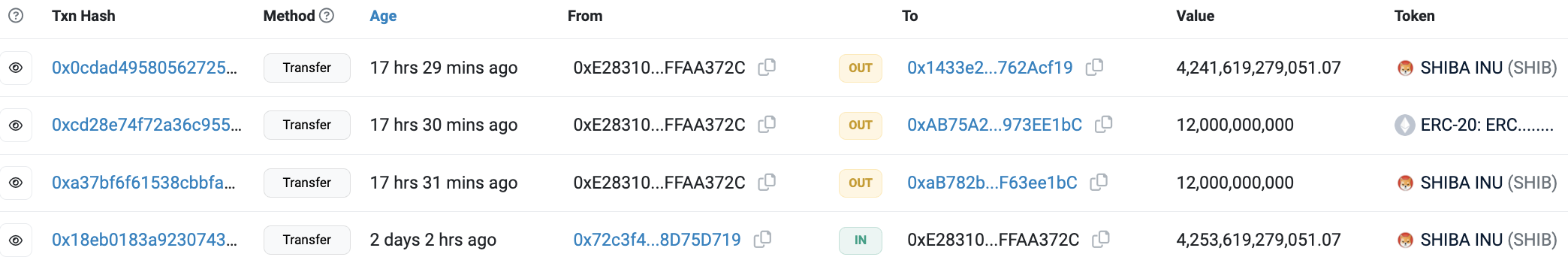

Whale Alert recently reported a noteworthy event in the crypto space — the movement of 4.24 trillion SHIB tokens, totaling $44.64 million, from an undisclosed wallet to another. Delving into on-chain data, interesting details emerged, painting a picture of intriguing developments.

The recipient wallet, as per Etherscan, is a fresh address with no prior transaction history. On the flip side, the sender's wallet, though relatively new, has been consistently involved in substantial Shiba Inu token transfers over the past few days. Notably, one of its transaction counterparts is linked to Coinbase Prime Custody, a platform offering clients trading, custody and prime services.

Speculation arises about potential affiliations between the unknown addresses and Coinbase, especially considering the timing. The significant transfers coincide with what seems like a proactive cleanup by the exchange, possibly in anticipation of the impending decision on Bitcoin ETFs. Coinbase's anticipated role as a crucial intermediary in the potential turnover of Bitcoin ETFs adds weight to this theory.

What does Bitcoin ETF have to do with it?

Adding to the intrigue is the fact that the involved address belongs to Coinbase's Prime division, catering primarily to institutional investors. This detail aligns with the broader market narrative surrounding the pending decision on Bitcoin ETFs, with Coinbase strategically positioning itself in the spotlight.

As 2023 approaches its conclusion, SHIB unexpectedly finds itself entwined in the year's most compelling narratives, marked by the Bitcoin ETF decision and Coinbase's discerning approach.

u.today

u.today