Increased selling activity on Binance has pushed the $TUSD stablecoin well below its pegged $1 value.

TrueUSD, the stablecoin backed by controversial crypto entrepreneur Justin Sun, has struggled to maintain its dollar peg. In the past 24 hours, the stablecoin traded as low as $0.984 and has only managed a recovery to $0.988 at the time of writing.

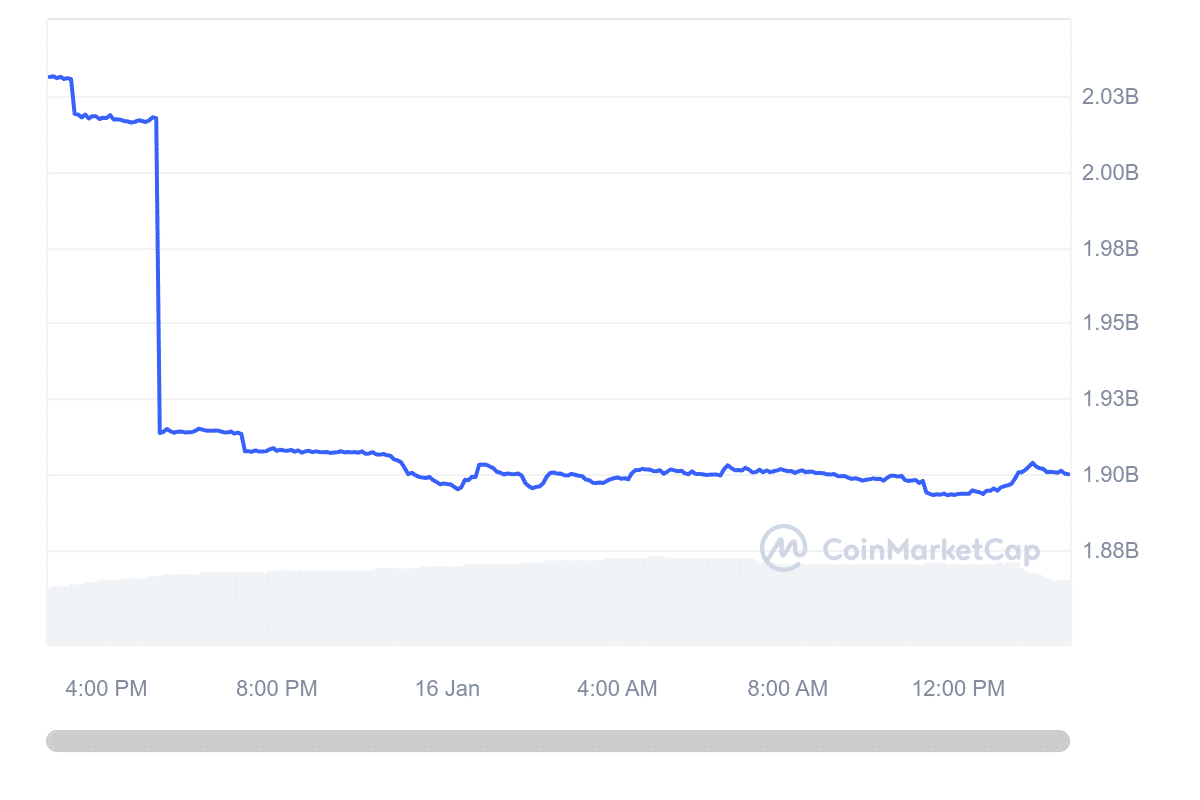

Its current market value means that $TUSD is trading more than 1.3% below its stated peg of $1. The $TUSD market capitalization has also dropped by $100 million within the past 24 hours, signaling fear among holders.

Factors Driving $TUSD Depeg

Speculation abounds on the factors driving the $TUSD depeg. One theory is that the selloff is driven by uncertainties regarding the stablecoin’s reserves. Last week, reports emerged that TrueUSD was having issues sharing the value of its collateral assets.

While the issue appears to have been resolved on the TrueUSD attestation website, market participants may still be in fear of the stablecoin being undercollateralized.

Another more target="_blank" rel="noopener">trend of $TUSD losing its stablecoin market share on Binance.

Among large orders, Binance’s data shows that traders have sold $250.9 million worth of $TUSD, with only $166.3 million buy orders coming in within the same timeline. The figures translate to a net outflow of $84 million in $TUSD sold for USDT.

Including small and medium orders, over $323 million $TUSD have been sold on Binance, with only $224 million in buy orders. Hence, outflows stand at $98.7 million, closely reflecting the decline in the $TUSD stablecoin market cap.

Yet another possibility is that the $TUSD depeg is driven by Binance’s increased adoption of the newly launched $FDUSD stablecoin.

As many on Crypto X have been keen to point out, the exclusion of $TUSD from Binance’s latest launchpool offering may have dampened investor confidence in the stablecoin.

In contrast, $FDUSD is included in the basket of assets users can deposit to farm the new launchpool project, Manta.

TrueUSD Onboards MooreHK

Amid the depeg, TrueUSD has taken measures to restore investor confidence. In the hours leading up to press time, the stablecoin issuer announced that it had officially launched daily attestation in partnership with MooreHK.

🌟$TUSD has elevated the reserve audit system with the initiation of daily attestation services by leading accounting firm #MooreHK!

👀Dive into the upgraded report➡️https://t.co/DBifmCaCy9

👇Learn more: https://t.co/lzOn9uvUMk

— TrueUSD (@tusdio) January 16, 2024

The Hong Kong-based audit firm will provide a form of upgraded attestation report that includes additional details about $TUSD reserve assets.

In the first of its reports, MooreHK attested that $TUSD is 101% collateralized, holding $1.937 billion in escrowed collateral as opposed to the $1.925 billion worth of tokens in circulation.

thecryptobasic.com

thecryptobasic.com