Binance Coin (BNB) price has tumbled 10% from $267 to $240 as markets Binance Founder Changpeng Zhao’s exit. Derivative Market analysis provides vital insights into possible BNB price action for the days ahead.

Binance Founder Changpeng Zhao has confirmed his exit as CEO of the world’s largest crypto exchange. While a successor has been announced, investors trading Binance’s native BNB coins have made a series of initial bearish moves in response to CZ’s ouster.

Changpeng Zhao Confirms Exit as CEO of Binance

On Tuesday, November 21, the US Department of Justice reported that Binance CEO Chanpeng Zhao (CZ) has agreed to step down. Hours later, CZ confirmed in an X (Twitter post) that his set to “take responsibility” as he left his role as CEO of the world’s leading crypto exchange by trading volume.

The shock announcement comes as part of a reported $4.3 billion settlement with the US Securities and Exchange Commission (SEC), in which Binance admitted to being used “to funnel money to Hamas.”

Meanwhile, Richard Teng, who was appointed to oversee Binance’s regional markets outside the U.S. in June has been announced as CZ’s successor.

“It is an honour and with the deepest humility that I step into the role of Binance’s new CEO. We operate the world’s largest cryptocurrency exchange by volume. The trust placed on us by our 150m users and thousands of employees is a responsibility that I take seriously,” said Teng.

Teng’s wealth of experience in core areas of regulation and compliance stands out. Prior to heading the Financial Services Regulatory Authority at Abu Dhabi Global Market (ADGM), he was chief regulatory officer of the Singapore Exchange (SGX). He had also spent 13 years with the Monetary Authority of Singapore (MAS)

Over $3 Million Trades Liquidated Within an Hour

Binance has been the subject of multiple bouts of regulatory squabbles in 2023. The latest bout has triggered a knee-jerk bearish reaction among crypto investors trading BNB, the native coin of the Binance ecosystem.

Within an hour of the report, $3 million on BNB Long positions had been liquidated, according to crypto derivatives market data tracker Coinglass.

The Total Liquidations chart tracks the number of trades closed, liquidated, or wiped out within a given period. A significant spike in LONG liquidations during a major news event, as observed above, is a bearish signal. It is an indication that investors are anticipating a prolonged negative fallout.

The chart also illustrates that this is the highest daily liquidation of bullish BNB contracts in 90 days. This puts BNB price at risk of a Long Squeeze.

A long squeeze is a market phenomenon that occurs when traders who have taken long positions (betting on the price of an asset to increase) face significant losses and are forced to sell their positions to limit their losses.

This selling pressure, in turn, can lead to a rapid and extended decline in the BNB price over the next few days.

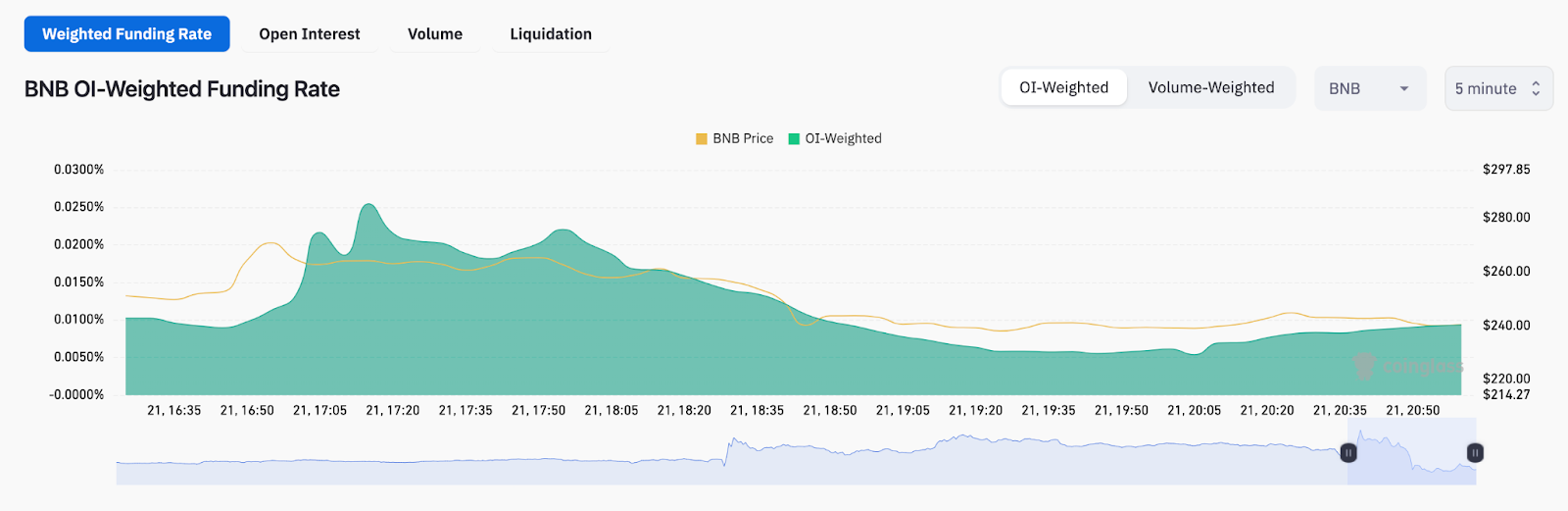

Funding Rates Drop as Investors Brace for Pain

In further confirmation of the bearish stance, BNB Funding Rate has also entered a sharp decline within the hour of Chanpeng Zhao’s reported exit announcement.

The chart below illustrates that BNB Funding Rate dropped from a daily peak of 0.025% to 0.0093% at press time.

Perpetual Funding Rates represent the variance between the marked price of the perpetual futures market and the index (spot) price. Generally, when Funding Rates begin to decline, it means that bullish traders are paying less to SHORT traders to maintain their open positions.

The sharp decrease in BNB Funding Rates means most investors anticipate that prices and market liquidity will decline further in the coming days.

BNB is currently trading at $240 at press time. But if the Funding Rate slides into negative values, the bears could effectively seize control of the market and force a BNB price downswing closer to the $200 mark.

On the flip side, the quick succession plan could allay initial market FUD and boost investor confidence in the days ahead. In this case, bullish traders swooping in to buy the dip could inadvertently trigger a quick BNB price rebound.

beincrypto.com

beincrypto.com