Banks from North America, Europe, and other parts of the world have declared investments in crypto assets, with XRP holding prominent positions.

The Basel Committee on Banking Supervision (BCBS), a foremost global authority on regulation for banks, has published a report capturing the exposures of its 45 member central banks on cryptocurrencies such as XRP.

BCBS noted that its committee had undertaken various analytical and supervisory initiatives in response to cryptocurrency over the last five years. It mentioned a novel crypto data collection template was implemented as a component of these efforts.

In the report, BCBS stated that 19 banks submitted crypto asset data. Of this total, ten banks came from North America, seven from Europe, and two from other regions. It disclosed that the banks collectively reported €9.4 billion in crypto asset exposures or $10.27 billion.

Meanwhile, the report highlighted that crypto exposures exhibit an uneven distribution among reporting banks. Specifically, two banks account for over half of the total, and four additional banks represent just under 40% of the remaining exposures.

XRP Exposure

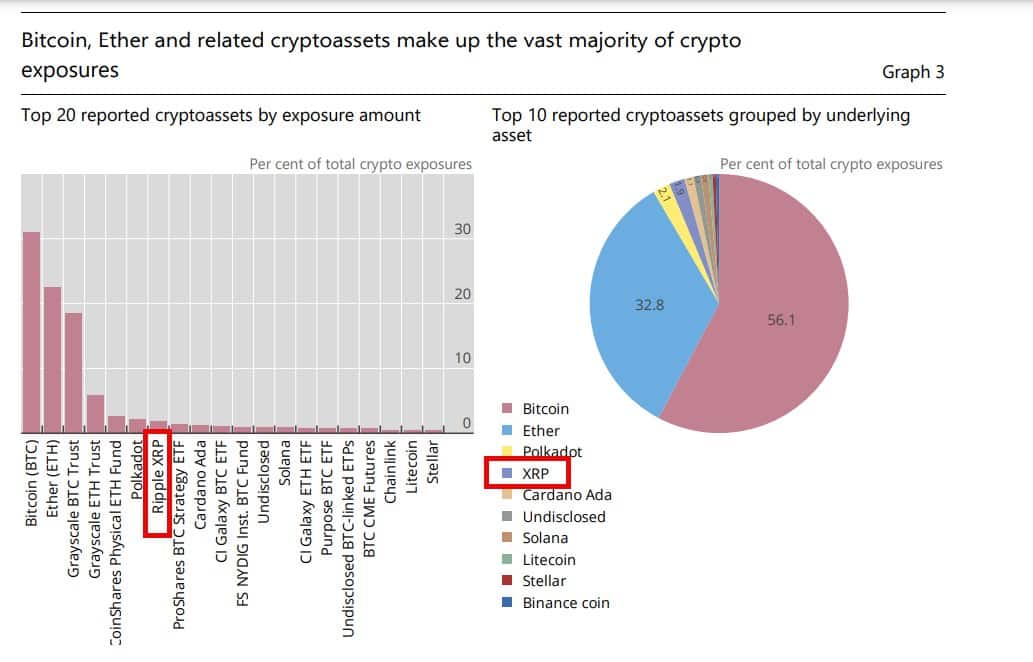

According to the Basel committee findings, XRP ranked as the third largest altcoin in which the reporting banks disclosed commitments. Specifically, it was identified that XRP constituted 2% of the total exposure of €9.4 billion. This percentage translates to total XRP positions worth €188 million or $205 million.

Exposures to Bitcoin and other Crypto

Furthermore, the report mentioned that most bank crypto exposures predominantly consist of Bitcoin (BTC) and Ethereum (ETH). The dominance also applies to instruments that track BTC and ETH as the underlying digital assets.

Specifically, BTC and ETH exposures account for 31% and 22%, respectively, and in terms of investment vehicles tracking the assets, BTC and ETH amounted to 25% and 10%, respectively.

Among the top 20 reported crypto assets by exposure, other noteworthy entries include Polkadot (DOT, 2%), Cardano (ADA, 1%), Solana (SOL, 1%), Litecoin (LTC, 0.4%), and Stellar (XLM, 0.4%).

Overall, Bitcoin, Ethereum, and XRP constitute nearly 90% of the reported exposures from the banks. Additionally, the banks reported smaller amounts for a stablecoin and tokenized assets.

thecryptobasic.com

thecryptobasic.com