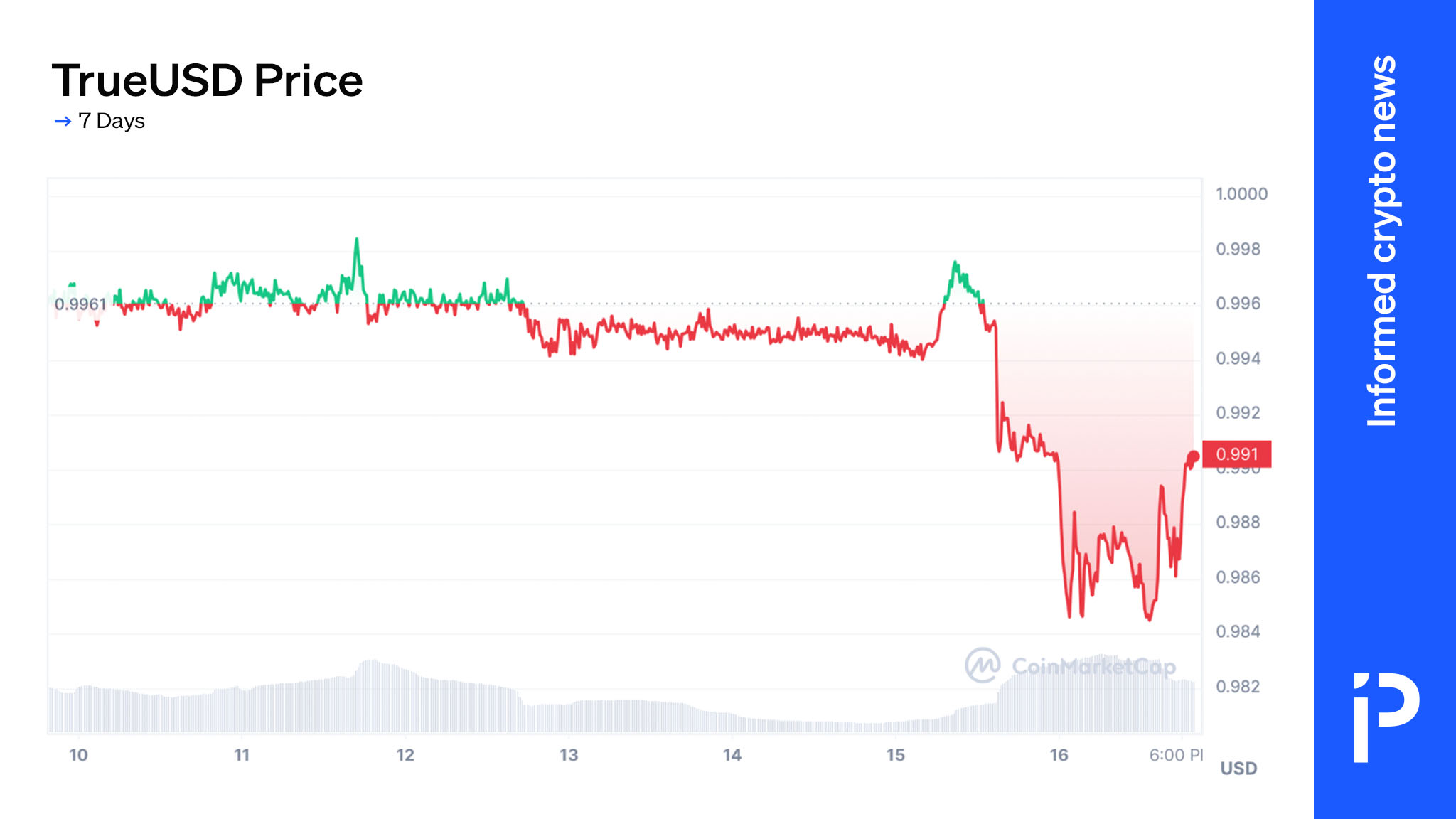

TrueUSD ($TUSD), the Justin Sun-affiliated stablecoin, is currently experiencing a de-peg and trading below par on multiple centralized exchanges, including Binance, HTX, and KuCoin. This happened shortly after TrueUSD switched accounting firms from The Network Firm to Moore Hong Kong for its attestations.

TrueUSD recently benefited from Binance adopting $TUSD as one of its zero-fee trading pairs.

The currency is currently trading more than one cent below the peg on Binance, both against other stablecoins like Tether ($USDT) and other cryptocurrencies. This pattern is repeated in DeFi, with Curve currently showing that you’ll lose more than one cent exchanging $TUSD for $USDT.

Even on the Tron-based SunSwap, trading $TUSD for $USDT will result in you losing two pennies for each $TUSD you swap.

New attestations

TrueUSD has switched from The Network Firm, started by former Armamino auditors, to the Hong Kong-based Moore office for these attestations. The new attestations provide additional insight into the purported reserves for $TUSD.

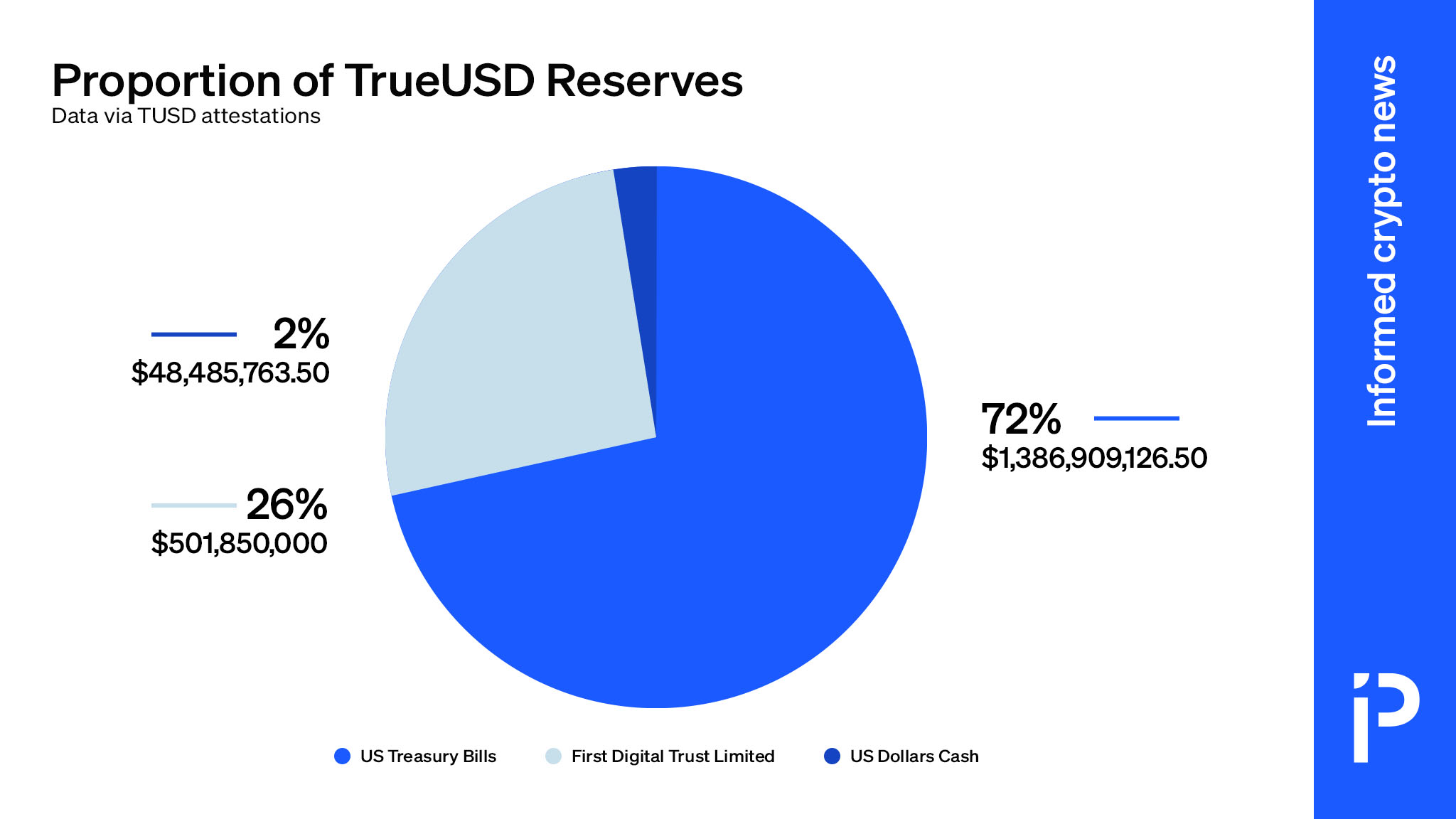

The reserves in the report are broken into three different categories:

- US Treasury Bills

- First Digital Trust Limited

- US Dollars Cash

The US Treasury bills make up the bulk of the reserves, are supposedly accounted for at cost, and don’t seem to be marked-to-market.

The First Digital Trust Limited category describes securities that are held at First Digital Trust to earn yield; very little information is provided about these securities in the report. First Digital is also behind the new First Digital USD (FDUSD) stablecoin, which has become increasingly popular on Binance.

The Context: 🪄 Stablecoins get a little help from their friends

— Protos (@Protos) December 8, 2023

Issuers have likely benefited from tri-party agreements for years.

Latest from @BennettTomlin

Subscribe and read 👉 https://t.co/qda0GIJdh3 pic.twitter.com/LaTU0i21Dh

Read more: TrueUSD attestations paused again, this time for improper ‘balances’

The US Dollars Cash category, which makes up only about 2% of the total, comprises funds held “at a Hong Kong depository institution, a Swiss depository institution, and Bahamian depository institutions.”

Techteryx, the firm behind $TUSD, no longer discloses the identities of these firms, but historically it has relied on FlowBank in Switzerland, First Digital in Hong Kong, and Capital Union in the Bahamas. Additionally, the attestations warn that:

“On 21 April 2023, the agent of Techteryx opened a conventional corporate account with a Swiss depository institution with terms within the account’s ‘General Terms and Conditions’ (“Terms”) that do not explicitly specify that the related funds are escrowed on behalf of TrueUSD token holders or that Techteryx and the agents are not entitled to any funds at any time and no amounts deposited into the accounts shall become the property of Techteryx, the agents, or any other entity, or be subject to any debts, liens or encumbrances of any kind of Techteryx, the agents, or any other entity.

“Techteryx and its agents began utilizing the account starting on 13 June 2023, which maintained balances contributing to the total USD Denominated Collateral.”

Techteryx previously informed Protos that the relevant “Custody Agreement has been under legal review process by the Swiss bank which is beyond our direct control.”

It is currently not clear exactly which conditions are leading to this $TUSD de-peg.

protos.com

protos.com