Circle, a well-known issuer of cryptographic stablecoins, announced this morning that it will immediately stop supporting its USDC coin within the Tron blockchain, citing a group adjustment as part of its risk strategy.

Users holding USDC on the Tron network can perform the official redeem until February 2025 to redeem fiat currency, or use a variety of intermediary services available on CEX or in DeFi.

The choice of the issuer suggests a likely expansion of the company in the field, which could be inclined to launch its own native network in the future.

In the coming months, Circle could also abandon other blockchains if it deems it appropriate.

Summary

USDC stablecoin: Circle abandons Tron blockchain as part of its risk management strategy and considers a proprietary network

The stablecoin issuer Circle, officially announced this morning that it will remove USDC support on the Tron blockchain, as part of its risk exposure strategy adjustment.

1/ We are discontinuing USDC on the TRON blockchain in a phased transition. Effective immediately, we will no longer mint USDC on TRON. Transfers and redemptions of USDC on TRON will continue to operate normally through February 2025. Read the details: https://t.co/kw9A3ZUpWH

— Circle (@circle) February 21, 2024

The decision was announced on the company’s blog, where it is revealed that the second largest stablecoin by market capitalization is being removed with immediate effect from the proprietary network of billionaire Justin Sun.

“Circle Mint” customers holding USDC on Tron have the option to make a redeem for fiat currency by February 2025, alternatively passing through intermediary services, including retail exchanges, providers on/off-ramps and bridges to transfer the crypto to different blockchains.

By underlining its commitment to growing its ecosystem and ensuring investors a reliable, transparent, and secure environment for the proliferation of USDC, Circle has explained the reason for this delicate decision:

“As part of our risk management framework, Circle continuously evaluates the suitability of all blockchains in which USDC is supported. Our decision to discontinue support for USDC on TRON is the result of a company-wide approach that involved corporate organization, compliance, and other functions of our company.”

Circle, main competitor of Tether (which has a dominant position on Tron with USDT) has also stated that it will continue to evaluate the suitability of all blockchains supported by USDC, aiming to offer the widest access to users and the most complete choice for developers.

This suggests possible expansion plans for the cryptographic company located in Boston, Massachusetts, which could potentially launch its own proprietary blockchain to develop a competitive environment for USDC.

This could change the game for the stablecoin, which in 2023 suffered the advance of its biggest enemy, USDT, capable of significantly increasing its market capitalization at the expense of the former, which has lost over 16 billion dollars since last year.

Circle has not spoken to the media about this actual possibility, but given the context DeFi in which its stablecoin operates, we can think that it is more than feasible and in line with its values. We look forward to further updates from the company.

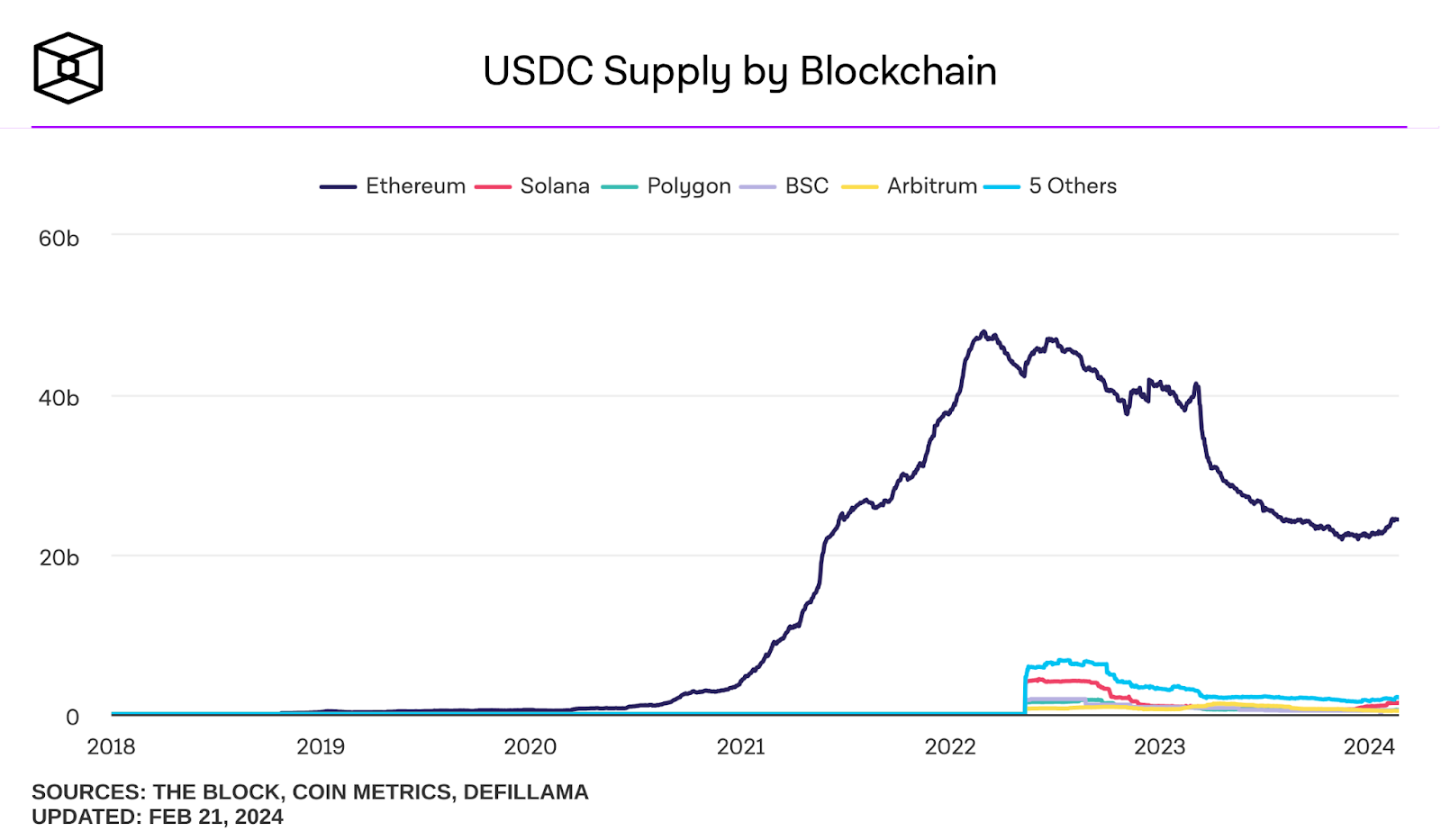

Analysis of the circulating supply of USDC: Tron becomes increasingly central for USDT

Beyond the strategic reasons in terms of corporate risk management, Circle’s decision to abandon support for USDC on Tron comes after a decidedly dark year in terms of stablecoin growth on the mentioned blockchain.

At the time of writing on Tron, there are approximately 313.5 million USDC, which is just over 1% of the circulating supply of the currency.

Exactly one year ago, in February 2023, on Justin Sun’s network we could count a total of 1.4 billion of the same stablecoin. In total, approximately 1.086 billion dollars were lost along the way, resulting in an overall decrease of 77%

By analyzing the snapshot of the circulating supply of USDC, we notice how its main home is the Ethereum blockchain, where we find a component of 83% compared to the total, with a total of 24.38 billion dollars.

For the rest, Circle’s stablecoin is present in smaller quantities on a wide range of cryptographic networks such as Solana, Polygon, BSC, Arbitrum, Avalanche, Base, Sui and others.

On Solana we notice the presence of a whopping 1.4 billion USDC while in the rest of the networks its presence ranges from 500 million to 200 million tokens.

The connection with multiple blockchains and interoperability of USDC make the stablecoin an efficient resource in decentralized markets, capable of being widely used for swaps, lending operations, decentralized leveraged trading, and much more.

Exiting the Tron kingdom can be seen as a relatively painless choice by Circle, especially considering how seamlessly it integrates with other infrastructures.

While for USDT a similar scenario would mean leaving over 51.8 billion dollars on the table, losing its role as leader in the sector, for USDC it is a negligible loss from which new, more efficient solutions can emerge.

Speaking of Tron and USDT, we remind you that rumors have been circulating for some time (not confirmed by official sources) regarding alleged money laundering operations that several criminals would have carried out using the two cryptographic resources.

The USDC exodus from Tron could therefore be exclusively linked to the company’s decision to abandon the much-discussed blockchain, avoiding issues with various international market regulatory authorities.

This is huge — Circle just announced it's ending support for USDC on Tron.

— Leo Schwartz (@leomschwartz) February 21, 2024

The troubled blockchain has become the largest home for Tether, surpassing Ethereum, and has been plagued with accusations of money laundering pic.twitter.com/SxJJFvx8FP

en.cryptonomist.ch

en.cryptonomist.ch