- The TrueUSD team has linked the recent $TUSD depegging to Binance Launchpool activities.

- The team reiterated that $TUSD redemption services “are always accessible.”

The team behind TrustToken-issued stablecoin TrueUSD ($TUSD) has issued a statement linking the recent depegging incident to “activities associated with Binance Launchpool.”

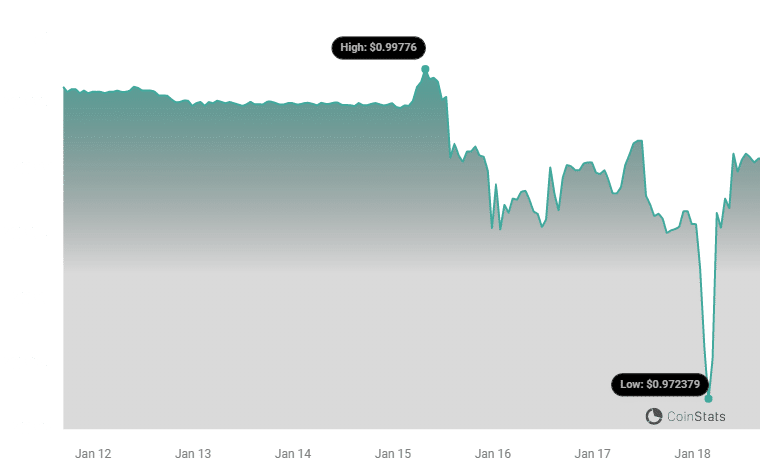

The stablecoin fell below its $1 peg to trade at $0.985 on January 16 amid an outsized trading volume of the pair $TUSD-$USDT on Binance.

During the incident, the trading pair faced a shortfall of $369.3M in buy orders against $435M sales, leading to about $67M net outflow.

TrueUSD Team Addresses Depegging Incident

In an X (formerly Twitter) post shared on January 18, the $TUSD team noted that it had observed recent community mining activities linked to Binance Launchpool, which had led to “short-term arbitrage opportunities.”

See Also: TrueUSD ($TUSD) Depegs Further, Hits Low Point Of $0.97

“These are considered a normal aspect of market dynamics and liquidity adjustments. Furthermore, our $TUSD redemption channels, involving various global banks, are functioning smoothly as always.” The team wrote.

The $TUSD team consistently focuses on and continues to enhance $TUSD services through cutting-edge technologies and strategic industry partnerships, such as with Binance.

— TrueUSD (@tusdio) January 18, 2024

Noting that it would continue to further broaden collaboration with Binance, the team reiterated that $TUSD minting and redemption services “are always accessible” via the stablecoin’s official website.

At press time, $TUSD had recovered from its early Thursday price of around 96 cents and is now trading at $0.99, according to Coinstats data. Still, the price is not pegged.

As of January 18, $TUSD’s market cap stood at $1,891,851,560, making it the fifth largest stablecoin in the market behind $USDT, USDC, BUSD, and DAI.

bitcoinworld.co.in

bitcoinworld.co.in