1,27 billion

- Dymension (DYM), market cap: $934 million

- Astar (ASTR), market cap: $892 million

- Ronin Network (RON), market cap: $873 million

- Altlayer (ALT), market cap: $557 million

- Treasure (MAGIC), market cap: $326 million

- Ankr (ANKR), market cap: $320 million

- Space ID (ID), market cap: $255 million

- SleeplessAI (AI), market cap: $216 million

- Polymesh (POLYX), market cap: $194 million

- Radiant Capital (RDNT), market cap: $167 million

- MyNeighborAlice (ALICE), market cap: $130 million

- Stella (ALPHA), market cap: $117 million

A Timely Entry Into the Crypto Market

Michaël van de Poppe, another respected voice in the crypto market, offered sage advice for navigating the altcoin season. He strongly advised against buying into the frenzy during the peak of an altcoin hype cycle, when social media buzz and exponential price increases can seduce investors into making impulsive decisions.

Van de Poppe highlighted the importance of entering the market when confidence is low, such as after a correction or in the wake of negative news. This counterintuitive strategy banks on the cyclical nature of markets, suggesting that what is currently undervalued may be tomorrow’s success story.

“An example is the price of Bitcoin. After the collapse of FTX, Bitcoin’s price was swimming around a value of $15,500 per Bitcoin. During this period, almost no one was interested in getting into a position,” van de Poppe explained.

He also recommended waiting for a significant correction before making an investment. Subsequently, patience can lead to more favorable entry points and a better risk-reward ratio. He added that most altcoins will experience pullbacks after major rallies, offering a strategic window for entry.

This method discourages chasing rallies and instead suggests buying during moments of consolidation or downturn when the asset is more likely to be undervalued. By doing so, investors avoid the pitfalls of buying at the top and facing potential losses during the inevitable corrections.

Read more: 13 Best Altcoins To Invest In February 2024

His strategy also included the principle of early entry into market segments that are not yet in the limelight but show solid fundamentals and are part of growing ecosystems. Van de Poppe’s rule of thumb for entry is to consider investments in altcoins that have corrected by 25-60% from their recent highs, often indicating a shaking out of speculative excess and price stabilization.

“If you wait for the correction to be happening, most likely people who want to take profits have been doing this and are out of the markets, [and] people who want to enter the markets are getting closer to their entry points. This means buyers are likely to take over, and the risk/reward is more positive,” van de Poppe concluded.

By adhering to these principles, investors can navigate the complexities of the altcoin market with a strategy designed to capture upside while protecting against downside risk.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

beincrypto.com

beincrypto.com