Financial institutions in Europe, North America, and various other regions have acknowledged their investments in XRP.

The Basel Committee on Banking Supervision (BCBS) has disclosed engaging in various supervisory activities in response to the emergence of virtual assets over the years.

The BCBS committee gathered detailed data on banks’ crypto holdings, including information about individual crypto assets. In total, 19 banks presented data on their crypto assets investments. Ten of the banks were from countries in North America. While seven were European banks, the other two were from other regions.

Exposures to XRP and Other Crypto

According to the report, the collective disclosure from the banks indicated that their crypto exposures amounted to €9.4 billion or $10.27 billion.

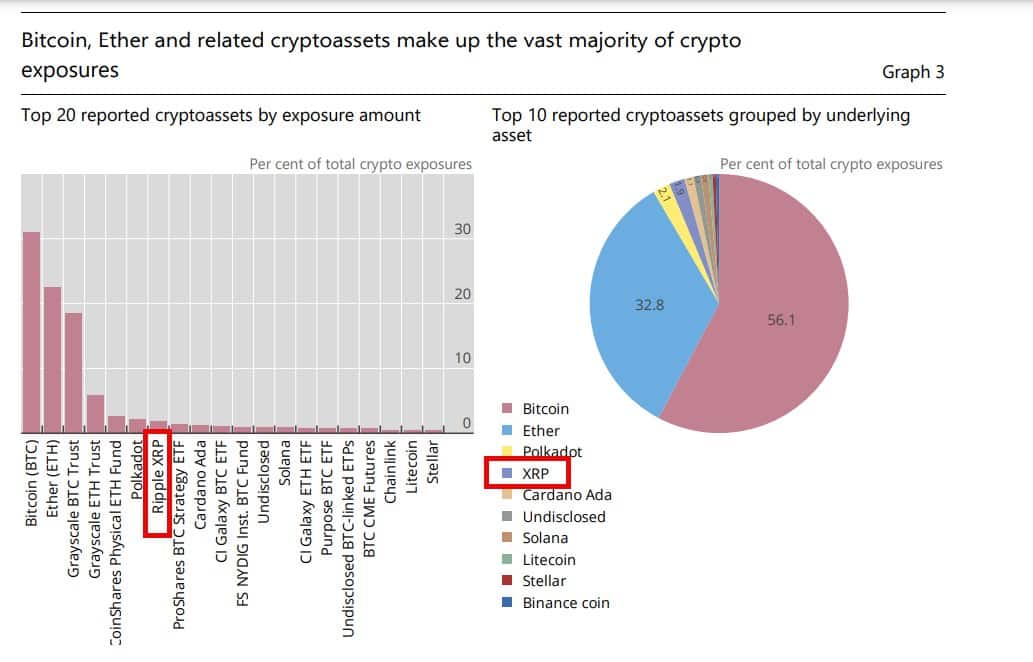

Furthermore, the findings indicated that XRP ranked as the third-largest altcoin for which the 19 banks acknowledged substantial commitments. In particular, XRP constituted 2% of the total exposure of €9.4 billion, equating to a total XRP position valued at €188 million or $205 million.

Within the top 20 reported crypto assets by exposure, other noteworthy entries include Cardano (ADA), Polkadot (DOT), Solana (SOL), Stellar (XLM), and Litecoin (LTC).

Meanwhile, the report highlighted that most banks concentrated on Bitcoin and Ethereum investments. Respectively, these two assets constituted 31% and 22% of the €9.4 billion.

Regarding investment vehicles tracking BTC and ETH, they make up 25% and 10%, respectively.

BCBS’ Disclaimer

Given that the report was the inaugural data collection utilizing the new template, BCBS clarified that the findings could have potential biases and data quality issues.

Moreover, it stated that it was unclear whether certain banks may have underreported or overreported their crypto exposures. As a result, BCBS noted that while the findings offer an overview of the member banks’ crypto activity, they should be interpreted with a degree of caution.

It is worth mentioning that the BCBS report relied on data the banks submitted in 2021. Besides, BCBS noted that the 19 banks represented a relatively small segment within the extensive sample of 182 banks considered in its monitoring exercise, accounting for 17.1% of total Risk-Weighted Assets (RWA) and 20.9% of the overall Leverage Ratio Exposure Measure (LREM).

The majority of these proportions, approximately three-quarters, are attributed to banks from North America.

thecryptobasic.com

thecryptobasic.com