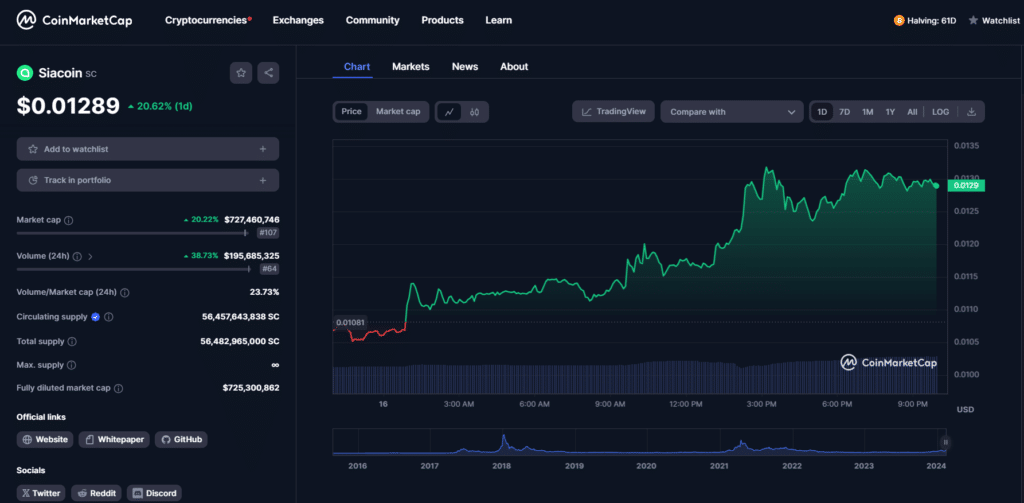

Siacoin (SC) jumped as high as 20% in 24 hours as liquidity rotated around crypto’s $2 trillion market.

Siacoin is the native token decentralized cloud storage blockchain Sia, launched in 2015 for users to rent out unused storage. SC’s market cap increased to $733 million as the price rose, and its daily trading volume surged 38% to nearly $200 million per CoinMarketCap.

One of crypto’s underlying missions is fixing concerns in traditional and centralized services. Sticking to this ethos, Sia plans to provide trustless access to secure cloud storage at competitive rates compared to larger entities like Amazon and Google.

Data uploaded on Sia’s blockchain is fragmented across 30 encrypted hosts. The network requires a minimum of 10 hosts to remain functional to support data retrieval. Users pay hosts in SC, and decentralized storage leasers lock the tokens via smart contracts as collateral.

Siacoin operates with a proof-of-work (PoW) consensus, depending on miners adding new blocks to the network and emitting new coins. Bitcoin (BTC) is built around a PoW model as well. The idea is to bolster Sia’s blockchain against bad actors and hackers since this on-chain architecture requires expensive hardware and energy commitments to attempt attacks.

Blockchain has become a go-to technology for offering cloud storage due to its cost-effectiveness and borderless access. Aurora Labs chief strategy officer Matt Henderson said blockchain makes an ideal pair for cloud storage as it allows flexibility, improves efficiency, and guarantees optimization.

Read more: Blockchain and cloud computing: surprising allies who benefit each other