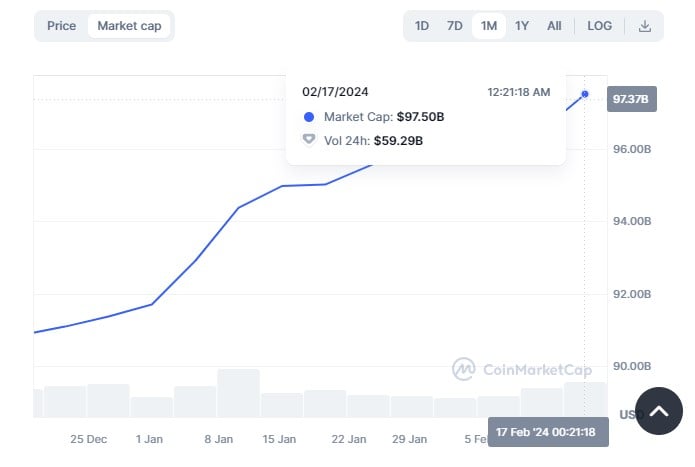

Tether (USDT), the world’s leading stablecoin, is close to hitting a historic all-time-high (ATH) market capitalization of $100 billion. According todata from CoinMarketCap, Tether’s market cap has increased from around $91 billion at the start of the year to nearly $98 billion at press time, up around 7% year-to-date.

This growth coincides with Tether’s strong financial performance. The firm recently reported nearly $3 billion in profits for Q4 2023, with $1 billion stemming from US Treasury interest and the remainder driven by rising gold and Bitcoin values in its reserves.

However, Tether’s dominance raises concerns. Mike McGlone, Bloomberg senior commodity strategist, suggested that Tether’s widespread adoption could strengthen the US dollar and put downward pressure on traditional assets like commodities and gold.

A $100 Billion #Tether? #Bitcoin vs. #Gold, #Dollar vs. #Commodities – The proliferation of #stablecoins could portend increasing dollar dominance, with headwind implications for commodities and old analog gold vs. the digital version. What I call crypto dollars, Tether is the… pic.twitter.com/6mWTIfLfGg

— Mike McGlone (@mikemcglone11) February 16, 2024

Tether’s rise in market cap comes amid ongoing concerns over the US regulatory crackdown on stablecoins. JPMorgan’s recent report indicates that while Tether operates outside the US, its reliance on the US dollar and potential interactions with US entities can still subject it to some control from US regulators, especially through OFAC’s sanctions.

Meanwhile, Tether’s closest competitor, USD Coin (USDC), also experiences a 4% year-to-date growth with a market cap of around $28 billion. However, it remains significantly below its ATH in June 2022 and trails Tether by roughly $70 billion.

cryptobriefing.com

cryptobriefing.com