Grayscale recently spotlighted XRP as an alternative to SWIFT in cross-border payments, as it aimed to highlight the difference between fiat and crypto assets.

In an update to the Grayscale Currencies Crypto Sector pushed earlier this month, the investment firm shed light on the crypto asset sector, categorizing each of the largest cryptocurrencies in specific groups.

The Grayscale Crypto Sector is a framework pushed by Grayscale to help its investors get a proper glimpse of how the crypto sector works, and provide them with useful insights that can help shape their investment decisions.

The latest update emphasized that cryptocurrencies are different from fiat currencies due to the lack of governmental control. Essentially, such governmental control could come in the form of money printing and interest rates reviews.

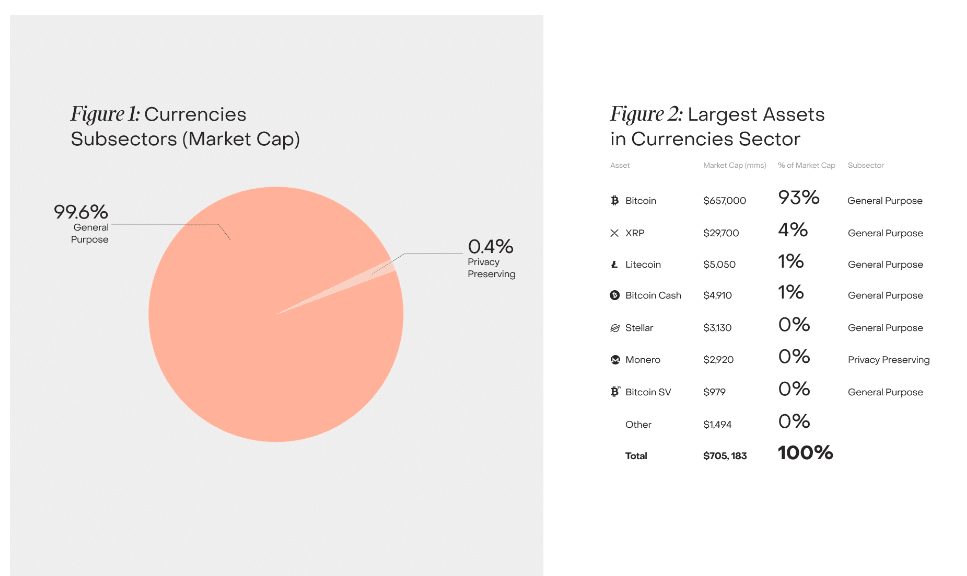

The Grayscale report went on to highlight the largest crypto assets it currently tracks in its Crypto Sector framework. These assets include Bitcoin (BTC), XRP, Litecoin (LTC), Bitcoin Cash (BCH), Stellar (XLM), Monero (XMR) and Bitcoin SV (BSV). Surprisingly, Ethereum (ETH) is missing.

Speaking on Bitcoin, the report positioned the firstborn crypto as a safe haven for individuals in inflation-raged countries like Venezuela and Argentina. The report highlighted Bitcoin’s limited and transparent supply as an attractive feature in this regard.

XRP as an Alternative to SWIFT

In the absence of ETH and BNB, the company noted that XRP sits as the second largest asset currently tracked in the framework, only behind Bitcoin. Notably, XRP makes up 4% of the combined market capitalization of all the assets it the firm currently tracks.

According to the Grayscale report, XRP is designed as an alternative to SWIFT due to its attractive features in terms of cross-border payments. “XRP aims to offer fast cross-border payments at lower transaction costs than competitors,” the report notes.

The recent report from Grayscale has triggered speculation that the firm might be looking to resume support for XRP amid its push to transform the GBTC Trust to a spot BTC ETF. Recall that Grayscale held XRP in its GDLC product and XRP Trust.

However, in January 2021, the company dissolved the XRP Trust and removed XRP from the GDLC vehicle. This move came as a response to the SEC’s lawsuit against Ripple. Nonetheless, Grayscale has not indicated any interest in resuming support for XRP since the July 13 ruling that declared that the asset is not a security.

thecryptobasic.com

thecryptobasic.com