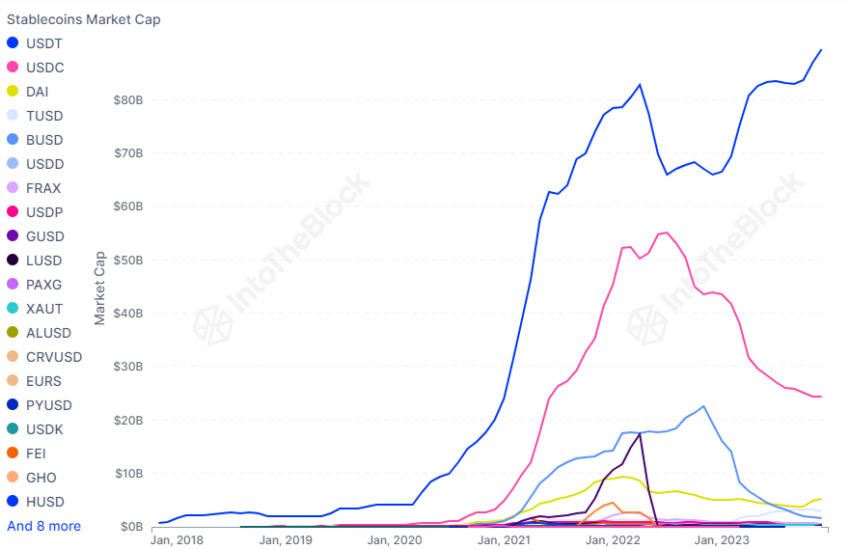

The first week of December 2023 marked a significant milestone as Tether (USDT) reached a new high in market capitalization. The popular stablecoin hit $90 billion while its competitors saw declines in market cap.

This achievement positions Tether as a dominant force in the stablecoin market, commanding a staggering 70% market share. This surge in market cap reflects the growing influence of Tether. It also shows the broader acceptance and usage of stablecoins in the digital economy.

Tether Remains the Most Popular Stablecoin

This dominance is further underscored by trading volumes. As pointed out by Rob Hadick, General Partner at Dragonfly, “USDT volumes are nine times more than those for USDC,” which he suggests indicates “how these tokens are just serving different use cases today.”

This disparity highlights the preference of traders outside of the regulated US/UK firms and the emerging markets for USDT as a transaction mechanism. In contrast, USDC is primarily used today for holding value or flight to safety for US-based firms.

Additionally, Tether dominance seems to be gaining traction among other major stablecoins. The recent surge in market cap to a new all-time high clearly indicates a divergence between the second-biggest stablecoin, USDC.

As of July 2023, Tether has seen a 36% increase in its market cap. However, USDC has seen its market cap plummet below its July 2023 market cap of $27 billion – a 5-month low.

Additionally, the previously third-largest stablecoin in BUSD has since lost its attraction following its removal from Binance as a stablecoin. Allowing DAI and TrueUSD to overtake it.

17.2% of TRON Users Hold USDT, Says Justin Sun

The growing influence of Tether is also evident on the Tron platform. Tron Founder Justin Sun, commenting on Tron’s growth, noted an impressive statistic:

“34,500,061 users on Tron, which represents 17.2% of all our users, now hold #USDT.”

This not only marks a significant milestone for Tron. But also attests to the increasing usage of USDT and other stablecoins in the market.

TRON (TRX) is currently the twelfth biggest cryptocurrency project by market cap. It is one of over forty projects that currently use the popular stablecoin within their ecosystems.

Stablecoin Adoption Spreading to Banks

The rise of stablecoins is not limited to Tether alone. In a pioneering move, France’s third-largest bank, Société Générale, is set to launch its own stablecoin, the EUR CoinVertible. The stablecoin will launch on Bitstamp, a Luxembourg-based exchange.

This marks the first time a major bank offers digital tokens tracking the price of hard currencies to a wide range of investors. Jean-Marc Stenger, chief executive of SocGen Forge, the bank’s digital assets unit, spoke about this venture, stating,

“The crypto ecosystem is highly concentrated on a few existing stablecoins, 90 per cent denominated in US dollars… we definitely think that there is a place for a bank in this field and there is a place for a euro [denominated] stablecoin.”

This move by Société Générale may pave the way for other traditional financial institutions to follow suit, potentially leading to a more diverse stablecoin market.

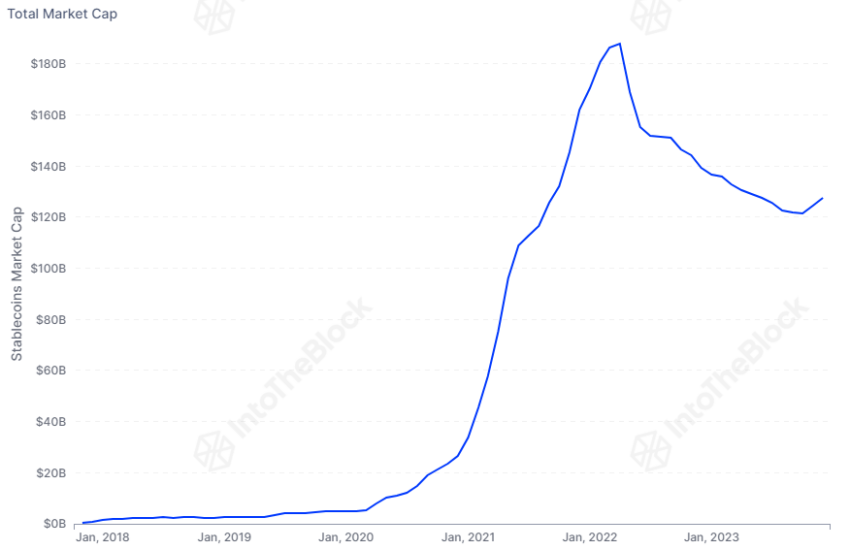

The stablecoin market, currently valued at $130 billion, is largely dominated by Tether and the US’s Circle. Both have faced questions over audits of the reserves that back their tokens.

In contrast, SocGen has assured that euros would fully back EUR CoinVertible, adding another layer of trust and credibility to the stablecoin market.

In conclusion, the recent surge in Tether’s market cap to $90 billion, the launch of Société Générale’s EUR CoinVertible, and the growing adoption of stablecoins on platforms like TRON, all signal an undeniable shift towards stablecoins in the digital economy.

Therefore, as more traditional institutions and retail users embrace these digital tokens, the stablecoin market, currently dominated by Tether, is likely to become more diverse and robust in the near future

beincrypto.com

beincrypto.com