Cosmo Jiang, a portfolio manager at digital assets-focused hedge fund Pantera Capital, is highlighting one crypto project that could witness an explosion in activity this year.

Stacks ($STX) aims to enable smart contracts and decentralized finance (DeFi) applications on Bitcoin (BTC). The project’s native token, $STX, is up nearly 95% in the past month.

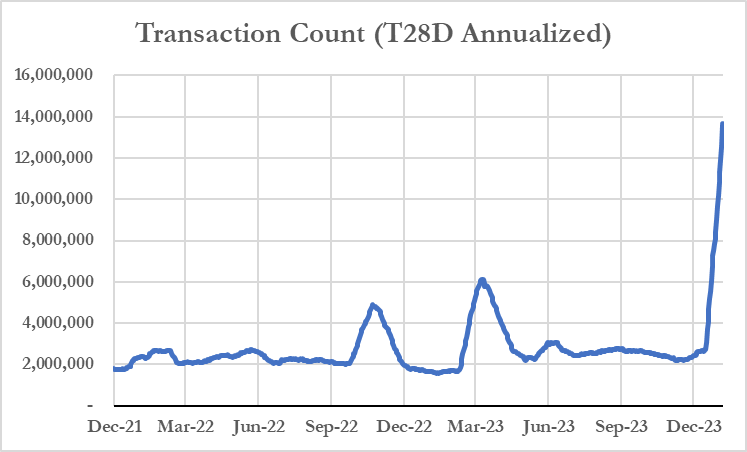

Jiang notes Stacks’ transaction activity has also been skyrocketing.

“On the eve of the Bitcoin ETF (exchange-traded fund), user activity already gives us a tell – they want to do more. Transaction activity on Stacks continues to trend upward. What does this look like in April, when the Nakamoto upgrade increases transaction speeds >100x?

Networks are flywheel businesses. Flywheel has begun spinning faster.”

The Stacks Foundation says the Nakamoto upgrade is currently scheduled for release before the Bitcoin halving, which is currently estimated to happen on April 17th, according to BuyBitcoinWorldwide.com.

The upgrade aims to reduce the time it takes for a user-submitted transaction to be mined and confirmed from around 10 minutes to a few seconds, according to Resh Singh, a business development manager at $STX:LDN.

“Fast confirmation times are critical for building scalable decentralized applications on Stacks, especially decentralized finance apps where price volatility is a major risk. By confirming trades in seconds rather than minutes, DeFi on Stacks can reach performance comparable to centralized exchanges.”

$STX:LDN is a London-based, community-led organization that facilitates Bitcoin and Stacks development and educational events.

$STX is trading at $1.76 at time of writing. The 39th-ranked crypto asset by market cap is down more than 11% in the past 24 hours.

Generated Image: DALLE3

dailyhodl.com

dailyhodl.com