It is very unlikely that USTC will repeg to $1. The supply of both USTC and $LUNC is still very large despite the community’s token burn efforts, and it’s very unlikely that the markets will trust Terra Classic’s algorithmic stablecoin mechanism again following its collapse in 2022. The value of USTC, which is down 96% from its intended $1 peg, has been in a downtrend in 2023.

Terra was one of the crypto and blockchain space’s biggest success stories before it all came crumbling down in May of 2022. However, a part of the former Terra community is attempting to restore the project to its former glory under the name Terra Classic. Terra Classic and its native token $LUNC have reached a surprising level of popularity, so it’s no surprise that many crypto investors are wondering if USTC can repeg back to its targeted $1 price.

Key takeaways:

- USTC plummeted from its $1 peg in May 2022, hitting a low of $0.006. Despite sporadic price surges, it struggles around $0.040, nowhere near the intended value.

- Trust in Terra Classic's stabilizing mechanism is crucial for a $1 repeg. Presently, market confidence is shaky post-2022 collapse, making investor buy-in improbable.

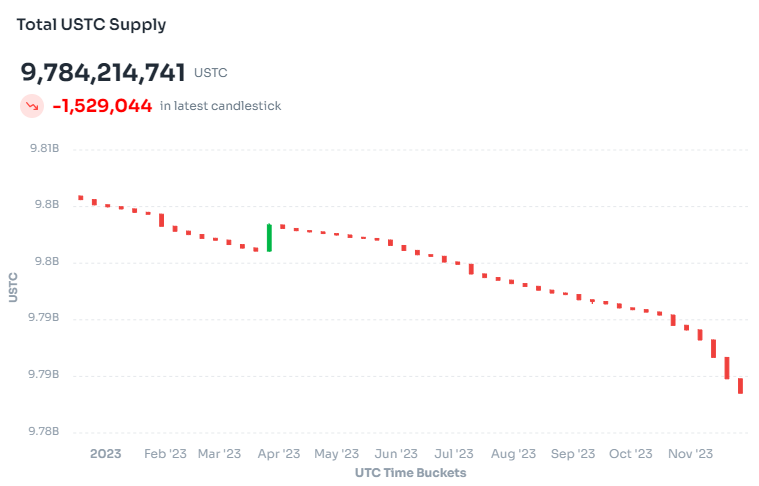

- Token supply reduction efforts exist but are sluggish. USTC's burn rate is slow, decreasing supply by a mere -0.2% between Dec 2022 and Nov 2023, hindering a substantial impact on price stabilization.

- The community voted to cease USTC minting, aiming to prevent further circulation increase. However, this move might not significantly expedite the token's return to $1 due to other overarching concerns.

What has been going on with the USTC price?

In May of 2022, USTC suffered a devastating price crash, which took its value from the targeted $1 peg all the way down to $0.006 at the bottom. Following this crash, the highest price USTC has managed to reach so far has been $0.07, which is still nowhere close to the $1 target.

In 2023, USTC has been exhibiting a negative price trend and is changing hands at a price of around $0.041 at the time of writing this article. It is worth noting that USTC saw a major increase of over +300% on November 27, following Binance's announcement of the launch of new USTC-based perpetual contracts.

Will USTC Repeg to $1?

In order for the USTC price to return to $1 again, crypto market participants would need to trust in the ability of the Terra Classic algorithmic mechanism to keep the price of USTC stable. As we can see from the significant fluctuations in the value of USTC, this is certainly not the case at the moment, and it’s difficult to imagine a scenario where a large number of crypto investors would be willing to risk getting burned by Terra again after what happened in 2022.

The main reason why Terra and UST exploded in popularity was the Anchor Protocol, a DeFi lending protocol that was offering a massive 20% APY on UST deposits. This kind of yield for an asset pegged at $1 was practically unheard of, which led to a huge surge in deposits and demand for minting UST.

Eventually, Anchor Protocol proved to be unsustainable, as there was much more demand for lending USTC than borrowing it. Since interest payments from borrowers were not sufficient to maintain the advertised yields, the protocol was artificially propped up with capital injections.

Now, the Terra Classic ecosystem doesn’t offer anything akin to Anchor Protocol. Since the value of USTC is not stable, it has become much less attractive as an asset to earn a yield on, as downward fluctuations in its price can easily negate any gains earned through yield. This means that currently, USTC simply doesn’t have any advantages over other stablecoins on the market, even if we discount the fact that it’s trading far below its targeted $1 peg.

Another issue that’s making a USTC repeg in 2023 unlikely is the token’s supply. There are currently 8.98 billion USTC tokens in circulation, although the supply is slowly decreasing, according to data from StakeBin. USTC tokens are burned in two ways — the Terra Classic network applies a burn tax to every transaction, and some users are also voluntarily burning their USTC tokens in order to decrease the supply.

Still, the current USTC burn rate is far too slow to have a noticeable effect on the USTC price. The USTC supply has only decreased by about -0.2% between December 2022 and November 2023.

The USTC supply is constantly decreasing, although at a very slow pace. Image source: StakeBin

At its current supply, USTC would be the third-largest stablecoin and the twelfth-largest crypto asset overall if it had a price of $1. Given the Terra Classic project’s reduced stature in the crypto markets, it’s hard to imagine USTC having such a prominent rank.

Community votes to end USTC minting

In September, the Terra Classic community voted on a proposal to end the USTC minting and reminting. In the proposal, the Terra Classic community stated that the move "opens the door for institutions like Binance to start burning USTC" as they can rest assured that any algorithmic minting and re-minting is over.

The proposal – which passed with 55% votes in favor and 38% against – still allows the minting and reminting of USTC so long as the Terra Classic community votes for it. "This proposal also stops loopholes such as converting xUST to mint USTC," the proposal added.

The move should prevent further increase in the number of USTC stablecoins entering circulation, which should in theory lead to USTC achieving a repeg to $1 more easily.

The bottom line — You shouldn’t expect USTC to repeg anytime soon

A USTC repeg at some point in the future is not impossible, but it is highly unlikely. The USTC token is in a very bad position at the moment as it’s not performing like a stablecoin, and it also does not have any special utility. Therefore, buying USTC at the moment is highly risky, especially if you have the expectation that it will return to the $1 peg.

The biggest issue with the Terra Classic project at the moment is that it simply doesn’t offer anything unique that other blockchain platforms cannot deliver. Terra Classic also has a transaction tax, which impedes the platform’s adoption. The project’s strongest point is its dedicated community of holders, and not its technology or economic design.

If you wish to learn more about the difficult situation the Terra Classic project is in, make sure to read our article exploring if $LUNC can recover.

coincodex.com

coincodex.com