- Telegram

- Facebook Messenger

It has been revealed the fact that Circle is looking forward to expanding its USDC presence in Japan with SBI Holdings. Check out the latest reports about the matter below.

Circle expands USDC presence in Japan

Circle, a global crypto finance company, announced on Monday that it has signed a Memorandum of Understanding with SBI Holdings.

According to the statement released, the MoU outlines the collaboration between SBI Group and Circle to promote the circulation of USDC and to expand the use of stablecoins in Japan.

SBI VC Trade, an online cryptocurrency trading platform, is seeking to register in Japan as an electronic payment instruments service. This move is aimed at facilitating the circulation of USDC stablecoins within Japan.

Japan is the world’s third-largest economy, and it is projected to slip to fourth place this year, according to estimates from the International Monetary Fund.

SBI Shinsei Bank will also provide banking services to Circle, according to the statement. “This will enable USDC access and liquidity for Japan-based businesses and users,” Circle said in the statement.

“Moreover, as part of SBI Group’s digital asset portfolio strategy, SBI Group will also adopt Circle’s Web3 Services solutions such as Programmable Wallet, blockchain infrastructure and smart contract management tools.”

Jeremy Allaire, CEO and co-founder of Circle, said the partnership with SBI Holdings “represents a shared vision for the future of digital currency, and is a significant milestone in Circle’s expansion plans in Japan and Asia Pacific.”

Circle has formed a partnership in Japan following the revision of the Payment Services Act in June, which established regulations related to stablecoins.

The Japanese government’s aim was to protect investors in stablecoins after TerraUSD’s collapse.

SBI Holdings has been actively involved in the cryptocurrency industry for a long time.

Earlier this month, the financial conglomerate partnered with SC Ventures, the investment arm of Standard Chartered, to establish a $100 million cryptocurrency vehicle in the United Arab Emirates.

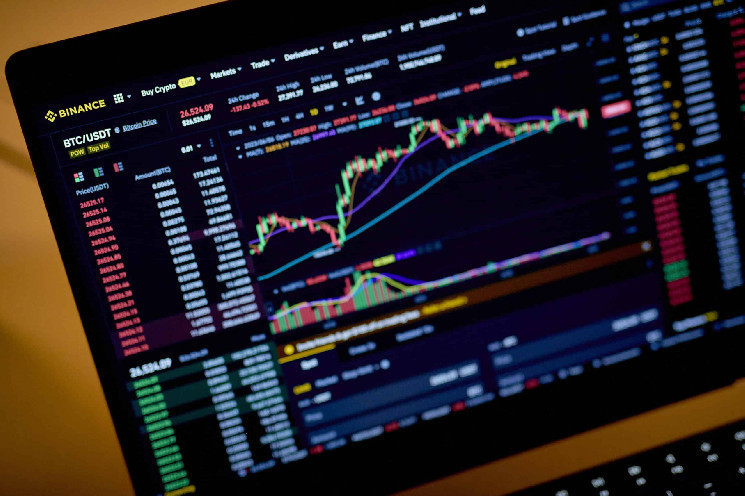

In September, Binance announced its partnership with a unit of Japanese bank MUFG to explore the issuance of a new stablecoin tied to fiat currencies, as it made a comeback to the Japanese market.

- Telegram

- Facebook Messenger

cryptogazette.com

cryptogazette.com