Despite a slowdown in the previous quarter, XRP beat other notable names such as SOL, BNB and DOGE in liquidity rank for Q4 2023, securing the third spot overall.

The fourth quarter of 2023 was a favorable one for the crypto scene, as the broader market witnessed a massive uptrend due to increased interest. This surge in interest contributed to an impressive growth in trade volume and liquidity across the market.

However, amid the uptrend, XRP performed poorly compared to other mainstream names such as Bitcoin (BTC), Ethereum (ETH) and Solana (SOL).

XRP recorded a drop in liquidity and volume in Q4 2023. Despite this slowdown, the crypto token still occupied the third spot in liquidity ranking.

Kaiko, a crypto market intelligence platform, disclosed this in its latest quarterly report on crypto market liquidity.

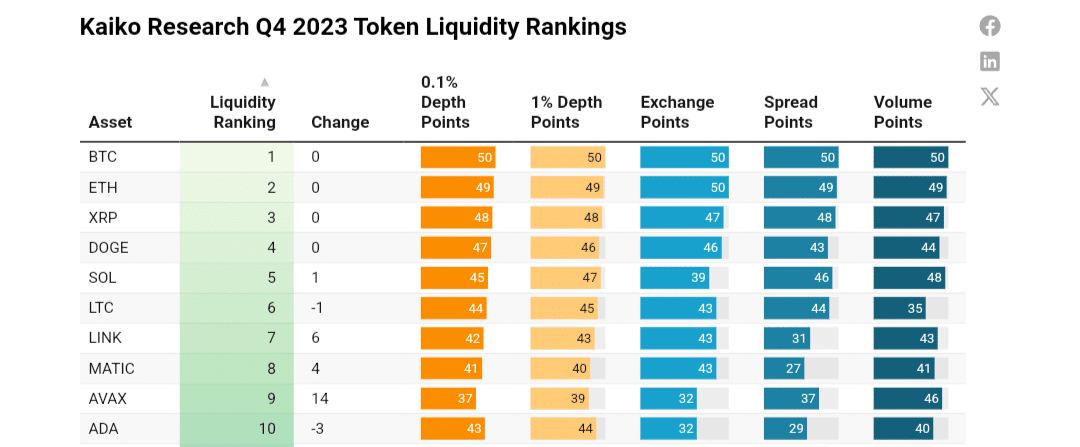

Data shows that XRP was only behind BTC and ETH in liquidity score in Q4 2023, as these three assets retained their respective positions on the top three list.

📌Pin this page 📌

Kaiko's quarterly #crypto asset liquidity ranking is now live! Q4 2023's top 5 assets were:

1. #BTC

2. #ETH

3. #XRP

4. #DOGE

5. #SOL https://t.co/O00MAPnyGM— Kaiko (@KaikoData) January 15, 2024

XRP Third in Liquidity Ranking

Notably, Bitcoin recorded a perfect score across all rankings in the previous quarter, with 50 points in terms of 0.1% liquidity depth, 50 points in 1% liquidity depth. In addition, exchange points, spread points and volume points were all 50.

While volume and liquidity are closely related, they are both fundamentally different. Volume is a measure of the total number of assets traded over a specific period.

However, liquidity measures how easily market participants can buy or sell those assets without significantly affecting their price.

A 0.1% liquidity depth assesses the liquidity of an asset very close to the current market price, within a 0.1% price range.

Nonetheless, a 1% depth measures the token’s liquidity in a much broader manner, considering 1% of the asset’s current market price. This presents an idea of the overall liquidity across a wider range of prices.

Ethereum scored 49 points across all the metrics, including 0.1% and 1% liquidity depths. However, it recorded a perfect 50 points for the exchange score.

Meanwhile, XRP scored 48 points in terms of 0.1% liquidity depth, 1% liquidity depth, and spread. The token scored 47 exchange and volume points.

While these scores are slightly lower than BTC’s and ETH’s, XRP towers over every other asset, including SOL, BNB and Dogecoin (DOGE).

Most assets performed admirably, but others saw more substantial growth from Q3 2024. For instance, Solana overtook Litecoin (LTC) to secure the fifth rank.

In addition, Chainlink (LINK), Polygon (MATIC) and Avalanche (AVAX) broke into the top 10. AVAX saw the biggest spike, jumping 14 places up.

XRP Liquidity Ranking Outperforms Market Cap Ranking

In a more elaborate report, Kaiko revealed that the liquidity rankings of BTC and ETH were on par with their respective market cap rankings.

However, XRP’s liquidity ranking (third) slightly outperformed its market cap ranking (fifth). On the other hand, Solana’s liquidity ranking (fifth) underperformed its market cap ranking (fourth).

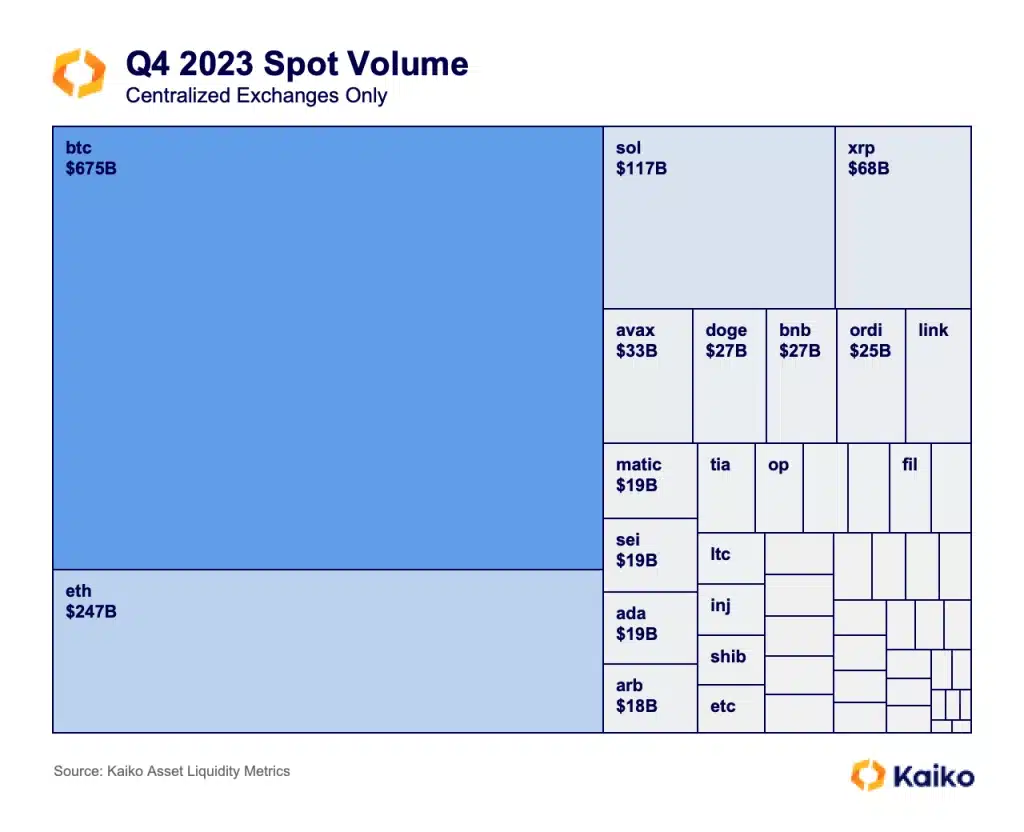

Meanwhile, Solana performed admirably well in terms of volume, with its trade volume soaring from $20 billion in Q3 2023 to $116 billion in Q4 2023.

With this jump, Solana soared above XRP in volume, as XRP’s trade volume dropped from $70 billion in Q3 2023 to $68 billion in Q4 2023.

thecryptobasic.com

thecryptobasic.com