TOKYO, Japan — In a groundbreaking move, SBI Holdings, Inc. (SBI) and Circle Internet Financial (Circle) have officially entered into a Memorandum of Understanding (MOU) to usher in a new era of digital currency in Japan.

—

SBI Holdings, led by Yoshitaka Kitao, is a significant financial services company based in Tokyo, Japan. Established in 1999, it has evolved into a conglomerate with diverse financial services, showing keen interest and investments in fintech and blockchain. The partnership is not unfamiliar territory for SBI, given its robust business relationship with Ripple in the development and promotion of blockchain-based payment technology in Asia.

Circle, a global fintech firm founded in 2013, is renowned for its contributions to the cryptocurrency space, including the co-creation of USD Coin (USDC), the world's largest regulated stablecoin. Circle focuses on blockchain-based financial services, and its collaboration with SBI aims to integrate USDC into Japan's financial ecosystem and promote Circle’s Web3 Services.

The backdrop to this partnership is the Japanese government's forward-thinking revision of the Payment Services Act on June 3, 2023. The amended regulations set the stage for the regulated issuance and circulation of stablecoins, aligning with Japan's trajectory toward a Web3 economy.

What makes this collaboration even more compelling is Circle's USD Coin (USDC), the world's largest regulated stablecoin. The Revised Payment Services Act mandates collateralized stablecoins, and USDC takes this a step further by being fully backed, 100%, by highly liquid cash and cash-equivalent assets, maintaining a 1:1 redeemability for U.S. dollars. As of November 17, 2023, USDC has facilitated over $12.7 trillion in on-chain transactions.

Jeremy Allaire, CEO, and co-founder of Circle, expressed excitement about the collaboration, calling it a "significant milestone in Circle’s expansion plans in Japan and the Asia Pacific." He emphasized the shared vision for the future of digital currency between the two companies.

"Japan is steadily preparing the groundwork for the full-scale introduction of stablecoins."

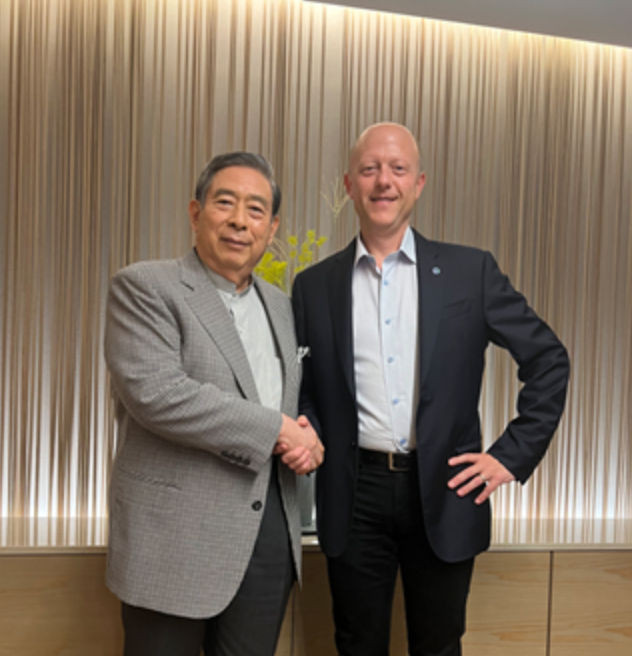

Yoshitaka Kitao of SBI Holdings

He expressed satisfaction with the alliance with Circle, noting USDC’s global usage and market capitalization, reaffirming SBI Group’s commitment to exploring new financial possibilities using stablecoins.

The MOU lays the foundation for SBI Group and Circle to work towards circulating USDC in Japan, adhering to stablecoin-related regulations and maintaining open communication with authorities. SBI VC Trade Co., Ltd., a subsidiary of SBI Holdings, is seeking registration as an electronic payment instruments service, aiming to facilitate the circulation of USDC in Japan.

SBI Shinsei Bank, Limited, another SBI entity, will provide banking services to Circle, enhancing USDC’s accessibility and liquidity for Japanese businesses and consumers. As part of SBI Group’s digital asset strategy, the integration of Circle’s Web3 Services, including programmable wallets, blockchain infrastructure, and smart contract management tools, is on the horizon.

SBI Holdings and Circle Partner to Integrate USDC in Japan's Digital Economy | Blockster

blockster.com

27 November 2023 15:18, UTC

blockster.com

27 November 2023 15:18, UTC